03 rules for registration of accounting practice in Vietnam

In 2016, the Ministry of Finance of Vietnam issued the Circular No. 296/2016/TT-BTC on guidelines for issuance, revocation and management of accounting practice certificates.

According to the Circular No. 296/2016/TT-BTC of the Ministry of Finance of Vietnam, registration of accounting practice must ensure the following rules:

- The registration of accounting practice shall be done by the accounting firm or accounting household business where the registrant has a full-time employment contract:

- The registrant shall be liable for the information declared in the application for registration of accounting practice. The legal representative of the accounting firm, representative of the accounting household business and other entities relevant to the verification of the application for registration of accounting practice shall be jointly liable for the truthfulness of the information verified.

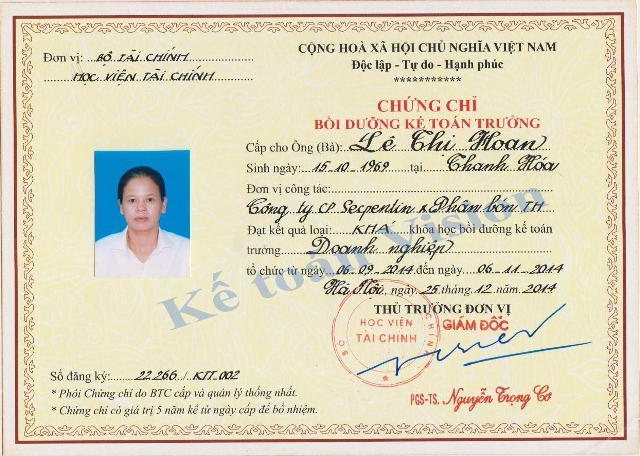

- Diplomas and certificates in the application for registration, if written in a foreign language, shall enclose with Vietnamese translations notarized or certified by the competent authority as prescribed.

View more details at the Circular No. 296/2016/TT-BTC of the Ministry of Finance of Vietnam, effective from January 01, 2017.

- Key word:

- Circular No. 296/2016/TT-BTC

- Number of deputy directors of departments in Vietnam in accordance with Decree 45/2025/ND-CP

- Cases ineligible for pardon in Vietnam in 2025

- Decree 50/2025 amending Decree 151/2017 on the management of public assets in Vietnam

- Circular 07/2025 amending Circular 02/2022 on the Law on Environmental Protection in Vietnam

- Adjustment to the organizational structure of the Ministry of Health of Vietnam: Certain agencies are no longer listed in the organizational structure

- Vietnam aims to welcome 22-23 million international tourists in Vietnam in 2025

-

- Vietnam: Issuance of accounting practicing certificate ...

- 11:30, 17/04/2017

-

.jpg)

- Vietnam: Guidance on management of accounting ...

- 11:26, 12/01/2017

-

- Application for registration of accounting practice ...

- 14:10, 23/11/2016

-

- Vietnam: Guidance on determination of actual time ...

- 15:10, 22/11/2016

-

- Vietnam: When shall the accounting practice certificate ...

- 16:10, 21/11/2016

-

- Notable new policies of Vietnam effective as of ...

- 16:26, 11/04/2025

-

.Medium.png)

- Notable documents of Vietnam in the previous week ...

- 16:21, 11/04/2025

-

.Medium.png)

- Notable documents of Vietnam in the previous week ...

- 16:11, 02/04/2025

-

.Medium.png)

- Notable new policies of Vietnam to be effective ...

- 16:04, 02/04/2025

-

.Medium.png)

- Notable new policies of Vietnam effective from ...

- 14:51, 21/03/2025

Article table of contents

Article table of contents