Vietnam: How is personal income tax calculated for teacher salaries?

How will teacher salaries be calculated from July 1, 2024?

According to Circular 07/2024/TT-BNV of the Ministry of Home Affairs of Vietnam, the salaries of official public employees in general and teachers as public employees are calculated as follows:

Salary = Base Salary x Salary coefficient

Additionally, when the statutory pay rate increases to 2,340,000 VND/month, the teacher's salary is calculated as follows:

Salary = 2,340,000 VND x Salary coefficient

*Unit: VND/month

Note: The above salary does not include allowances and supports received by officials and public employees.

How is personal income tax for teacher salaries calculated? (Image from the Internet)

How is personal income tax for teacher salaries calculated?

Below is the way to calculate personal income tax (PIT) on income from wages and salaries for teachers:

According to the provisions of Article 7 Circular 111/2013/TT-BTC of the Ministry of Finance of Vietnam and Article 8 Circular 111/2013/TT-BTC (both articles related to personal income tax for business individuals are abolished by clause 6, Article 25 Circular 92/2015/TT-BTC), the PIT from wages and salaries of resident individuals is determined by the following formula:

| PIT from wages and salaries = Taxable income from wages and salaries x Tax rate |

Where:

Taxable income = Taxable earnings - Deductions

Taxable earnings = Total income - Exempt amounts

Taxable earnings from wages and salaries are determined by the total income from wages and salaries that the taxpayer receives in the tax period, including:

- Wages, salaries, and amounts of a wage nature;- Allowances and subsidies, except for:

+ Allowances and subsidies as per laws for those with meritorious services;

+ National defense and security allowances;

+ Hazardous and dangerous work allowances for sectors, professions, or jobs in hazardous or dangerous workplaces;

+ Incentive and regional allowances as per laws;

+ Unexpected hardship allowances, workplace accident benefits, occupational disease benefits, one-time childbirth or adoption allowances, work reduction benefits, one-time retirement benefits, monthly survivor benefits, and other benefits under social insurance laws;

+ Severance and job loss allowances as per the Labor Code;

+ Social protection allowances and other allowances and subsidies not of a wage nature as per the Government of Vietnam.

Deductions when calculating PIT from wages and salaries include:

- Contributions to social insurance, health insurance, unemployment insurance, occupational liability insurance for certain mandatory insurance professions, voluntary pension funds;

- Personal and dependent deductions:

The current personal deduction levels are implemented according to Resolution 954/2020/UBTVQH14, as follows:

- Personal deduction for the taxpayer is 11 million VND/month (132 million VND/year);

- Dependent deduction for each dependent is 4.4 million VND/month.

- Deductions for contributions to charity, humanitarian funds:

Charity and humanitarian contributions are deducted from income before calculating tax on business income, wages, and salaries for resident taxpayers, including:

- Contributions to organizations, facilities caring for children in especially difficult circumstances, disabled persons, and elderly people without support;

- Contributions to charity funds, humanitarian funds, and study promotion funds.

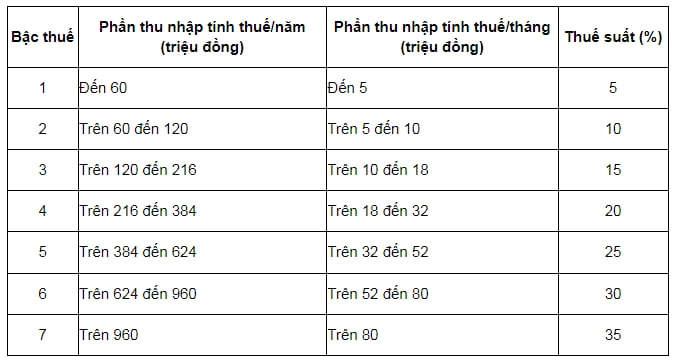

Personal income tax rates:

The tax rate schedule is stipulated in clause 2, Article 7 Circular 111/2013/TT-BTC as follows:

How many dependents can teachers claim for maximum family deduction when paying personal income tax?

According to Resolution 954/2020/UBTVQH14, personal deductions consist of personal deductions for the taxpayer and dependent deductions. The taxpayer, in general, and teachers, in particular, will naturally receive personal deductions when calculating personal income tax, and currently, there is no regulation limiting the maximum number of dependents for deductions.

Based on point c, clause 1, Article 9 Circular 111/2013/TT-BTC (the content related to personal income tax for business individuals is abolished by clause 6, Article 25, Circular 92/2015/TT-BTC), the principles for calculating personal deductions are as follows:

- Taxpayers with income from wages and salaries automatically receive personal deductions;

- Taxpayers can claim dependent deductions after taxpayer registration and being assigned a tax code.

- Each dependent can only be claimed for deduction once in that tax year by one taxpayer. In cases where several taxpayers share a dependent, they must agree on who will register the dependent for deduction.

Thus, currently, the law does not limit the number of dependents for each taxpayer, in general, and for teachers, in particular, provided that the dependent falls under the eligible group for deduction and meets the corresponding legal conditions, the taxpayer will receive dependent deductions.

- Shall students of all educational levels at Ho Chi Minh City be eligible for tuition exemption? Who is eligible for tuition exemption? Who is not required to pay tuition in Vietnam?

- What are the 03+ 2nd mid-semester question papers and answers for 11th-grade Mathematics in 2025? What are the eligibility requirements for providing internal extra classes for 11th-grade Mathematics in Vietnam?

- Vietnam: What are the 2nd mid-semester question papers and answers for 10th-grade Mathematics in 2025? What are the regulations on assessing the educational outcomes for 10th-grade Mathematics?

- What are the guidelines for presentation on the significance of planting and protecting green trees in Vietnam? What are the objectives of 7th-grade Natural Sciences?

- What are the 05+ sample 200-word paragraphs expressing feelings about a poem in the 6th-grade Literature curriculum in Vietnam? What are the objectives of the 6th-grade Literature curriculum?

- What is the sample outline for descriptive essays on a person who left a good impression on you for 5th-grade students in Vietnam? Are internal extra classes for 5th-grade Vietnamese language allowed?

- What are the guidelines for finding ideas for a paragraph expressing emotions and feelings about an event? What are the required outcomes regarding the writing process in the 5th-grade Vietnamese language curriculum?

- What are the 07 best sample expository essays on literary works for 11th-grade students in Vietnam? What are the academic topics in the 11th-grade Literature curriculum in Vietnam?

- What are the guidelines for preparing the lesson "Hai quan niệm về gia đình và xã hội" for 12th-grade students in Vietnam? What are the required outcomes regarding the academic topic - Learning about the creative style of literary schools in the 12th-grade Literature curriculum in Vietnam?

- What are the guidelines for preparing the lesson "Ai đã đặt tên cho dòng sông" for 11th-grade students in Vietnam? Is it allowed to charge for internal extra classes for 11th-grade Literature in Vietnam?