On August 18, 2020, Vietnam Social Security issued Decision 1040/QD-BHXH promulgating the Report on the Employment Situation and the list of participants in social insurance, health insurance, and unemployment insurance.

Guidance on preparing labor utilization reports and lists of participants for social insurance, health insurance, unemployment insurance (Illustration)

To be specific, the preparation of labor utilization reports and lists of participants for social insurance, health insurance, and unemployment insurance aims to assist units and enterprises in registration, debt collection, and adjustment of social insurance, health insurance, unemployment insurance, labor accident insurance, occupational disease insurance contributions, issuance of social insurance books, health insurance cards, and reporting on labor utilization for employees of the unit.

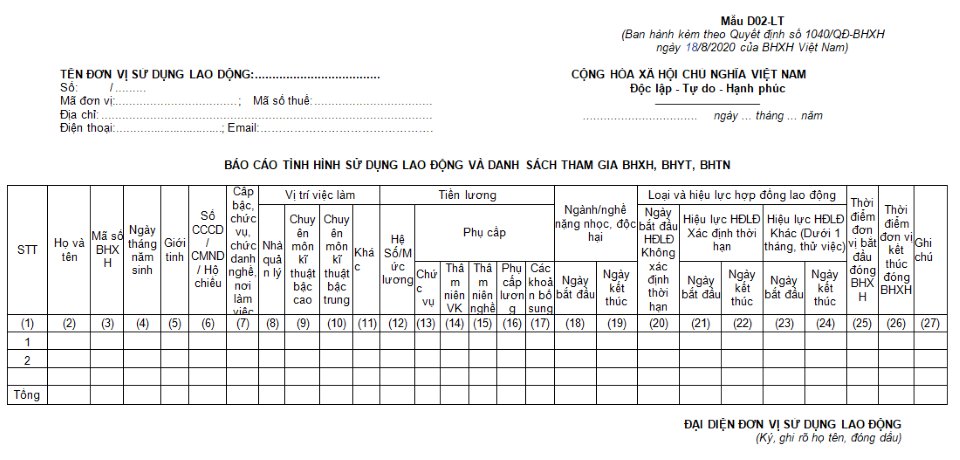

Labor utilization report and list of participants for social insurance, health insurance, unemployment insurance

Labor utilization report and list of participants for social insurance, health insurance, unemployment insurance

As of August 18, 2020, when the employing unit has developments in terms of labor, salaries, and back payments for employees, it must prepare the Report form (Form D02-LT) to send to the social insurance agency. The preparation method is as follows:

1. General Information Section

- Unit name: Write the full name of the unit as per the business registration or establishment decision.- Unit code: Write the unit code issued by the social insurance agency.- Tax code: Write the tax code issued by the tax authority.- Address: Write the address of the unit's head office.- Phone: Write the unit's phone number.- Email: Write the unit's email.

2. Column Indicators:

- Column (1): Write serial numbers in ascending order.- Column (2): Clearly state the full name of each employee.

For units with large numbers of health insurance participants requiring group categorization for convenient reception and health insurance card distribution, the social insurance agency is responsible for guiding the units in preparing the list for issuing health insurance cards. Column (2) should be split into groups according to the subordinate unit code (group and subordinate unit code generated by the unit but not exceeding 6 characters, which may be numerical or alphabetical).

Example: Company A has 2 workshops, each with 50 employees. Company A should list them as 2 groups: Workshop 1, code 01, with the list of 50 employees of Workshop 1; then Workshop 2, code 02, with the list of 50 employees of Workshop 2 (subordinate unit codes may be 01, 02, or AA, AB, or more characters but not exceeding 6).

- Column (3): Write the social insurance number for those who already have one.- Column (4): Write the full date of birth as per the birth certificate or ID card/citizen card/passport.- Column (5): Write the gender of the participant (if male, write 'male'; if female, write 'female').- Column (6): Write the national ID card/citizen card/passport number issued by relevant authority (passport only for foreigners).- Column (7): Write the full details of rank, position, job title, workplace conditions as per the decision or labor contract (Example: Deputy Chief Inspector of Department A, industrial sewing machine operator at Company B, etc.).

- Columns (8), (9), (10), (11): Categorize into: managers; high-level technical professionals; mid-level technical professionals; office assistants; service and sales staff; skilled labor in agriculture, forestry, and fisheries; craftsmen; machine operators and assemblers; simple labor.

- Column (12): Write the salary received:

+ For employees following state-regulated salary policies, write the coefficient (including any differential preservation coefficient if applicable).

Example: Salary stated in the recruitment decision or labor contract is 2.34, write 2.34.

+ For employees following employer-decided salary policies, write the salary according to the job or position, in Vietnamese dong.

Example: The employee's salary is 52,000,000 dong, write 52,000,000 dong.

- Columns (13), (14), (15): Write the position allowance by coefficient; seniority allowance by percentage (%) in the corresponding column, leave blank if none.

- Column (16): Write salary allowances according to labor law (if any).- Column (17): Write other additional amounts according to labor law from January 1, 2018 (if any).- Column (18): Write the start date in heavy, hazardous, dangerous occupation.- Column (19): Write the end date in heavy, hazardous, dangerous occupation.- Column (20): Write the start date of an indefinite-term labor contract.- Column (21): Write the effective date of a fixed-term labor contract.- Column (22): Write the expiry date of a fixed-term labor contract.- Column (23): Write the effective date of other labor contracts (less than a month, probation).- Column (24): Write the expiry date of other labor contracts (less than a month, probation).- Column (25): Write the date when the unit starts paying social insurance for the employee.- Column (26): Write the date when the unit stops (ceases) paying social insurance for the employee.- Column (27): Write the contract number; date of the labor contract, labor service contract (clearly stating the term of the labor contract, labor service contract from date to date) or decision (recruitment, acceptance); temporary suspension of labor contract, unpaid leave ..., Also write the higher health insurance benefit entitlement if there are supporting documents like for people with meritorious services, veterans, etc.

Notes:

- If within a month the unit prepares multiple lists of employees for social insurance, health insurance, unemployment insurance, number the lists.- The unit must accurately and fully declare the salaries for social insurance, health insurance, unemployment insurance, labor accident insurance, and occupational disease insurance contributions of each employee according to the law and is responsible for the paperwork; storing records of participation in social insurance, health insurance, unemployment insurance, labor accident insurance, occupational disease insurance.- In case of employees only participating in labor accident and occupational disease insurance, note in column 27 as above.- In case the unit reports an increase in labor for employees who already have a social insurance number, fully fill out the indicators on the form and record the initial medical examination and treatment registration place in column 27.- In case the unit has many people changing the initial medical examination and treatment registration place, write columns (2), (3) and the content of changing the initial medical examination and treatment registration place in column 27, leave other columns blank.

3. Basis for Preparation

- Social insurance, health insurance participation declaration (Form TK1-TS);- Labor contract, labor service contract, recruitment decision, acceptance; salary raise, transfer decision;- Other relevant documents.

Le Hai

Article table of contents

Article table of contents

.jpg)