Vietnam: Organizations and entities may not transfer, sell, borrow or lend stamps

This is a notable content specified in Circular No. 15/2020/TT-BTC of the Ministry of Finance of Vietnam providing guidelines for printing, issuance, management and use of stamps for alcohol produced for domestic sale and imported alcohol.

Specifically, according to Clause 2 Article 6 of Circular No. 15/2020/TT-BTC of the Ministry of Finance of Vietnam, organizations and entities may not transfer, sell (excluding tax authorities), borrow or lend stamps, concurrently, they must comply with the following regulations:

- Stamps for domestic alcohol shall only be sold to holders of effective alcohol production licenses.

- The General Department of Taxation shall provide domestic alcohol stamps for Departments of Taxation. Departments of Taxation shall sell these stamps to holders of alcohol production license (including license to produce commercial alcohol manually and license for mass production of alcohol), who shall affix these stamps by themselves as regulated.

- Tax authorities shall keep written records of opening stock, amounts of stamps received, sold, lost or damaged within the accounting period and closing stock, and submit quarterly and annual reports on settlement of stamp payments to supervisory tax authorities.

Besides, notification of stamp issuance must comply with the following regulations:

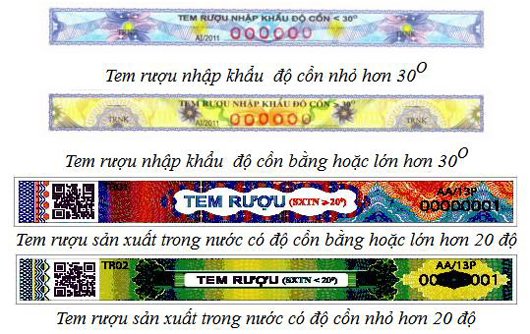

- The General Department of Taxation shall notify issuance of domestic alcohol stamps to Departments of Taxation before the stamps are on sale. If there is any change to the size, contents or design of a current stamp specimen, the General Department of Taxation must issue a new notification of stamp issuance.

- The notification must include the design, contents, size and characteristics of each stamp specimen.

- Every notification of issuance of domestic alcohol stamps must be posted on the website of the General Department of Taxation for 15 working days starting from the date on which the notification comes into force.

View details at Circular No. 15/2020/TT-BTC of the Ministry of Finance of Vietnam, effective from May 07, 2020.

Le Hai

- Key word:

- Circular No. 15/2020/TT-BTC

- Procedures for commendation of individuals with achievements in militia and self-defense forces in Vietnam

- Determination of asset valuation costs in civil proceedings and administrative proceedings in Vietnam from July 1, 2025

- Procedures for commendation of collectives with achievements in militia and self-defense forces in Vietnam

- Formula for calculating severance policy for officials during organizational apparatus in Vietnam

- Content of statistical reporting policies in the planning and investment sector in Vietnam from April 1, 2025

- Cases exempt from advance payment of on-site inspection and assessment costs in civil proceedings in Vietnam from July 1, 2025

-

- Vietnam: Guidelines for printing stamps for alcohol ...

- 09:40, 26/03/2020

-

- Vietnam: Guidelines for printing specimens of ...

- 09:27, 26/03/2020

-

.jpg)

- Vietnam: How shall imported alcohol stamps be ...

- 09:10, 26/03/2020

-

- Vietnam: Which units are allowed to affix stamps ...

- 08:59, 26/03/2020

-

- Vietnam: 03 cases in which alcohol is not required ...

- 08:48, 26/03/2020

-

- Procedures for commendation of individuals with ...

- 09:30, 23/01/2025

-

- Promulgation of technical regulations on the system ...

- 17:42, 22/01/2025

-

- Latest guidelines on electing delegates for the ...

- 17:40, 22/01/2025

-

- 17 propaganda slogans celebrating the 95th anniversary ...

- 17:30, 22/01/2025

-

- Regulations on the professional title codes for ...

- 16:52, 22/01/2025

Article table of contents

Article table of contents