Accounting Documents for Foreign Loans and Debt Repayments

On August 16, 2018, the Ministry of Finance issued Circular 74/2018/TT-BTC, which includes several notable regulations on accounting documents related to foreign loans and debt repayments.

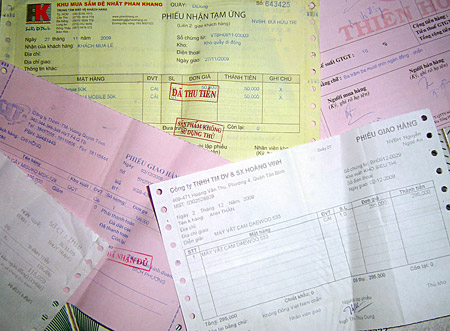

Circular 74 stipulates certain mandatory accounting document templates that accountants must adhere to in both format and content. Accountants are permitted to create accounting documents on computers, but they must ensure the documents conform to the stipulated formats and content as per regulations.

- For certain borrowing and debt repayment transactions without specific prescribed document templates, accountants can prepare account recording documents according to this Circular based on foreign loan and repayment records to perform accounting in compliance with regulations.- In cases where electronic accounting documents are used, these must adhere to legal provisions concerning the creation, coding, circulation, storage, and exploitation of electronic data.

Additionally, Circular 74 mandates that all economic and financial transactions related to foreign loans and repayments must be documented with accounting records; such records are to be created only once for each economic or financial transaction.

Requirements for creating accounting documents include:

- The accounting document must contain full, clear, and accurate content as required. For documents prepared on paper, the handwriting must be uniform, clear, and fully reflective of the content, without erasures; the same color of non-fading ink must be used throughout; and red ink must not be used.- Regarding the recording of amounts in numbers and words on documents:- The amount in words must match the amount in numbers;- The total amount must match the sum of detailed amounts;- The first letter must be in uppercase, and the remaining letters must not be in uppercase;- Writing must start at the beginning of the line, letters and numbers must be continuous without spacing, and a new line should be used only after the previous one is full. Abbreviations, line insertions, and overlapping on pre-printed text are not allowed;- Any blank spaces must be crossed out to prevent alterations, additions, or insertions.- For documents prepared on paper, any erasures or alterations invalidate the document for payment and accounting purposes. Mistakes on pre-printed document templates must be canceled by crossing out the incorrect document.- The date, month, and year on documents must be written in numerical form.

Circular 74 also stipulates that accounting documents must include signatures in accordance with designated titles on the documents. Signatures must be in non-fading ink. It is prohibited to sign accounting documents in red ink or use pre-engraved signature stamps. The signature of an individual on accounting documents must be consistent.

Signatures on accounting documents must be from authorized or delegated individuals. It is strictly prohibited to sign accounting documents before completing the full content required attributed to the signatory.

Electronic documents must bear electronic signatures, and these signatures have the same legal standing as signatures on paper documents according to e-transaction regulations.

Notably, an individual is only allowed to sign one title per approval process on one document or a set of accounting documents.

For more details, see Circular 74/2018/TT-BTC which came into effect on January 1, 2019.

-Thao Uyen-

- Number of deputy directors of departments in Vietnam in accordance with Decree 45/2025/ND-CP

- Cases ineligible for pardon in Vietnam in 2025

- Decree 50/2025 amending Decree 151/2017 on the management of public assets in Vietnam

- Circular 07/2025 amending Circular 02/2022 on the Law on Environmental Protection in Vietnam

- Adjustment to the organizational structure of the Ministry of Health of Vietnam: Certain agencies are no longer listed in the organizational structure

- Vietnam aims to welcome 22-23 million international tourists in Vietnam in 2025

-

- Notable new policies of Vietnam effective as of ...

- 16:26, 11/04/2025

-

.Medium.png)

- Notable documents of Vietnam in the previous week ...

- 16:21, 11/04/2025

-

.Medium.png)

- Notable documents of Vietnam in the previous week ...

- 16:11, 02/04/2025

-

.Medium.png)

- Notable new policies of Vietnam to be effective ...

- 16:04, 02/04/2025

-

.Medium.png)

- Notable new policies of Vietnam effective from ...

- 14:51, 21/03/2025

Article table of contents

Article table of contents