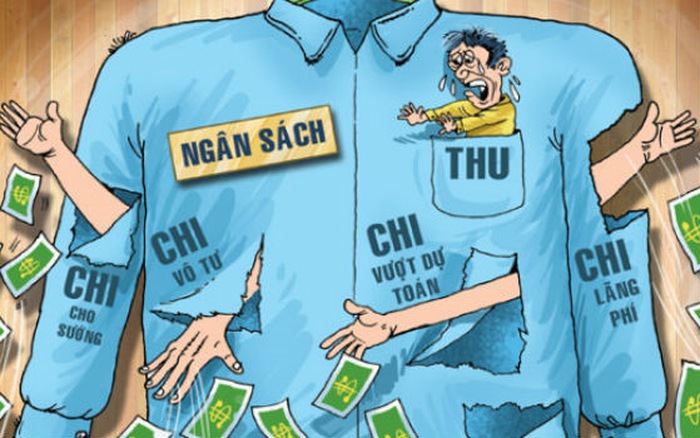

Vietnam: Deployment of publicization of state budget finance in 2012

This is a notable content of the Circular No. 177/2011/TT-BTC on organization and implementation of state budget estimates in 2012, issued by the Ministry of Finance of Vietnam on December 06, 2011.

Specifically, according to Article 12 of the Circular No. 177/2011/TT-BTC of the Ministry of Finance of Vietnam, disclosure of State budget and finance in 2012 is carried out as follows:

- Ministries, central and local agencies shall direct and fully implement the provisions of Decision No. 192/2004/QĐ-TTg dated November 16, 2003 of the Prime Minister on the Regulation on financial disclosure for all levels of the state budget, budget estimation units, organizations supported by the state budget, capital construction investment projects funded by the state budget, state enterprises, funds sourced from the state budget and funds derived from contributions from the people and guiding Circulars of the Ministry of Finance on disclosure, which should be noted as follows:

+ Finance agencies at all levels shall implement the regime of publicizing the state budget in accordance with the provisions of Circular No. 03/2005/TT-BTC dated January 06, 2005 of the Ministry of Finance of Vietnam guiding the implementation of regulations on financial disclosure for all levels of the state budget and reporting on the implementation of financial disclosure, Circular No. 54/2006/TT-BTC dated June 19, 2006 of the Ministry of Finance of Vietnam guiding the Regulation on financial disclosure for direct state budget support to individuals and population.

+ Budget-using units shall make public disclosure in accordance with the provisions of Circular No. 21/2005/TT-BTC dated March 22, 2005 of the Ministry of Finance of Vietnam guiding the implementation of regulations on financial disclosure for budget estimate units and organizations supported by the state budget.

+ State-owned enterprises shall make public disclosure in accordance with the provisions of Circular No. 29/2005/TT-BTC dated April 14, 2005 of the Ministry of Finance of Vietnam guiding financial disclosure regulations for State-owned enterprises.

+ Agencies and units allowed to use state budget capital shall make public disclosure in accordance with the provisions of Circular No. 10/2005/TT-BTC dated February 02, 2005 of the Ministry of Finance of Vietnam guiding the implementation of regulations on financial disclosure for the allocation, management and use of capital construction investment capital from the state budget.

+ Agencies and units assigned to manage funds sourced from the state budget and funds sourced from people's contributions shall publicly comply with the guidance in Circular No. 19/2005/TT-BTC dated March 11, 2005 of the Ministry of Finance of Vietnam on the financial disclosure of funds sourced from the state budget, and funds derived from contributions from the people.

- Agencies, units and organizations that use state property shall make public disclosure in accordance with provisions of Decision No. 115/2008/QĐ-TTg dated August 27, 2008 of the Prime Minister of Vietnam on publicity of the management and use of state property at state agencies, public non-business units and organizations assigned to manage and use state property.

Concurrently, in order to implement Decision No. 192/2004/QĐ-TTg dated November 16, 2004 of the Prime Minister of Vietnam, State budgets at all levels, budget-using units must make reports on the implementation of regulations publicly and send them to functional agencies for general monitoring and evaluation throughout the country according to regulations. Ministries, central agencies and localities (Department of Finance) are responsible for sending public reports to the Ministry of Finance immediately after publicizing the 2012 budget estimate and the 2010 budget finalization.

View more details at the Circular No. 177/2011/TT-BTC of the Ministry of Finance of Vietnam, effective from January 01, 2012.

Le Vy

- Key word:

- Circular No. 177/2011/TT-BTC

- Number of deputy directors of departments in Vietnam in accordance with Decree 45/2025/ND-CP

- Cases ineligible for pardon in Vietnam in 2025

- Decree 50/2025 amending Decree 151/2017 on the management of public assets in Vietnam

- Circular 07/2025 amending Circular 02/2022 on the Law on Environmental Protection in Vietnam

- Adjustment to the organizational structure of the Ministry of Health of Vietnam: Certain agencies are no longer listed in the organizational structure

- Vietnam aims to welcome 22-23 million international tourists in Vietnam in 2025

-

- Vietnam: Decentralization of revenue sources and ...

- 17:13, 29/03/2023

-

- Vietnam: 03 arising cases for adjustment of the ...

- 17:20, 12/12/2011

-

- Vietnam: 04 conditions of the payment task to ...

- 17:10, 12/12/2011

-

- Vietnam: 14 spending tasks in 2012 granted in ...

- 17:05, 12/12/2011

-

- Vietnam: Summary of spending tasks from the State ...

- 17:00, 12/12/2011

-

- Notable new policies of Vietnam effective as of ...

- 16:26, 11/04/2025

-

.Medium.png)

- Notable documents of Vietnam in the previous week ...

- 16:21, 11/04/2025

-

.Medium.png)

- Notable documents of Vietnam in the previous week ...

- 16:11, 02/04/2025

-

.Medium.png)

- Notable new policies of Vietnam to be effective ...

- 16:04, 02/04/2025

-

.Medium.png)

- Notable new policies of Vietnam effective from ...

- 14:51, 21/03/2025

Article table of contents

Article table of contents