Vietnam: Some notes in the organization and management of state budget estimates in 2012

This is a notable content of the Circular No. 177/2011/TT-BTC of the Ministry of Finance of Vietnam on organization and implementation of state budget estimates in 2012, issued on December 06, 2011.

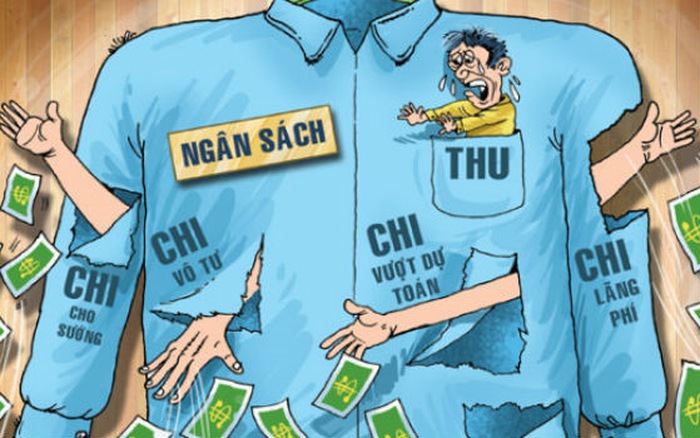

Specifically, according to Article 7 of the Circular No. 177/2011/TT-BTC of the Ministry of Finance of Vietnam, Ministries, central agencies, localities and budget-using units shall comply with the assigned budget estimates; financial agencies, the State Treasury shall organize and administer the budget within the approved estimate, strictly control expenditures to ensure that they are in accordance with the purposes, standards, norms and regimes prescribed by the State. It should be noted that:

- Expenditures from loan and aid sources shall be disbursed and controlled according to the following principles:

+ For expenditure estimates from loans and financial aid: To strictly implement the assigned estimate and implement the same mechanism as domestic capital (unless otherwise provided for in the agreement, the agreement shall apply).

+ For estimates of expenditures from loan and aid sources according to the state budget revenue and expenditure recording method: Follow the actual disbursement progress of each project.

- Directing relevant agencies and units to coordinate with financial agencies to proactively allocate capital from the beginning of the year for important construction projects according to the prescribed regime, especially construction and repair of dikes and irrigation works, prevention of natural disasters and epidemics, overcoming of flood consequences, projects on migration out of dangerous landslide areas according to projects decided by competent authorities.

- Advance payment of capital construction investment expenditure estimates of the following year must comply with Directive No. 1792/CT-TTg dated October 10, 2011 of the Prime Minister of Vietnam on strengthening investment management from state budget capital and government bond capital.

- Regularly inspect and evaluate the progress of projects and works; for projects and works that are not done on schedule, must promptly decide or report to the agency competent to decide on adjustments to transfer capital to projects with fast implementation progress, capable of being completed but not yet allotted with sufficient capital.

- In the 2012 recurrent expenditure estimates assigned to ministries and central agencies; the Ministry of Finance clearly notified the expenditures in foreign currencies for the units to actively implement. For the equivalent budget of USD 500,000/year or more, the expenditure in foreign currency is guaranteed according to the assigned estimate, the implementation process is still controlled by the State Treasury according to the expenditure estimate in the local currency assigned to the unit, if due to fluctuations in exchange rate, the expenditure estimate in local currency has been exhausted but the expenditure estimate in foreign currency remains, the unit shall notify the Ministry of Finance for timely processing of additional funding in local currency; in case the budget amount is less than 500,000 USD/year, the ministries and central agencies may withdraw the estimate in foreign currency at the exchange rate accounting at the time of transaction, but not exceed the estimate delivered in local currency.

- For the provinces and central-affiliated cities, if there is an unexpected expenditure need arising outside the estimate but cannot be delayed but the budget reserve is not enough to meet, expenditures must be rearranged in the assigned estimate, or use the Financial Reserve Fund to meet such unexpected spending needs. Provincial-level People's Committees decide to use the provincial-level financial reserve funds according to the provisions of Point dd, Clause 3, Article 58 of Decree No. 60/2003/ND-CP dated June 06, 2003 of Vietnam’s Government detailing and guiding the implementation of the State Budget Law.

- Direct relevant agencies and units to coordinate with financial agencies to regularly inspect the organization and implementation of regimes and policies at units and grassroots levels; save spending, fight waste, cut expenses that are not really necessary; proactively arrange recurrent expenditures, prioritize important tasks, secure resources to implement social security policies and adjust wages. In case it is discovered that all levels and units are using the budget improperly with regimes and policies, especially those related to the implementation of social policies, hunger eradication and poverty reduction, etc. it is necessary to take timely handling measures to ensure that the policies and regimes are implemented correctly and effectively.

- Report on the implementation of state budget estimates according to regulations.

View more details at the Circular No. 177/2011/TT-BTC of the Ministry of Finance of Vietnam, effective from January 01, 2012.

Le Vy

- Key word:

- Circular No. 177/2011/TT-BTC

- Prime Minister of Vietnam requests to enhance inspection on extra teaching and learning activities

- Dossier for concluding new residential electricity purchase and sale contract in Vietnam

- Decree 18 of 2025 on electricity trading and situations ensuring electricity supply in Vietnam

- Circular 07/2025 guiding Decree 178/2024 on funding sources for the implementation of organizational restructuring in Vietnam

- General objectives for the development of nuclear energy in Vietnam in the future

- Localities in Vietnam announce Decisions related to the organization structure arrangement from February 18, 2025, to February 20, 2025

-

- Vietnam: Decentralization of revenue sources and ...

- 17:13, 29/03/2023

-

- Vietnam: Deployment of publicization of state ...

- 14:45, 12/12/2012

-

- Vietnam: 03 arising cases for adjustment of the ...

- 17:20, 12/12/2011

-

- Vietnam: 04 conditions of the payment task to ...

- 17:10, 12/12/2011

-

- Vietnam: 14 spending tasks in 2012 granted in ...

- 17:05, 12/12/2011

-

- Prime Minister of Vietnam requests to enhance ...

- 15:30, 10/02/2025

-

- Ministry of Construction of Vietnam issues the ...

- 15:29, 10/02/2025

-

- Dossier for concluding new residential electricity ...

- 15:24, 10/02/2025

-

- Decree 18 of 2025 on electricity trading and situations ...

- 15:18, 10/02/2025

-

- Circular 07/2025 guiding Decree 178/2024 on funding ...

- 15:00, 10/02/2025

Article table of contents

Article table of contents