Guidance on Declaration and Payment of Fees for Issuance of Citizen Identity Cards Collected

This is the noteworthy content mentioned in Circular 59/2019/TT-BTC of the Ministry of Finance, which stipulates the collection rate, policies on collection, remittance, and management of the fees for issuing Citizen Identification Cards.

According to the provisions of Article 6 of Circular 59/2019/TT-BTC, organizations collecting the fee for issuing citizen identity cards shall declare and submit the collected fees monthly and finalize the annual financial statements as guided in clause 3 Article 19, clause 2 Article 26 of Circular 156/2013/TT-BTC guiding the implementation of some articles of the Tax Administration Law; and the Law amending and supplementing some articles of the Tax Administration Law and Decree 83/2013/ND-CP.

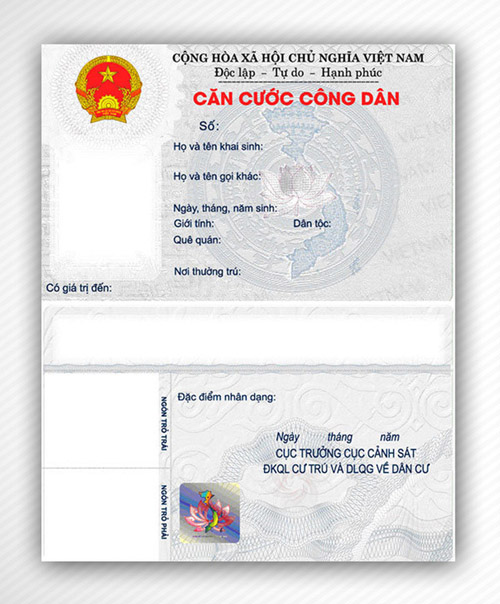

Illustration (source: internet)

According to Circular 59, organizations must submit 100% of the collected fees into the state budget according to the chapter, sub-item of the current state budget index.

The production, issuance, management of citizen identity cards and fee collection shall be carried out from the following funding sources:

- The cost for production, management, issuance (new, replacement, re-issuance) of citizen identity cards and fee collection is arranged in the state budget estimates of the collecting organization according to policies and expenditure norms of the state budget as prescribed by law.- The agency responsible for the production, management, issuance (new, replacement, re-issuance) of citizen identity cards and fee collection shall prepare annual state budget revenue and expenditure estimates and submit them to the competent authorities for approval as prescribed by the State Budget Law.

For more information, refer to Circular 59/2019/TT-BTC which took effect from October 16, 2019.

Thu Ba

- Procedures for commendation of individuals with achievements in militia and self-defense forces in Vietnam

- Determination of asset valuation costs in civil proceedings and administrative proceedings in Vietnam from July 1, 2025

- Procedures for commendation of collectives with achievements in militia and self-defense forces in Vietnam

- Formula for calculating severance policy for officials during organizational apparatus in Vietnam

- Content of statistical reporting policies in the planning and investment sector in Vietnam from April 1, 2025

- Cases exempt from advance payment of on-site inspection and assessment costs in civil proceedings in Vietnam from July 1, 2025

-

- Procedures for commendation of individuals with ...

- 09:30, 23/01/2025

-

- Promulgation of technical regulations on the system ...

- 17:42, 22/01/2025

-

- Latest guidelines on electing delegates for the ...

- 17:40, 22/01/2025

-

- 17 propaganda slogans celebrating the 95th anniversary ...

- 17:30, 22/01/2025

-

- Regulations on the professional title codes for ...

- 16:52, 22/01/2025

Article table of contents

Article table of contents