Hanoi-Vietnam: Notable legislative documents in last week (from November 12 to November 17, 2018)

Lawnet would like to highlight notable legislative documents on defense policy, insurance, and customs of Vietnam updated in the past week (from November 12, 2018, to November 17, 2018).

1. Special allowance levels for Guard Officers and Soldiers

On November 11, 2018, the Vietnam Ministry of National Defense issued Circular 162/2018/TT-BQP stipulating special allowances for the Guard force under the Ministry of National Defense. To be specific:

(1) The allowance level of 30% applies to:

- Guard officers and professional soldiers on duty for close protection; protecting international guests visiting and working in Vietnam; patrolling, and guarding residences, workplaces, and key areas;- Officers holding leadership and command positions in the Guard Division and Guard Task Force;- Officers with the military rank of Lieutenant/Professional soldiers with salaries equivalent to officers with the military rank of Lieutenant or lower.

(2) The allowance level of 25% applies to:

- Guard officers and professional soldiers on duty driving protection vehicles, driving service vehicles, guiding, escorting; inspecting explosives, flammable substances, radioactive substances, or other dangerous materials, etc.;'- Officers with the military rank of Senior Lieutenant, Captain/Professional soldiers with salaries equivalent to officers with the military rank of Senior Lieutenant, Captain, except for the cases mentioned in (1).

(3) The allowance level of 20% applies to:

- Guard officers and professional soldiers directly serving the leaders of the Communist Party, the State, and the Central Committee of the Vietnam Fatherland Front;

- Officers with the military rank of Major/Professional soldiers with salaries equivalent to officers with the military rank of Major or higher, except for the cases mentioned in (1) and (2).

(4) The allowance level of 15% applies to other Guard officers and professional soldiers.

Circular 162/2018/TT-BQP takes effect from December 26, 2018. The special allowance shall be applied from July 1, 2018.

2. Procedures for reimbursement of medical costs and copayment of amounts exceeding 6 months of the statutory pay rate

Ho Chi Minh City Social Security has issued Notice 2298/TB-BHXH providing guidelines for direct reimbursement of medical costs and copayment of amounts exceeding 6 months of the statutory pay rate.

Holders of health insurance cards who have participated in health insurance for 5 consecutive years and have copay expenses and copayment of amounts exceeding 6 months of the statutory pay rate from the point of continuous participation for 5 years will be reimbursed for the difference between the copay and the 6 months of the statutory pay rate. To be specific:

To be reimbursed for the differential amount, the documentation must include:

- A health insurance card with the inscription: "The point of sufficient 05 consecutive years..." or confirmation of 5 years of continuous participation and a photo ID (copy) up to the point of incurring medical expenses;

- The original hospital fee invoice.

To be reimbursed directly for medical costs, the documentation must include:

- Discharge notes, surgery certificates, emergency certificates, death certificates, prescriptions, X-rays, ultrasound, and laboratory test orders, etc. (copies with the originally seen confirmation for one or more of these documents);- The original hospital fee invoice.

3. Clarifications on sickness benefits for employees

According to the guidelines in Official Dispatch 2219/BHXH-CD of Ho Chi Minh City Social Security, sickness benefits for employees contain several noteworthy contents:

- In cases where the sickness leave certificate is issued for ½ day but the employer confirms a full day of actual leave, the sickness benefit is applied for the full day leave;

- The number of days of sickness leave approved by the Social Insurance authority should not exceed the number of days prescribed by the medical facility and the number of days requested by the employer;

- In cases of prolonged illness, if the employer only requests for working days, the claim is temporarily not resolved. The employer is notified to adjust the leave days to include public holidays and weekly breaks;

- If both parents participate in social insurance and have two or more children sick during the same period, both parents taking leave to care for the sick children will enjoy sickness benefits as prescribed in Clause 1, Article 27 of the 2014 Social Insurance Law.

- The voluntary social insurance premium payment period will not be counted for enjoying sickness, maternity, occupational accident, or disease benefits if the employee has both voluntary and compulsory social insurance premium payment periods.

More details on maternity and recovery benefits may be found in Official Dispatch 2219/BHXH-CĐ dated November 7, 2018.

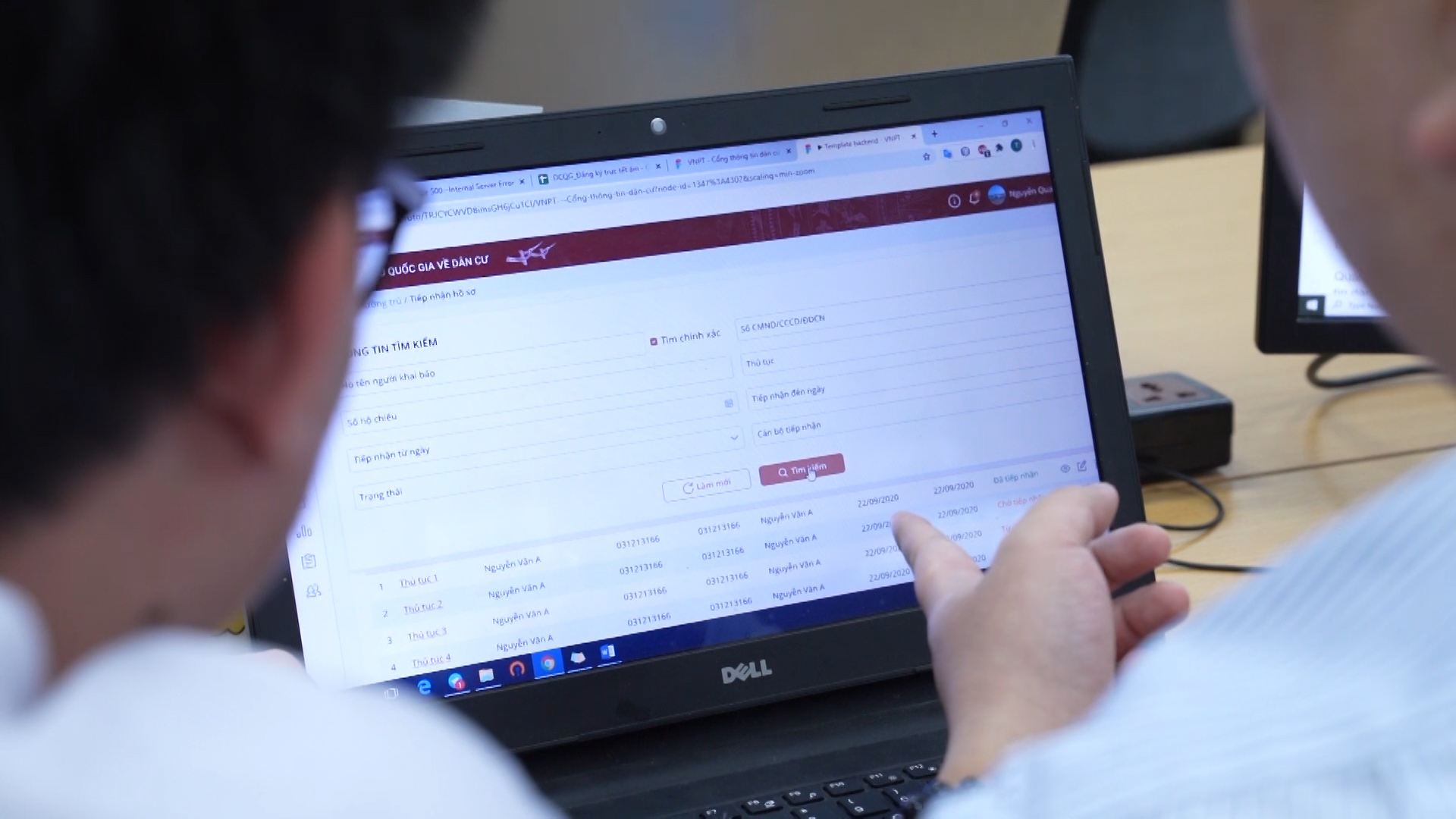

3. Customs procedures for importing scrap from abroad into Vietnam

The General Department of Vietnam Customs issued Official Dispatch 6644/TCHQ-GSQL guiding the provincial and municipal Customs Departments on carrying out customs procedures for importing scrap from abroad.

Notably, the stage of checking and comparing information on the customs declaration with the documents in the customs dossier sent through the electronic customs data processing system by the enterprise is specified as follows:

- Check information on the Import Scrap Confirmation Certificate;

- Check the Deposit Payment Confirmation Certificate to ensure imported scrap per regulations in Article 58 and Article 59 of Decree 38/2015/ND-CP;

- Check the inspection results notice on the quality of imported scrap;

- Handle the results of the dossier inspection.

Detailed procedures may be found in Official Dispatch 6644/TCHQ-GSQL dated November 13, 2018.

- Regulations on passing the theoretical knowledge of the law test to restore driver license points in Vietnam from January 1, 2025

- Approval of the Scheme for connecting, authenticating, and standardizing the National Insurance Database in Vietnam

- Specialized veterinary management agencies in Vietnam shall conduct veterinary sanitation inspection

- Immediate disbursement for supported and mobilized resources to eliminate temporary and dilapidated houses in Vietnam

- Ministry of Health of Vietnam issues economic - technical characteristics of 990 quarantine and preventive healthcare services at public healthcare facilities in Vietnam

- Report to the National Assembly of Vietnam on the continuation of a 2% reduction in value-added tax for the first 6 months of 2025 in Vietnam

-

- Regulations on passing the theoretical knowledge ...

- 15:15, 22/11/2024

-

- Approval of the Scheme for connecting, authenticating ...

- 11:48, 22/11/2024

-

- Program for the prevention and control of child ...

- 11:29, 22/11/2024

-

- Specialized veterinary management agencies in ...

- 11:23, 22/11/2024

-

- Guidelines on adjusting citizen information in ...

- 11:00, 22/11/2024

-

- Notable new policies of Vietnam effective from ...

- 17:30, 22/11/2024

-

- Regulations on passing the theoretical knowledge ...

- 15:15, 22/11/2024

-

- Approval of the Scheme for connecting, authenticating ...

- 11:48, 22/11/2024

-

- Program for the prevention and control of child ...

- 11:29, 22/11/2024

-

- Specialized veterinary management agencies in ...

- 11:23, 22/11/2024

Article table of contents

Article table of contents