Vietnam: How shall imported alcohol stamps be issued from May 07, 2020?

On March 23, 2020, the Ministry of Finance of Vietnam issued Circular No. 15/2020/TT-BTC providing guidelines for printing, issuance, management and use of stamps for alcohol produced for domestic sale and imported alcohol.

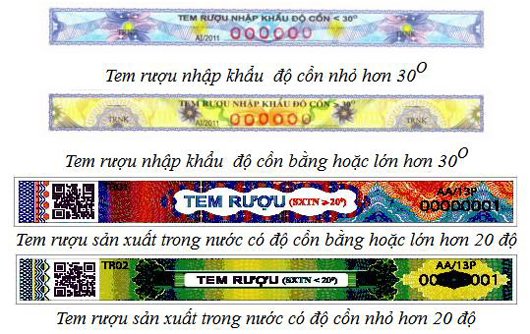

.jpg)

According to Clause 2 Article 5 of Circular No. 15/2020/TT-BTC of the Ministry of Finance of Vietnam, imported alcohol stamps shall only be sold to holders of effective licenses for sale of alcohol. Issuance of imported alcohol stamps is as follows:

- The General Department of Vietnam Customs shall provide stamps for Departments of Customs in requested amounts on an annual basis.

- Based on the amount of imported alcohol declared, the customs authority with which the import procedures are registered shall sell stamps to the importer and specify the quantity of stamps actually sold and serial numbers thereof in the customs declaration for imported alcohol.

- The customs official in charge of selling stamps and supervising affixing thereof shall settle the payment for the purchased stamps with the importer within 02 working days from the date customs clearance is completed.

- When selling imported alcohol stamps, customs authorities must keep written records of opening stock, amounts of stamps received, sold, lost and damaged within the accounting period and closing stock, and submit quarterly, semiannual and annual reports on use of stamps to supervisory customs authorities according to regulations.

Besides, Circular No. 15/2020/TT-BTC stipulates the notification of stamp issuance as follows:

- The General Department of Vietnam Customs shall notify issuance of imported alcohol stamps to Customs Departments before providing these stamps for Customs Departments. If there is any change to the size, contents or design of a current stamp specimen, the General Department of Vietnam Customs must issue a new notification of stamp issuance.

- The notification must include the design, contents, size and characteristics of each stamp specimen.

- Every notification of imported alcohol stamp issuance must be posted on the website of the General Department of Vietnam Customs for 15 working days starting from the date on which the notification is issued.

View details at Circular No. 15/2020/TT-BTC of the Ministry of Finance of Vietnam, effective from May 07, 2020.

Le Hai

- Key word:

- Circular No. 15/2020/TT-BTC

- Number of deputy directors of departments in Vietnam in accordance with Decree 45/2025/ND-CP

- Cases ineligible for pardon in Vietnam in 2025

- Decree 50/2025 amending Decree 151/2017 on the management of public assets in Vietnam

- Circular 07/2025 amending Circular 02/2022 on the Law on Environmental Protection in Vietnam

- Adjustment to the organizational structure of the Ministry of Health of Vietnam: Certain agencies are no longer listed in the organizational structure

- Vietnam aims to welcome 22-23 million international tourists in Vietnam in 2025

-

- Vietnam: Guidelines for printing stamps for alcohol ...

- 09:40, 26/03/2020

-

- Vietnam: Guidelines for printing specimens of ...

- 09:27, 26/03/2020

-

- Vietnam: Organizations and entities may not transfer ...

- 09:16, 26/03/2020

-

- Vietnam: Which units are allowed to affix stamps ...

- 08:59, 26/03/2020

-

- Vietnam: 03 cases in which alcohol is not required ...

- 08:48, 26/03/2020

-

- Notable new policies of Vietnam effective as of ...

- 16:26, 11/04/2025

-

.Medium.png)

- Notable documents of Vietnam in the previous week ...

- 16:21, 11/04/2025

-

.Medium.png)

- Notable documents of Vietnam in the previous week ...

- 16:11, 02/04/2025

-

.Medium.png)

- Notable new policies of Vietnam to be effective ...

- 16:04, 02/04/2025

-

.Medium.png)

- Notable new policies of Vietnam effective from ...

- 14:51, 21/03/2025

Article table of contents

Article table of contents