What are the regulations on the classification of levels of financial autonomy of public administrative units in Vietnam? - Thien Kim (Ben Tre, Vietnam)

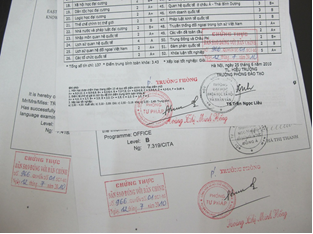

Classification of levels of financial autonomy of public administrative units in Vietnam (Internet image)

1. Classification of public non-business units in Vietnam

According to Clause 2, Article 9 of the Law on Public Employees 2010, public non-business units include:

- Public non-business units assigned with absolute autonomy in task performance, finance, apparatus organization and personnel (below referred to as autonomous public non-business units);

- Public non-business units not yet assigned with absolute autonomy in task performance, finance, apparatus organization and personnel (below referred to as non-autonomous public non-business units).

2. Classification of levels of financial autonomy of public administrative units in Vietnam

The classification of financial autonomy of public non-business units according to Article 9 of Decree 60/2021/ND-CP is as follows:

- A public administrative unit self-covering both recurrent and investment expenses (hereinafter referred to as “group-1 unit”) is the one meeting one of the following conditions:

+ The public administrative unit has a rate of self-covering of recurrent expenses which is determined according to the plan specified in Article 10 of Decree 60/2021/ND-CP is equal to or higher than 100%;

The total amount of self-covered investment expenses is equal to or higher than its total amount of depreciation and amortization of fixed assets.

Total amount of self-covered investment expenses includes the followings:

++ Estimated amounts paid to the fund for development of administrative operations in the planning year or the average of contributions paid to the fund for development of administrative operations in the previous 05 years;

++ The amount of collected fees retained for covering recurrent expenses as prescribed.

+ The public administrative unit provides public administrative services which are not funded by state budget and of which prices are determined according to the market mechanism, and include adequate fixed asset depreciation costs and accumulated amounts for covering investment expenses.

- A public administrative unit self-covering recurrent investment expenses (hereinafter referred to as “group-2 unit”) is the one meeting one of the following conditions:

+ The public administrative unit has a rate of self-covering of recurrent expenses which is determined according to the plan specified in Article 10 of Decree 60/2021/ND-CP is equal to or higher than 100%, and has not yet covered its investment expenses with funding from its fund for development of administrative operations, collected fees retained as prescribed by law regulations on fees and charges, and other lawful financial sources as prescribed by law;

+ The public administrative unit provides public administrative services which are included in the list of public administrative services funded by state budget, or provides public administrative services in the form of order placement or bidding at the price to which a full amount of costs has been added (excluding fixed asset depreciation costs).

- The public administrative unit self-covering part of its recurrent expenses (hereinafter referred to as “group-3 unit”) is a unit that has a rate of self-covering of recurrent expenses which is determined according to the plan specified in Article 10 of Decree 60/2021/ND-CP is from 10% to less than 100%, and provides public administrative services in the form of order placement or bidding at the price to which expenses have not been fully added, and is classified as follows:

+ The public administrative unit self-covering 70% to less than 100% of recurrent expenses;

+ The public administrative unit self-covering 30% to less than 70% of recurrent expenses;

+ The public administrative unit self-covering 10% to less than 30% of recurrent expenses.

- The public administrative units of which recurrent expenses are covered by state budget (hereinafter referred to as “group-4 unit”) include:

+ The public administrative unit has a rate of self-covering of recurrent expenses which is determined according to the plan specified in Article 10 of Decree 60/2021/ND-CP is less than 10%;

+ The public administrative unit does not earn revenues from administrative operations.

Quoc Dat

Article table of contents

Article table of contents