Giáo dục 24/7

- 08:56 | 28/02/2025

- 08:52 | 28/02/2025

- 08:47 | 28/02/2025

- 08:37 | 28/02/2025

- 08:35 | 28/02/2025

- 08:19 | 28/02/2025

-

09:51 | 27/02/2025

What is the organizational structure of the Ministry of Home Affairs of Vietnam from March 1, 2025? What is the current tax professional training and retraining regime for Vietnamese tax officials? What is the organizational structure of the Ministry of Home Affairs of Vietnam from March 1, 2025? What is the current tax professional training and retraining regime for Vietnamese tax officials?

- 09:49 | 27/02/2025

- 09:31 | 27/02/2025

-

09:29 | 27/02/2025

What are important contents on province merger, organizational machinery arrangement in Vietnam according to Conclusion 126? What are important contents on province merger, organizational machinery arrangement in Vietnam according to Conclusion 126? What are the duties and powers of the Ministry of Finance in tax administration in Vietnam?

-

09:24 | 27/02/2025

How many years is a digital signature certificate valid from April 10, 2025? How shall taxpayers use digital signatures in e-tax transactions in Vietnam? How many years is a digital signature certificate valid from April 10, 2025? How shall taxpayers use digital signatures in e-tax transactions in Vietnam?

- 09:03 | 27/02/2025

-

08:52 | 27/02/2025

What is the guidance on automatic PIT refund 2025 according to Official Dispatch 126 from the Tax Departments of major businesses in Vietnam? What is the guidance on automatic PIT refund 2025 according to Official Dispatch 126 from the Tax Departments of major businesses in Vietnam? What is the time limit for processing 2025 PIT tax refund claims?

- 08:49 | 27/02/2025

-

08:46 | 27/02/2025

What are guidelines for customs declaration, monitoring of tax and customs fees for low-value declarations in Vietnam in 2025? What are guidelines for customs declaration, monitoring of tax and customs fees for low-value declarations in Vietnam in 2025? What are included in the Customs document in Vietnam?

- 08:26 | 27/02/2025

- 08:21 | 27/02/2025

- 08:11 | 27/02/2025

-

07:58 | 27/02/2025

What is the organizational structure of the General Department of Taxation of Vietnam? What is the direction for downsizing the General Department of Taxation of Vietnam according to Report 219? What is the organizational structure of the General Department of Taxation of Vietnam? What is the direction for downsizing the General Department of Taxation of Vietnam according to Report 219?

-

09:14 | 26/02/2025

What are 5+ Speeches for the Cell Congress of Communist Party of Vietnam in 2025? What are the expenditure contents and the basis for drafting expenditure estimates for the activities of a CPV Cell? What are 5+ Speeches for the Cell Congress of Communist Party of Vietnam in 2025? What are the expenditure contents and the basis for drafting expenditure estimates for the activities of a CPV Cell?

- 09:08 | 26/02/2025

- 09:04 | 26/02/2025

-

08:58 | 26/02/2025

What is the organizational structure of the State Bank of Vietnam from March 1, 2025? What are the tasks the State Bank of Vietnam collaborates with the Ministry of Finance of Vietnam on March 1, 2025? What is the organizational structure of the State Bank of Vietnam from March 1, 2025? What are the tasks the State Bank of Vietnam collaborates with the Ministry of Finance of Vietnam on March 1, 2025?

-

08:56 | 26/02/2025

What are guidelines for handover, accounting, and bookkeeping in the case of dissolution, merger, or consolidation of units of Vietnamese Trade Union? What are guidelines for handover, accounting, and bookkeeping in the case of dissolution, merger, or consolidation of units of Vietnamese Trade Union? Shall an enterprise retain its TIN after a merger in Vietnam?

- 08:51 | 26/02/2025

- 08:50 | 26/02/2025

-

08:47 | 26/02/2025

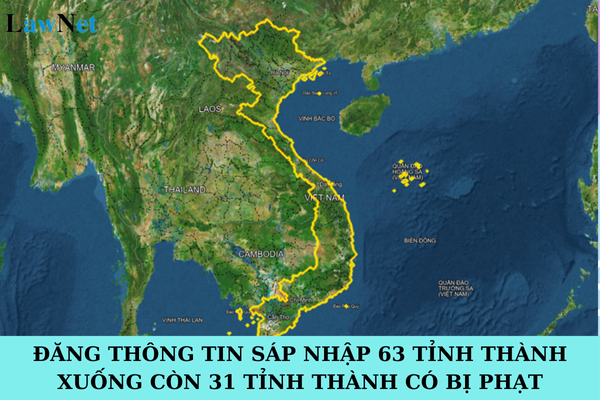

When will the provinces in Vietnam be merged? Which address shall be written on the e-invoices when the address hasn't been updated due to province merging in Vietnam? When will the provinces in Vietnam be merged? Which address shall be written on the e-invoices when the address hasn't been updated due to province merging in Vietnam?

-

08:43 | 26/02/2025

Is there a penalty for publishing information about merging 63 provinces and cities into 31? How to change information for using e-invoices when merging provinces and cities in Vietnam? Is there a penalty for publishing information about merging 63 provinces and cities into 31? How to change information for using e-invoices when merging provinces and cities in Vietnam?

-

08:41 | 26/02/2025

What is the List of 63 Provinces and Cities in Vietnam from January 1, 2025? What is the List of 63 Provinces and Cities in Vietnam from January 1, 2025? Where do businesses issue e-invoices if the address has not been updated with provincial changes due to administrative boundary modification in Vietnam?

- 08:33 | 26/02/2025

- Hàng hóa nhập khẩu

- Giảm thuế GTGT

- Miễn thuế TNCN

- Giao dịch thuế điện tử

- Chứng từ điện tử

- Tờ khai đăng ký thuế

- Cơ cấu tổ chức

- Hóa đơn điện tử

- Sáp nhập tỉnh

- Chứng thư chữ ký số

- Chứng thư số

- Hoàn thuế tncn

- Thuế xuất nhập khẩu

- Khai hải quan

- Miễn thuế GTGT

- Đóng thuế tncn

- Chuyển nhượng bất động sản

- Tổng cục Thuế

- Đại hội chi bộ

- Quyết toán thuế thu nhập cá nhân

Nghị định 168 bãi bỏ hoàn toàn quy định xử phạt giao thông trong Nghị định 100?

Tổng hợp 16+ bài mẫu viết thư UPU lần thứ 54 2025 ngắn gọn và ấn tượng nhất? Cá nhân đạt giải nhất từ Cuộc thi viết thư UPU lần thứ 54 năm 2025 thì có phải đóng thuế TNCN?

02 mẫu viết chi tiết Bản kiểm điểm đảng viên 2024 đối với cá nhân không giữ chức vụ lãnh đạo? Đảng viên ra nước ngoài học tập từ ngân sách nhà nước đóng đảng phí bao nhiêu?

Cách viết 2 Bản kiểm điểm cá nhân đảng viên năm 2024 mẫu 2A, 2B? Đảng viên trong Công đoàn Việt Nam đóng đảng phí bao nhiêu?

02 cách điền Bản kiểm điểm cá nhân đảng viên 2024 cho cá nhân không giữ chức vụ lãnh đạo? Đảng viên trong cơ quan đại diện Việt Nam ở nước ngoài đóng đảng phí bao nhiêu?

Tổng hợp 2 cách viết Bản kiểm điểm cá nhân đảng viên 2024? Đảng viên là sinh viên thì đóng mức đảng phí là bao nhiêu?

Tải và hướng dẫn viết Bản kiểm điểm cá nhân đảng viên 2024? Đảng viên là sinh viên thì đóng đảng phí bao nhiêu?

Lịch chiếu phim Na Tra 2: Ma Đồng Náo Hải tại Việt Nam? Nhập khẩu, phát hành và chiếu phim chịu thuế suất thuế GTGT bao nhiêu?

Tổng hợp 15 mẫu vẽ tranh Cuộc thi Ý tưởng trẻ thơ 2024 2025 đẹp nhất? Tiền thưởng từ Cuộc thi Ý tưởng trẻ thơ có đóng thuế TNCN không?

Tổng hợp 3 cách viết mẫu 2A Bản kiểm điểm cá nhân đảng viên 2024? Đảng viên trong cơ quan hành chính đóng đảng phí bao nhiêu?