Guidelines on Filling Customs Declaration Form for Persons Entering and Exiting the Country in Vietnam

17:49, 10/07/2024

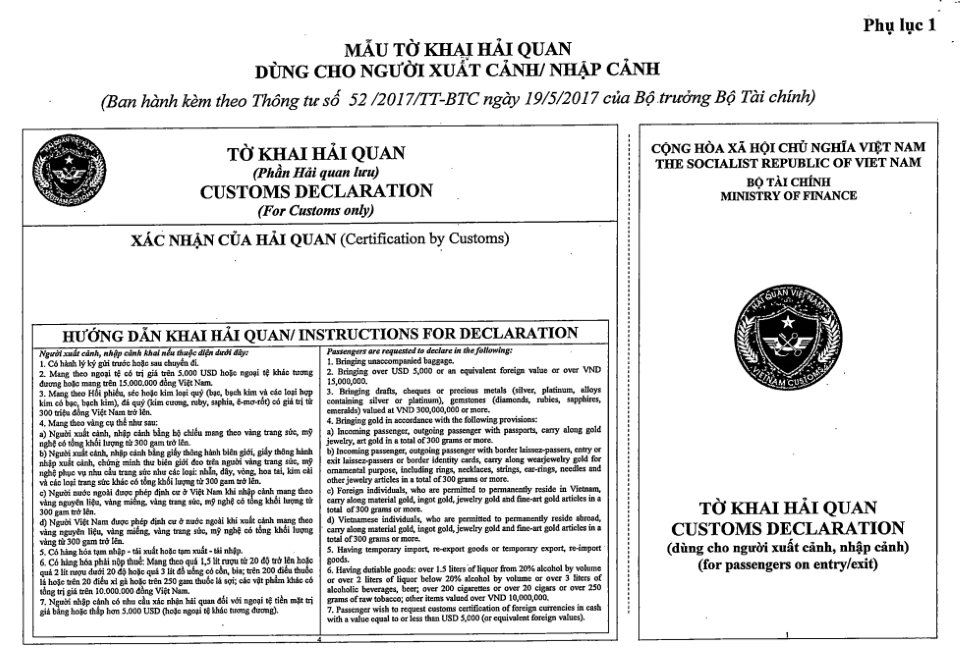

Consolidated Document No. 02/VBHN-BTC (dated February 02, 2018) combining the Circular provides regulations on the form, issuance, management, and use of Customs Declarations for individuals exiting or entering the country in Vietnam. Below are the guidelines for filling out the customs declaration for individuals exiting or entering the country.

| Content Customs Declaration Form in Vietnam | Instructions |

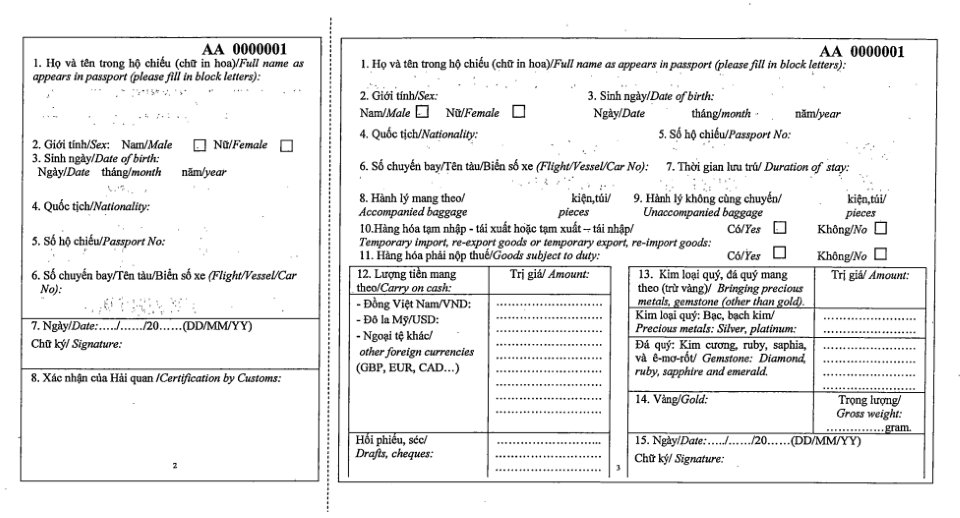

| PAGE 2 | |

| Box No. 1 | The entrant, exit person must clearly and fully declare the name according to the passport, written in uppercase letters in the order of each blank box, separated by 01 space between surname, middle name, and first name. |

|---|---|

| Box No. 2 | Mark an “X” in the corresponding box. |

| Box No. 3 | Write the numbers in the blank box. |

| Box No. 4 | State nationality according to the passport or entry/exit documents upon entry or exit. |

| Box Nos. 5 and 6 | Write letters and numbers in the box. |

| Box No. 7 | The entrant, exit person writes the entry date. |

| Box No. 8 | Customs Officer confirms the declaration of the entrant, exit person, signs, and stamps officially. |

| PAGE 3 | |

| Box Nos. 1 to 6 | Declaration similar to Page 2 mentioned above. |

| Box No. 7 | Write the conversion time in days, only used for foreign entrants to serve as a basis for VAT refund if applicable. |

| Box Nos. 8 and 9 | Write in numbers the total number of packages, bags. |

| Box No. 10 | - Mark an “X” in the declaration box “Yes” if there are temporarily imported goods for re-export or temporarily exported goods for re-import. - Mark an “X” in the declaration box “No” if there are no temporarily imported goods for re-export or temporarily exported goods for re-import. Specifically declare on the paper Customs Declaration Form (name, brand, value), luggage, and time of temporary import - re-export or temporary export - re-import. |

| Box No. 11 | - Mark an “X” in the declaration box “Yes” if there are goods subject to tax payment, or if bringing along goods exceeding the tax-free allowance. - Mark an “X” in the declaration box “No” if there are no goods subject to tax payment, or bringing along goods exceeding the tax-free allowance. Specifically declare on the paper Customs Declaration Form (name, brand, value, quantity). |

| Box No. 12 | Cases requiring specific declaration in the value box: + Bringing Vietnamese cash with a value over 15,000,000 VND; + Bringing cash in foreign currencies with a value over 5,000 USD; + Bringing cash in other types of foreign currencies with a conversion value over 5,000 USD (British Pound, EURO, Canadian Dollar, etc.); + In case the entrant brings cash in foreign currencies equal to or less than 5,000 USD but needs customs authority’s certification to deposit into a bank account. |

| Box No. 13 | Cases requiring declaration when bringing along precious metals (excluding gold), precious stones with a conversion value according to interbank rates: + Precious metals (excluding gold): silver, platinum; artisanal crafts and jewelry made of silver, platinum; alloys containing silver, platinum with a value from 300,000,000 VND and above; + Precious stones include: Diamonds, Ruby, Sapphire, Emerald with a value from 300,000,000 VND and above. |

| Box No. 14 | Declare the specific weight of gold (calculated in grams) if the entrant, exit person falls into any case mentioned at point 4, page 4 of the Customs Declaration Guide. |

| Box No. 15 | State the entry/exit date, sign, and clearly write the full name. |

For details, see Consolidated Document 02/VBHN-BTC consolidating Circular 120/2015/TT-BTC and Circular 52/2017/TT-BTC.

Related Content

- Number of deputy directors of departments in Vietnam in accordance with Decree 45/2025/ND-CP

- Cases ineligible for pardon in Vietnam in 2025

- Decree 50/2025 amending Decree 151/2017 on the management of public assets in Vietnam

- Circular 07/2025 amending Circular 02/2022 on the Law on Environmental Protection in Vietnam

- Adjustment to the organizational structure of the Ministry of Health of Vietnam: Certain agencies are no longer listed in the organizational structure

- Vietnam aims to welcome 22-23 million international tourists in Vietnam in 2025

SEARCH ARTICLE

Related Article

-

- Number of deputy directors of departments in Vietnam ...

- 15:04, 05/03/2025

-

- Cases ineligible for pardon in Vietnam in 2025

- 14:43, 05/03/2025

-

- Decree 50/2025 amending Decree 151/2017 on the ...

- 12:00, 05/03/2025

-

- Circular 07/2025 amending Circular 02/2022 on ...

- 11:30, 05/03/2025

-

- Adjustment to the organizational structure of ...

- 10:34, 05/03/2025

JUST UPDATED

-

- Notable new policies of Vietnam effective as of ...

- 16:26, 11/04/2025

-

.Medium.png)

- Notable documents of Vietnam in the previous week ...

- 16:21, 11/04/2025

-

.Medium.png)

- Notable documents of Vietnam in the previous week ...

- 16:11, 02/04/2025

-

.Medium.png)

- Notable new policies of Vietnam to be effective ...

- 16:04, 02/04/2025

-

.Medium.png)

- Notable new policies of Vietnam effective from ...

- 14:51, 21/03/2025

New text summary report

-

Real estate

-

Policy analysis

-

Legal Counselling

-

Case law

-

Forms and Templates

-

New text catalog

-

New Text Notification

-

Highlights of the week

-

Finance

-

New policy in effect

-

Labor - Salary

-

Officials and civil servants

-

Land - Housing

-

Tax-free-fee

-

Custom

-

Enterprise - Investment

-

Administration

-

Insurance

-

Civil

-

Set of Laws

-

News about Case Law

-

Economy

-

Life

-

Health

-

Cultural

-

Commerce

-

Military

-

History

-

Strange story

-

Criminal

-

Traffic

-

Education

-

Other

Article table of contents

Article table of contents