Funding sources for statutory pay rates of provinces and cities in Vietnam under Decree 73

On August 20, 2024, the Minister of Finance of Vietnam issued Circular 62/2024/TT-BTC providing guidance on determining the requirements, sources, and methods of expenditure for implementing the statutory pay rate and bonus policies according to Decree 73/2024/ND-CP and adjusting the monthly allowance for commune officials who have retired according to Decree 75/2024/ND-CP.

Funding sources for statutory pay rates of provinces and cities in Vietnam under Decree 73

The funding sources for implementing the statutory pay rate and bonus policies as per Decree 73/2024/ND-CP for provinces and centrally governed cities in Vietnam include:

- Utilizing the source of 10% savings from regular expenditures (excluding salary expenses, allowances according to salary, salary-like expenses, and person-related expenses as per policies) in the 2023 budget forecast allocated by the competent authority in Vietnam.

- Utilizing the source of 10% savings from regular expenditures (excluding salary expenses, allowances according to salary, salary-like expenses, and person-related expenses as per policies) in the 2024 budget forecast, which is an increase compared to the 2023 budget forecast allocated by the competent authority.

- Utilizing 70% of the increased local budget revenue for 2023 and 50% of the increased local budget revenue forecast for 2024 compared to the 2023 budget forecast as assigned by the Prime Minister of the Government of Vietnam (excluding certain items as stipulated in Clause 2, Article 3 of Resolution 34/2021/QH15, Decision 1600/QD-TTg and 1602/QD-TTg of 2023).

- Utilizing 50% of the state budget savings from the reduction in regular administrative support activities (due to streamlining the workforce and reorganizing the political system to make it more streamlined, effective, and efficient) and from public service providers (due to the reformation of organizational and management systems, improving the quality and efficiency of activities of public service providers).

- Utilizing a minimum of 40% of the revenue left over according to policies in 2024 after deducting expenses directly related to service provision and fee collection.

Specifically, for the revenue from providing health examination, treatment services, preventive healthcare, and other medical services from public medical facilities, a minimum of 35% must be used after deducting expenses directly related to service provision and fee collection.

The scope of the deduction from the revenue left over should follow the guidelines in Clause 3, Article 3 of Circular 62/2024/TT-BTC.

- Utilizing the unused funds for salary reform up to the end of 2023 to be carried over (if available).

More details can be found in Circular 62/2024/TT-BTC which comes into force in Vietnam from August 20, 2024.

- Key word:

- statutory pay rates

- Vietnam

- in Vietnam

- Regulations on Establishment and Dissolution of the State Audit Teams

- Forms of Implementing Mass Mobilization Work by the People's Public Security Forces

- 04 Entities Subject to Regular Reporting Policies on Industrial Clusters from October 1, 2024

- Adjustment of medium-term public investment plan using the central budget in Vietnam for the 2021 - 2025 Period

- More than 7,000 public employees considered for conversion to officials

- Strengthening Personal Data Protection and Cyber Information Security in the Education Sector

-

- Forms of conducting mass mobilization in the People ...

- 12:30, 24/08/2024

-

- Improvement of the quality and efficiency of provision ...

- 12:00, 24/08/2024

-

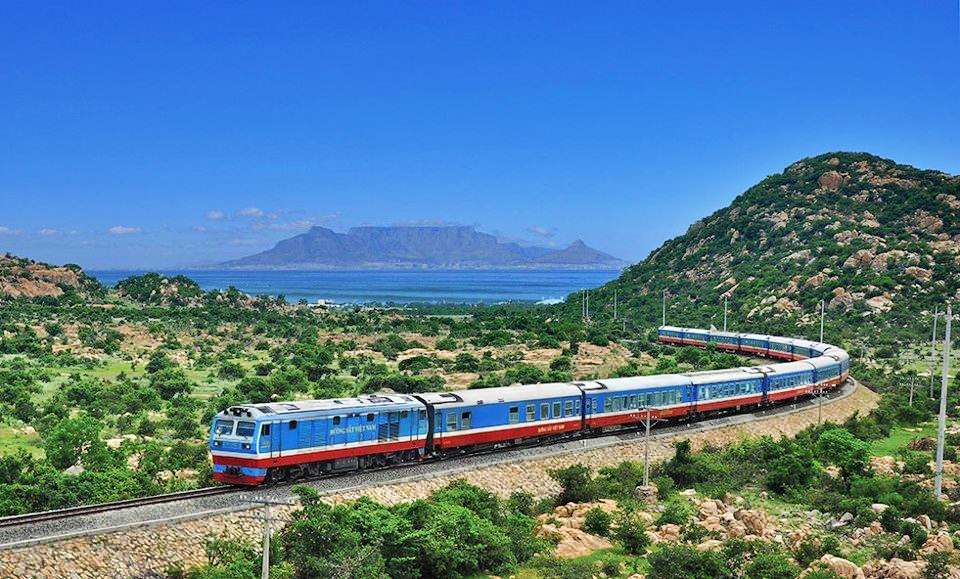

- Approval of the Scheme on national railway infrastructure ...

- 11:30, 24/08/2024

-

- Contents and forms of official recruitment through ...

- 10:33, 24/08/2024

-

- Newest guidelines for modifying contents of audit ...

- 10:30, 24/08/2024

-

- Regulations on the Duties and Powers of the Chief ...

- 19:00, 24/08/2024

-

- Regulations on the Audit Duration of the State ...

- 18:33, 24/08/2024

-

- Regulations on Establishment and Dissolution of ...

- 18:12, 24/08/2024

-

- Scope of Management of Private Ownership and Common ...

- 18:00, 24/08/2024

-

- Time Required to Process the Parcel Separation ...

- 17:30, 24/08/2024

(1).png)

Article table of contents

Article table of contents