What are 03 ways to look up e-invoices of Petrolimex in Vietnam in 2025?

What are 03 ways to look up e-invoices of Petrolimex in Vietnam in 2025?

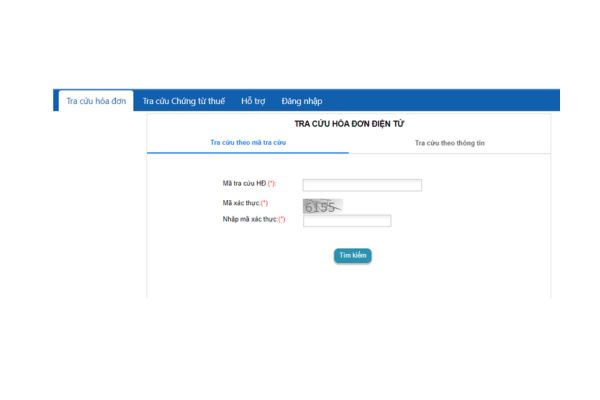

Method 01: Look Up e-invoices of Petrolimex Using the Lookup Code

Note: Customers can quickly lookup invoices for goods and services provided by Petrolimex.

Step 1: Access the website at https://www.petrolimex.com.vn/ >> On the homepage, select "Customer Services" >> Select "e-Invoices" >> Select "Invoice Lookup"

Step 2: Customers choose the function "Lookup by Lookup Code"

Step 3: Customers enter the invoice lookup code on the e-Invoice Lookup Receipt or the Invoice Issuance Notification Email.

Step 4: Enter the authentication code.

Step 5: Look up the invoice.

Step 6: Click “View” to display the invoice information.

Step 7: Read the invoice information, and you can download and print the invoice if needed.

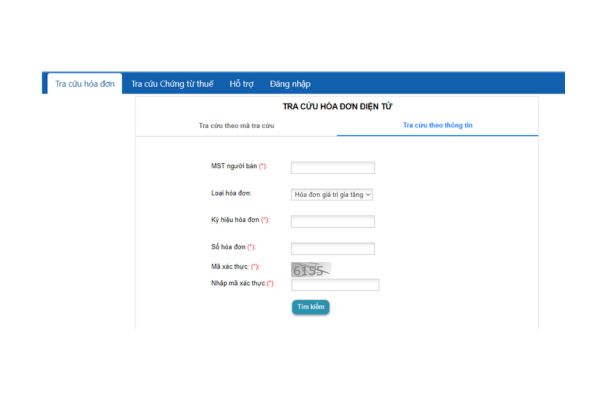

Method 02: Look Up e-invoices of Petrolimex by Invoice Information

Note: Customers do not need to search for the invoice again during the storage period but can rely on the information available on the customer's input goods and service invoice register.

Step 1: Access the website at https://www.petrolimex.com.vn/ >> On the homepage, select "Customer Services" >> Select "e-Invoices" >> Select "Invoice Lookup"

Step 2: Customers choose the function "Lookup by Information"

Step 3: Customers enter the information related to the invoice, including:

+ Seller's TIN (TIN);

+ Invoice type: Value-added invoice or Warehouse Dispatch Slip;

+ Invoice symbol;

+ Invoice number;

+ Enter the authentication code;

Step 4: Look up the invoice.

Step 5: Click “View” to display the invoice information.

Step 6: Read the invoice information, and you can download and print the invoice if needed.

Method 03: Look Up e-invoices of Petrolimex Using a Login Account

Note: Customers who sign contracts to purchase goods and services from Petrolimex nationwide will be provided an account to support invoice lookup based on the list of invoices within a selected transaction period.

Step 1: Customers choose the function "Login"

Step 2: Customers log in with the account and password notified via their Email.

Step 3: Enter the authentication code and select "Login"

Step 4: Customers select the new folder “Invoice Management” on the toolbar, and choose the transaction period information by month and invoice issuance year.

Step 5: Click “View” to display the invoice information.

Step 6: Read the invoice information, and you can download and print the invoice if needed.

What are 03 ways to look up e-invoices of Petrolimex in Vietnam in 2025? (Image from Internet)

When is the issuance time for e-invoices at Petrolimex Gas Stations in Vietnam?

Based on point i, clause 4, Article 9 of Decree 123/2020/ND-CP the regulations are as follows:

Invoice Issuance Time

...

4. The invoice issuance time for certain specific cases is as follows:

...

i) The issuance time for e-invoices in the case of retail gasoline sales at gas stations to customers is the time when each gasoline sale transaction is completed. The seller must ensure full e-invoice storage in the case of gasoline sales to individual non-business customers, business individuals, and ensure availability for lookup when requested by relevant authorities.

...

Thus, the issuance time for e-invoices at Petrolimex gas stations is when each gasoline sale transaction is completed.

The seller, in addition to issuing invoices to the buyer, must also ensure complete e-invoice storage for gasoline sales to individual non-business customers, business individuals and ensure availability for lookup when requested by relevant authorities.

Is the TIN included in e-invoice in Vietnam?

Based on clause 14 Article 10 of Decree 123/2020/ND-CP, some cases involve e-invoices not necessarily having full contents as follows:

Invoice Content

...

14. Some cases where e-invoices do not necessarily have full contents

a) e-invoices do not necessarily need to have the buyer's digital signature (including cases where e-invoices are issued for goods and services provided to overseas customers). In cases where the buyer is a business entity and the buyer, seller have agreed that the buyer meets technical conditions for digital signature on e-invoices issued by the seller, the e-invoices will carry the digital signature, e-signature of both the buyer and the seller as per mutual agreement.

b) For e-invoices issued by tax authorities for each instance that it occurs, there is no need for the digital signature of the seller and the buyer.

c) For e-invoices for sales at supermarkets, shopping centers where the buyer is an individual non-business, it is not necessary to have the name, address, buyer's TIN on the invoice.

For e-invoices for fuel sales to individual non-business customers, it is not necessary to include the invoice name, invoice template symbol, invoice symbol, invoice number; the name, address, TIN of the buyer, the buyer's e-signature; the seller's digital signature, e-signature, value-added tax rate.

..

According to the above regulations, for e-invoices issued to individual non-business customers, it is not necessary to have the invoice name, template symbol, symbol, number; the name, address, TIN of the buyer, the buyer's e-signature; the seller's digital signature, e-signature, value-added tax rate.

Thus, e-invoices issued to individual customers do not necessarily have to include the individual's TIN.