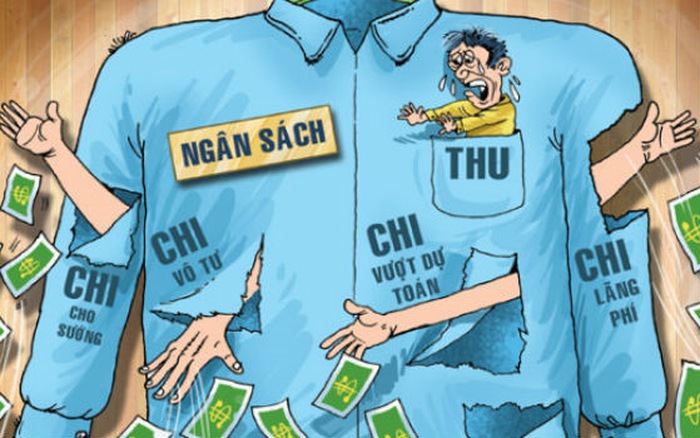

Vietnam: People's Committees at all levels organize the budget collection work from the beginning of the year

Recently, the Ministry of Finance of Vietnam has issued Circular No. 177/2011/TT-BTC on organization and implementation of state budget estimates in 2012.

According to Article 6 of the Circular No. 177/2011/TT-BTC of the Ministry of Finance of Vietnam, People's Committees at all levels, tax offices, customs offices and relevant agencies to organize the management of budget revenues are responsible for:

- Organizing the implementation of budget collection right from the beginning of the year, to ensure correct, sufficient and timely collection in accordance with law.

- Organizing and effectively implementing the Law on Environmental Protection Tax, the Law on Non-Agricultural Land Use Tax, and other financial and tax mechanisms and policies that have been in effect since 2012.

- Continuing to collect fees and charges in accordance with the law, localities seriously implement Directive No. 24/2007/CT-TTg dated November 01, 2007 of the Prime Minister of Vietnam on strengthening and correcting the implementation of legal provisions on fees and charges, policies on mobilizing and using contributions from the people. In order for units to have funds to perform their assigned tasks when exempting from collection of fees and charges according to Directive No. 24/2007/CT-TTg, People's Committees of the provinces and central-affiliated cities shall report to the People's Councils of the same level to proactively arrange funding support for units from the local budget.

- Strictly implementing the fiscal policies and the conclusions and recommendations of the Auditing and Inspection Agency.

Moreover, Tax and Customs offices strengthen monitoring, inspection and control of the declaration of goods names, codes, tax rates and tax declarations by organizations and individuals; timely detect cases of incorrect declaration, insufficient tax payable to take corrective measures. Organize timely collection of tax debts that can be collected by production and business organizations and individuals, closely coordinate with functional agencies to effectively implement measures to enforce tax debts; sum up and report to competent agencies to completely handle uncollectible tax debts. Step up the implementation of tax inspection and examination, with special attention paid to newly established enterprises and new investment enterprises in the first and second years that have incurred losses or incurred tax refunds, business losses for many years and losses in excess of equity; enterprises showing signs of transfer pricing; in the fields of banking, land projects, real estate business, pharmaceutical business etc. and the implementation of tax exemption, reduction and extension, tax refund to fully collect into the state budget sums of money tax fraud.

Promote the review and reform of tax administrative procedures under the Government's Project 30 to detect, eliminate or recommend the removal of unnecessary administrative procedures, creating the most favorable conditions for taxpayers. Improve the quality of operation of the "one-stop" department to handle tax administrative procedures.

Besides, Ministries, central agencies and localities are interested in directing the management of public assets and land use management from the stage of land use planning, making cadastral dossiers, and granting land use certificates, transferring land for management and budget collection fully and timely in accordance with the prescribed regime, especially revenues from auction of land use rights to ensure the avoidance of loss and waste of public property. Promote the rearrangement and handling of state-owned housing and land under Decision No. 09/2007/QD-TTg dated January 19, 2007 and Decision No. 140/2008/QD-TTg dated October 21, 2008 of the Prime Minister.

View more details at the Circular No. 177/2011/TT-BTC of the Ministry of Finance of Vietnam, effective from January 01, 2012.

Le Vy

- Key word:

- Circular No. 177/2011/TT-BTC

- Number of deputy directors of departments in Vietnam in accordance with Decree 45/2025/ND-CP

- Cases ineligible for pardon in Vietnam in 2025

- Decree 50/2025 amending Decree 151/2017 on the management of public assets in Vietnam

- Circular 07/2025 amending Circular 02/2022 on the Law on Environmental Protection in Vietnam

- Adjustment to the organizational structure of the Ministry of Health of Vietnam: Certain agencies are no longer listed in the organizational structure

- Vietnam aims to welcome 22-23 million international tourists in Vietnam in 2025

-

- Vietnam: Decentralization of revenue sources and ...

- 17:13, 29/03/2023

-

- Vietnam: Deployment of publicization of state ...

- 14:45, 12/12/2012

-

- Vietnam: 03 arising cases for adjustment of the ...

- 17:20, 12/12/2011

-

- Vietnam: 04 conditions of the payment task to ...

- 17:10, 12/12/2011

-

- Vietnam: 14 spending tasks in 2012 granted in ...

- 17:05, 12/12/2011

-

- Notable new policies of Vietnam effective as of ...

- 16:26, 11/04/2025

-

.Medium.png)

- Notable documents of Vietnam in the previous week ...

- 16:21, 11/04/2025

-

.Medium.png)

- Notable documents of Vietnam in the previous week ...

- 16:11, 02/04/2025

-

.Medium.png)

- Notable new policies of Vietnam to be effective ...

- 16:04, 02/04/2025

-

.Medium.png)

- Notable new policies of Vietnam effective from ...

- 14:51, 21/03/2025

Article table of contents

Article table of contents