Vietnam: 03 cases in which alcohol is not required to have stamps affixed on their wrapping

This is a notable content specified in Circular No. 15/2020/TT-BTC of the Ministry of Finance of Vietnam providing guidelines for Decree No. 105/2017/ND-CP on printing, issuance, management and use of stamps for alcohol produced for domestic sale and imported alcohol.

Specifically, according to Clause 2 Article 2 of Circular No. 15/2020/TT-BTC of the Ministry of Finance of Vietnam, stamps are not required for the following cases:

- Alcohol produced manually and sold to enterprises issued with the license for mass production of alcohol for further processing.

- Semi-finished alcohol that is provided for in Article 3 of Decree No. 105/2017/NĐ-CP of Vietnam’s Government and is imported.

- Alcohol imported as prescribed in Article 31 of Decree No. 105/2017/NĐ-CP of Vietnam’s Government.

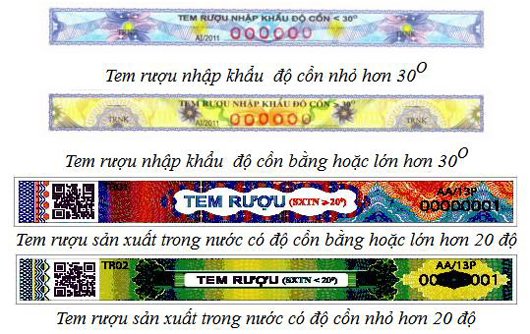

Besides, Circular No. 15/2020/TT-BTC also stipulates that domestic alcohol and imported alcohol must have stamps affixed on their wrapping

The printing, issuance, management and use of stamps for wine produced for domestic alcohol and imported alcohol must comply with the following rules:

- The General Department of Vietnam Customs has the power to print and issue imported alcohol stamps.

- The General Department of Taxation has the power to print and issue domestic alcohol stamps.

- Stamps shall be printed, issued, managed and used in accordance with existing regulations on management and use of written tax records.

Note: The stamps issued in accordance with Circular No. 160/2013/TT-BTC dated November 14, 2013 by the Ministry of Finance before the effective date of this Circular may continue to be used.

View details at Circular No. 15/2020/TT-BTC of the Ministry of Finance of Vietnam, effective from May 07, 2020.

Le Hai

- Guidelines for maintenance and renovation of villas in Ho Chi Minh City

- Guidelines for maintenance and renovation of villas in Ho Chi Minh City

- Resolution 190: Principles for addressing certain issues related to the organization and arrangement of state apparatus in Vietnam

- Guidance on identifying cases of inaccurate or non-operational electricity meters in Vietnam

- Official Telegram 16: Urgent requirement to allocate the entire state budget investment plan in 2025 in Vietnam

- Prime Minister of Vietnam directs to accelerate allocation and disbursement of public investment capital in 2025 in Vietnam

-

- Vietnam: Guidelines for printing stamps for alcohol ...

- 09:40, 26/03/2020

-

- Vietnam: Guidelines for printing specimens of ...

- 09:27, 26/03/2020

-

- Vietnam: Organizations and entities may not transfer ...

- 09:16, 26/03/2020

-

.jpg)

- Vietnam: How shall imported alcohol stamps be ...

- 09:10, 26/03/2020

-

- Vietnam: Which units are allowed to affix stamps ...

- 08:59, 26/03/2020

-

- Guidelines for maintenance and renovation of villas ...

- 14:30, 21/02/2025

-

- Guidelines for maintenance and renovation of villas ...

- 14:30, 21/02/2025

-

- Procedures for high school admission in Vietnam

- 14:25, 21/02/2025

-

- Resolution 190: Principles for addressing certain ...

- 11:30, 21/02/2025

-

- Guidance on identifying cases of inaccurate or ...

- 11:00, 21/02/2025

Article table of contents

Article table of contents