Vietnam: Guidance on management of accounting practice certificates

On November 15, 2016, the Ministry of Finance of Vietnam issued the Circular No. 296/2016/TT-BTC on guidelines for issuance, revocation and management of accounting practice certificates.

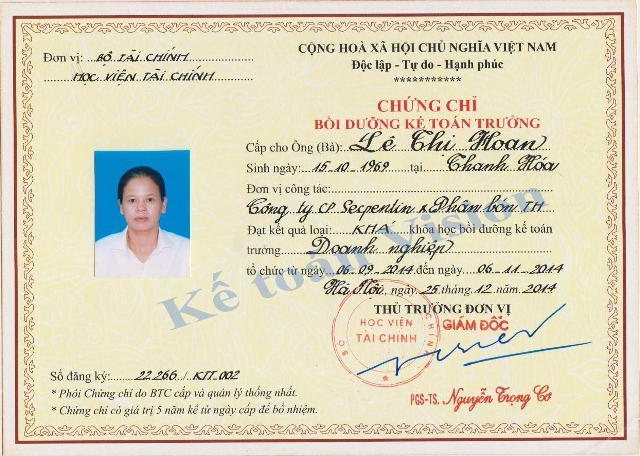

Circular No. 296/2016/TT-BTC of the Ministry of Finance of Vietnam stipulates the issuance, re-issuance, revocation of accounting practice certificates (APCs); suspension, revocation, management and disclosure of the list of accounting practitioners.

1. Full-time employment contract and actual time of working experience in finance, accounting or auditing

An employment contract is considered full-time when the employment contract is legal under the Labor Code of Vietnam, the working time in the employment contract and the actual working time of the person registering to practice accounting services is consistent with the working time of the accounting firm or accounting service household.

The actual time of working experience in finance, accounting or auditing is the period of time that the registrant has worked in the field of finance, accounting or auditing at the agencies, organizations or units where he/she have been recruited or have entered into employment contracts in conformity with the working time of these employers.

2. Registration of accounting practice

According to the Circular No. 296/2016/TT-BTC of the Ministry of Finance of Vietnam, the registrant shall have the accounting firm or accounting household business submit an application to the Ministry of Finance via.

The legal representative of the accounting firm, representative of the accounting household business shall verify the application and sign to certify the application form for issuance of APC of every registrant.

The accounting firm or accounting household business shall submit a list of registrants of APC with their equivalent applications to the Ministry of Finance.

Within 15 business days after receiving a duly complete application, the Ministry of Finance shall consider issuing an APC to the registrant via the accounting firm or accounting household business.

3. Revocation of APC

According to the Circular No. 296/2016/TT-BTC of the Ministry of Finance of Vietnam, the person whose APC has been revoked may not keep working as an accountant, chief accountant, or accounting consultant, preparing financial statements and performing other accounting-related works and must return the APC.

On the other hand, a person whose APC is revoked may not apply for an APC within twelve months from the effective date of the revocation decision.

4. Responsibilities of accounting practitioner

It is clearly stated in Circular No. 296/2016/TT-BTC of the Ministry of Finance of Vietnam that no later than August 31 every year, the accounting practitioner must send a report on compliance with requirements for accounting practice to the Ministry of Finance.

The accounting practitioner shall notify in writing to the Ministry of Finance at least 10 days before the APC expires or is no longer valid and submit the old APCs to the Ministry of Finance through the accounting firm or the accounting household business within 15 days after the APC expires or is invalid.

An accounting practitioner who registers to practice in an accounting firm or accounting household business, but also acts as the legal representative, Director (Director General), President of the Board of Directors, President of the Member Assembly, Chief Accountant (or accountant in charge), accountant, internal audit or other positions at other entity must notify the Ministry of Finance in writing within 15 days from the start or end date of holding the job or having a change in working time, title at such entity.

Circular No. 296/2016/TT-BTC takes effect from January 01, 2017 and replaces regulations on registration and management of accounting practice of Circular No. 72/2007/TT-BTC dated June 27, 2007 of the Ministry of Finance of Vietnam. For persons who have been practicing accounting services since 2016 or earlier, their applications for issuance of the APC are not required to have a certification of actual time of working experience in finance, accounting or auditing.

Source: Finance Magazine

- Key word:

- Circular No. 296/2016/TT-BTC

- Number of deputy directors of departments in Vietnam in accordance with Decree 45/2025/ND-CP

- Cases ineligible for pardon in Vietnam in 2025

- Decree 50/2025 amending Decree 151/2017 on the management of public assets in Vietnam

- Circular 07/2025 amending Circular 02/2022 on the Law on Environmental Protection in Vietnam

- Adjustment to the organizational structure of the Ministry of Health of Vietnam: Certain agencies are no longer listed in the organizational structure

- Vietnam aims to welcome 22-23 million international tourists in Vietnam in 2025

-

- Vietnam: Issuance of accounting practicing certificate ...

- 11:30, 17/04/2017

-

- Application for registration of accounting practice ...

- 14:10, 23/11/2016

-

- Vietnam: Guidance on determination of actual time ...

- 15:10, 22/11/2016

-

- Vietnam: When shall the accounting practice certificate ...

- 16:10, 21/11/2016

-

- 03 rules for registration of accounting practice ...

- 09:09, 19/11/2016

-

- Notable new policies of Vietnam effective as of ...

- 16:26, 11/04/2025

-

.Medium.png)

- Notable documents of Vietnam in the previous week ...

- 16:21, 11/04/2025

-

.Medium.png)

- Notable documents of Vietnam in the previous week ...

- 16:11, 02/04/2025

-

.Medium.png)

- Notable new policies of Vietnam to be effective ...

- 16:04, 02/04/2025

-

.Medium.png)

- Notable new policies of Vietnam effective from ...

- 14:51, 21/03/2025

Article table of contents

Article table of contents