Vietnam: Issuance of accounting practicing certificate shall require practical experience

Implementing Resolution No. 01/NQ-CP dated January 01, 2018 of Vietnam’s Government on continuing to create an open business environment, the Ministry of Finance has recently reviewed and planned to reduce and simplify existing business conditions. This is a timely move, meeting the urgent requirements of the business community and opening up opportunities to provide public services for all organizations and individuals.

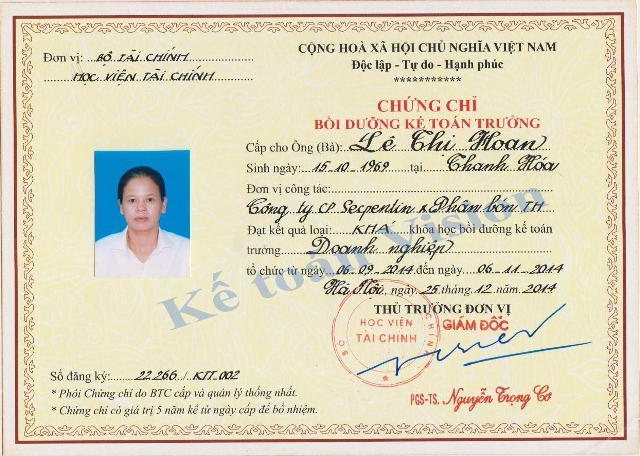

According to current regulations, State management agencies often base themselves on practicing certificates to confirm the ability of organizations and individuals to participate in professions requiring professional qualifications. Some prominent professional certifications in the financial industry include: appraiser, customs declarant, tax agent, auditor and accountant. The process of examination and issuance of practice certificates has been carried out for many years and has obtained positive results, effectively serving the state management. However, up to now, it has also revealed some inappropriate points when the economy is increasingly modern, developing and expanding international cooperation.

Currently, in order to practice accounting, a practicing enterprise must meet the provisions of Circular No. 296/2016/TT-BTC with the precondition of providing an accountant or auditor certificate. To do so, individuals must pass an exam to obtain an accounting practicing certificate, including 4 subjects: Economic law and law on enterprises; Finance and advanced financial management; Taxes and advanced tax administration; Financial accounting, advanced administrative accounting (according to Circular No. 91/2017/TT-BTC).

In fact, there were many problems with the implementation. Specifically, most people who want to practice accounting have graduated from university in accounting and finance. Most of them have worked as general accountants and chief accountants for many years in enterprises and corporations, so they have professional qualifications and are fully qualified to practice. However, when participating in certification exams, because most of the exam content often refers to traditional theoretical knowledge from the past, for those who have gone through many years of work, this is a limit. Therefore, many people with practical experience but failed the exam, not only disadvantaged skilled accountants, but also wasted human resources in the field of public services.

Another issue is that certification exams are also core subjects of university programs. Therefore, the content of the exam is duplicated in knowledge and does not fully reflect the accountant's ability to practice. Because, practitioners need more experience and skills to handle specific situations and deal with customers and state management agencies. Accordingly, the current certification training needs to be reconsidered in the direction of upholding standards and conditions of professional thinking to replace the unrealistic exam content.

This situation shows that it is time to review the process, regulations and content of the exam for the certification of accounting and tax consulting practice. Accordingly, it is necessary to expand the exam exemption for subjects with many years of seniority (over 10 years) as chief accountants or general accountants. Concurrently, training and exams should focus on practicing skills training, similar to practicing law. In addition, practice and training should be carried out regularly and considered as the basis for annual certificate renewal.

Source: Tax Magazine

- Key word:

- Circular No. 296/2016/TT-BTC

- Number of deputy directors of departments in Vietnam in accordance with Decree 45/2025/ND-CP

- Cases ineligible for pardon in Vietnam in 2025

- Decree 50/2025 amending Decree 151/2017 on the management of public assets in Vietnam

- Circular 07/2025 amending Circular 02/2022 on the Law on Environmental Protection in Vietnam

- Adjustment to the organizational structure of the Ministry of Health of Vietnam: Certain agencies are no longer listed in the organizational structure

- Vietnam aims to welcome 22-23 million international tourists in Vietnam in 2025

-

.jpg)

- Vietnam: Guidance on management of accounting ...

- 11:26, 12/01/2017

-

- Application for registration of accounting practice ...

- 14:10, 23/11/2016

-

- Vietnam: Guidance on determination of actual time ...

- 15:10, 22/11/2016

-

- Vietnam: When shall the accounting practice certificate ...

- 16:10, 21/11/2016

-

- 03 rules for registration of accounting practice ...

- 09:09, 19/11/2016

-

- Notable new policies of Vietnam effective as of ...

- 16:26, 11/04/2025

-

.Medium.png)

- Notable documents of Vietnam in the previous week ...

- 16:21, 11/04/2025

-

.Medium.png)

- Notable documents of Vietnam in the previous week ...

- 16:11, 02/04/2025

-

.Medium.png)

- Notable new policies of Vietnam to be effective ...

- 16:04, 02/04/2025

-

.Medium.png)

- Notable new policies of Vietnam effective from ...

- 14:51, 21/03/2025

Article table of contents

Article table of contents