Vietnam: Which units are allowed to affix stamps on alcohol from May 07, 2020?

Imported and domestic alcohol must be packed into bottles, jars, cans, bags, boxes or containers (hereinafter collectively referred to as “bottles”). Each bottle must bear a stamp. If the bottle is wrapped in cellophane paper, the stamp must be affixed onto the bottle before it is wrapped in cellophane paper.

According to Circular No. 15/2020/TT-BTC of the Ministry of Finance of Vietnam, units are allowed to affix stamps on alcohol produced for domestic sale and imported alcohol as follows:

- For bottled alcohol imported via border checkpoints, the importer shall affix imported alcohol stamps onto these bottles at its establishment, take responsibility for this task and report the number of stamps actually used (with the serial number of each stamp) to the customs authority with which the import procedures are registered before customs clearance.

- For alcohol imported in large containers/tanks for domestic bottling, the importer shall affix imported alcohol stamps onto the bottles at its bottling establishment before these bottles are on sale and take responsibility for this task.

- For domestic alcohol, holders of the license to produce alcohol (including license to produce commercial alcohol manually and license for mass production of alcohol) must affix stamps onto their bottled products at the manufacturing sites before these products are on sale.

Moreover, Circular No. 15/2020/TT-BTC also regulates stamp location as follows: Every stamp must be affixed over the opening of the alcohol bottle (lid, faucet or a similar location) to ensure that the stamp will break when the bottle is opened and cannot be reused.

Alcohol imported in large containers/tanks for bottling or production of finished products does not require stamps.

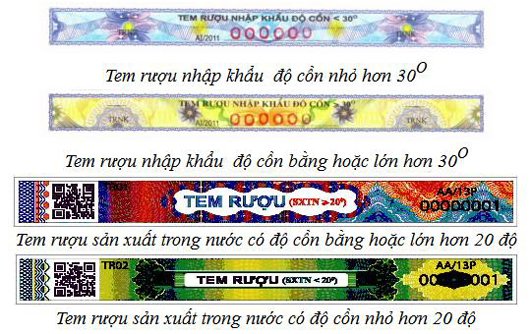

Stamp management rules are as follows: The General Department of Vietnam Customs has the power to print and issue imported alcohol stamps. The General Department of Taxation has the power to print and issue domestic alcohol stamps. Stamps shall be printed, issued, managed and used in accordance with existing regulations on management and use of written tax records.

View details at Circular No. 15/2020/TT-BTC of the Ministry of Finance of Vietnam, effective from May 07, 2020.

Le Hai

- Key word:

- Circular No. 15/2020/TT-BTC

- Guidelines for maintenance and renovation of villas in Ho Chi Minh City

- Guidelines for maintenance and renovation of villas in Ho Chi Minh City

- Resolution 190: Principles for addressing certain issues related to the organization and arrangement of state apparatus in Vietnam

- Guidance on identifying cases of inaccurate or non-operational electricity meters in Vietnam

- Official Telegram 16: Urgent requirement to allocate the entire state budget investment plan in 2025 in Vietnam

- Prime Minister of Vietnam directs to accelerate allocation and disbursement of public investment capital in 2025 in Vietnam

-

- Vietnam: Guidelines for printing stamps for alcohol ...

- 09:40, 26/03/2020

-

- Vietnam: Guidelines for printing specimens of ...

- 09:27, 26/03/2020

-

- Vietnam: Organizations and entities may not transfer ...

- 09:16, 26/03/2020

-

.jpg)

- Vietnam: How shall imported alcohol stamps be ...

- 09:10, 26/03/2020

-

- Vietnam: 03 cases in which alcohol is not required ...

- 08:48, 26/03/2020

-

- Guidelines for maintenance and renovation of villas ...

- 14:30, 21/02/2025

-

- Guidelines for maintenance and renovation of villas ...

- 14:30, 21/02/2025

-

- Procedures for high school admission in Vietnam

- 14:25, 21/02/2025

-

- Resolution 190: Principles for addressing certain ...

- 11:30, 21/02/2025

-

- Guidance on identifying cases of inaccurate or ...

- 11:00, 21/02/2025

Article table of contents

Article table of contents