Draft Decree on the Management of Debt Collection of Social Insurance, Health Insurance, Unemployment Insurance and Ensuring the Rights of Employees is currently in the process of collecting feedback with several noteworthy contents in Vietnam as follows:

04 types of debts related to social insurance, health insurance, and unemployment insurance in Vietnam:

Similar to the current regulations in Decision 959/QD-BHXH, debts related to social insurance, health insurance, and unemployment insurance in Vietnam are categorized into 04 types as follows:

- Late payment debt: This applies to units with a debt period of less than 01 month;

- Outstanding debt: This applies to units with a debt period from 01 month to less than 03 months;

- Long-term debt: This applies to units with a debt period of 03 months or more, excluding cases classified as difficult-to-recover debt;

- Difficult-to-recover debt, which includes:

- Units that are missing;

- Units undergoing procedures for dissolution, bankruptcy, or termination of operations; units not operating, without a manager or operator;

- Units whose foreign owner has fled from Vietnam;

- Units that have been dissolved, bankrupt, or terminated operations according to legal regulations;

- Units with debts currently in the period allowed to temporarily stop payment to retirement and survivorship funds, or units authorized by the competent authority to account for the debt.

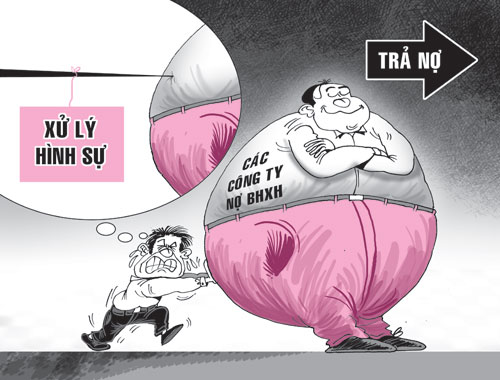

Debt Collection Procedures in Vietnam:

According to the guidance in the Draft Decree, on a monthly basis, the social insurance agency will send a notification of social insurance, health insurance, and unemployment insurance contributions to enterprises and employers. The notification will specify the amount of late payments and any incurred interest (if applicable). Additionally, it will urge the units to make timely and proper contributions in accordance with legal regulations.

For units with outstanding social insurance debts:

- The social insurance agency will directly visit the unit to urge payment and simultaneously send a written reminder once every 15 days;

- After sending two written reminders without receiving the payment for social insurance, health insurance, and unemployment insurance, a specialized inspection regarding the contributions will be conducted, and administrative violations will be handled as per legal regulations.

- During the urging period, if the unit commits to paying the social insurance, health insurance, and unemployment insurance debts within 30 days, monitoring and urging will continue, and inspection and violation handling will be temporarily suspended.

After 6 months from the date the social insurance agency visits the unit and takes urging measures without receiving the due payment, the agency will cooperate with the trade union to file a lawsuit in court or submit a prosecution request when there are signs of evading social insurance, health insurance, and unemployment insurance contributions.

If it is discovered that a unit’s foreign owner has fled from Vietnam, the social insurance agency will cooperate with local authorities to file for bankruptcy procedures.

Calculating Late Payment Interest for Social Insurance, Health Insurance, and Unemployment Insurance in Vietnam

For late payments of health insurance of 30 days or more, the interest shall be twice the interbank market interest rate for a 09-month term as published by the State Bank of Vietnam on its e-portal for the preceding year, calculated on the amount and duration of the late payment. If the interbank rate for the preceding year does not have a 09-month term, the interest rate of the nearest preceding term shall be applied.

For late payments of mandatory social insurance and unemployment insurance of 30 days or more, the interest shall be twice the average investment interest rate of the social insurance fund of the preceding year, calculated on the amount and duration of the late payment.

In cases of back payment due to adjustments in monthly salaries contributing to social insurance and unemployment insurance for employees or compensating for unpaid social insurance of employees working abroad under labor contracts, but the payment is made after 6 months from the date of salary adjustment or contract termination, the interest shall be the average investment interest rate of the social insurance fund of the preceding year, calculated on the amount and duration of the back-payment.

The interest for late payments due within a month is calculated using the formula:

Ln = Ln-1 + (T1 - T2) x k

Where:

- n: The sequence number of the current month in the year;

- k: The monthly late payment penalty interest rate (%/month) applied for the year;

- Ln: The total interest on late payment due for collection in month n;

- Ln-1: The cumulative late payment interest up to the end of the preceding month n;

- T1: The cumulative late payment amount up to the end of the preceding month n;

- T2: The late payment amount under 30 days arising in the preceding month n.

Evasion of payment for 30 days or more detected by the social insurance agency or competent state authority will result in not only back payment of the evaded amount but also back payment of interest calculated on the evaded amount, the duration of the evasion, and the late payment interest rate applied at the time of detection, using the formula:

| Back-paid Interest Amount | = | Evaded Amount (month) | x | Evasion Duration (month) | x | Late Payment Interest Rate Applied at Time of Detection (%/month) |

If by the end of the month when the evasion is detected, the unit has not paid or has not paid in full the evaded amount and interest, the evaded amount is transferred to the following month for collection and continued interest calculation; the unpaid interest is rolled over to the next month for collection.

- Key word:

- Debt Collection

- social insurance

- Vietnam

Article table of contents

Article table of contents

.jpg)