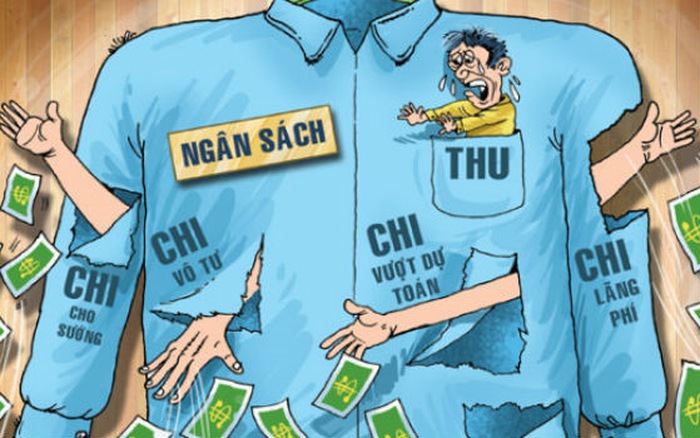

Vietnam: Localities must use 50% to increase the estimated 2012 budget revenue compared to 2011

Recently, the Ministry of Finance of Vietnam has issued Circular No. 177/2011/TT-BTC on organization and implementation of state budget estimates in 2012.

According to Article 4 of the Circular No. 177/2011/TT-BTC of the Ministry of Finance of Vietnam, in order to implement the financial mechanism to create a source to implement the salary and allowance regime in 2012 according to the Resolutions of the National Assembly, Decrees of the Government and Decisions of the Prime Minister, localities must use:

- 50% increase in local budget revenue (excluding the increase in revenue from land use levy) implemented in 2011 compared to the 2011 estimate assigned by the Prime Minister (for this source of revenue increase, in case the locality has difficulties, the rate of self-balancing from local revenue is low, the increase in revenue in 2011 is small compared to the estimate assigned by the Prime Minister, and for localities, when implementing wage reform, there are difficulties in resources due to the inability to harmonize revenue growth among local budget levels, the Ministry of Finance of Vietnam shall consider specifically to determine the increase in revenue to put into the source of wage reform in 2012; concurrently, summarize and report to the Prime Minister on implementation results);

- 50% increase in local budget revenue (excluding the increase in revenue from land use levy) estimated in 2012 compared with the 2011 estimate assigned by the Prime Minister;

- The unused source of salary reform in 2011 was transferred to;

- 10% savings in recurrent expenditures (excluding wages and salaries) estimated in 2011 have been assigned by competent authorities.

- 10% savings in recurrent expenditure estimates (excluding wages and salaries) in 2012 expenditure estimates increased compared to 2011 expenditure estimates and the remaining balance (if any) after ensuring the funding needs for salary reform to the minimum salary of 830,000 VND/month.

- 40% of the proceeds will be left according to the regime in 2012 (in the health sector alone, 35%, after deducting expenses for drugs, blood, infusion fluids, chemicals, substitutes, and consumables). The amount of revenue left behind according to the regime of administrative agencies and non-business units must not be deducted from direct expenses for collection work in case this revenue is collected from jobs and services invested by the State or from jobs and services under the State's prerogative and whose expenses have been covered by the state budget for collection activities, such as: tuition fees left to public schools; the amount of hospital fees left to the public hospital after deducting the costs of drugs, blood transfusions, chemicals, replacement supplies, consumables, etc. The amount of revenue that is left under the regime is deductible for direct expenses for collection in case this revenue is collected from jobs and services invested by the State or from jobs and services in the rights of the State, but the state budget has not yet been able to guarantee collection operating expenses.

- Amount allocated (if any) support from the central budget in the 2012 estimate to implement salary reform to the minimum salary of 830,000 VND/month.

View more details at the Circular No. 177/2011/TT-BTC of the Ministry of Finance of Vietnam, effective from January 01, 2012.

Le Vy

- Key word:

- Circular No. 177/2011/TT-BTC

- Prime Minister of Vietnam requests to enhance inspection on extra teaching and learning activities

- Dossier for concluding new residential electricity purchase and sale contract in Vietnam

- Decree 18 of 2025 on electricity trading and situations ensuring electricity supply in Vietnam

- Circular 07/2025 guiding Decree 178/2024 on funding sources for the implementation of organizational restructuring in Vietnam

- General objectives for the development of nuclear energy in Vietnam in the future

- Localities in Vietnam announce Decisions related to the organization structure arrangement from February 18, 2025, to February 20, 2025

-

- Vietnam: Decentralization of revenue sources and ...

- 17:13, 29/03/2023

-

- Vietnam: Deployment of publicization of state ...

- 14:45, 12/12/2012

-

- Vietnam: 03 arising cases for adjustment of the ...

- 17:20, 12/12/2011

-

- Vietnam: 04 conditions of the payment task to ...

- 17:10, 12/12/2011

-

- Vietnam: 14 spending tasks in 2012 granted in ...

- 17:05, 12/12/2011

-

- Prime Minister of Vietnam requests to enhance ...

- 15:30, 10/02/2025

-

- Ministry of Construction of Vietnam issues the ...

- 15:29, 10/02/2025

-

- Dossier for concluding new residential electricity ...

- 15:24, 10/02/2025

-

- Decree 18 of 2025 on electricity trading and situations ...

- 15:18, 10/02/2025

-

- Circular 07/2025 guiding Decree 178/2024 on funding ...

- 15:00, 10/02/2025

Article table of contents

Article table of contents