What is the Vietnam import tariff-rate quotas for salt and poultry eggs from March 2, 2025?

What is the Vietnam import tariff-rate quotas for salt and poultry eggs from March 2, 2025?

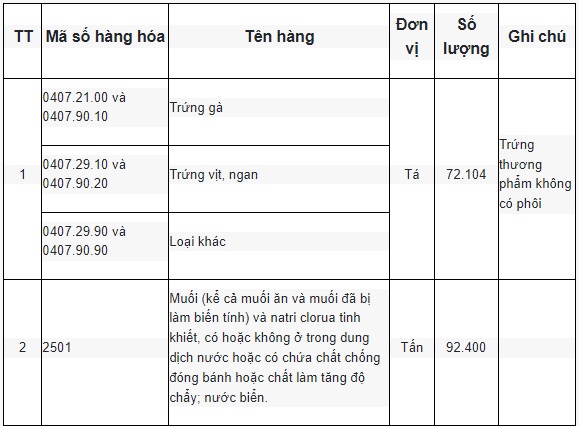

Based on Article 1 of Circular 01/2025/TT-BCT (effective March 2, 2025), which specifies the import tariff-rate quotas for salt and poultry eggs for the year 2025 as follows:

Note: Circular 01/2025/TT-BCT is effective from March 2, 2025, until December 31, 2025.

What is the method of allocating import tariff-rate quotas for salt and poultry eggs from March 2, 2025?

Based on Article 2 of Circular 01/2025/TT-BCT, effective from March 2, 2025, which stipulates the method of allocating import tariff-rate quotas for salt and poultry eggs as follows:

Method of Allocating import tariff-rate quotas for salt and poultry eggs in 2025

The import tariff-rate quotas for salt and poultry eggs in 2025 are allocated according to the method specified in Article 9 of Decree No. 69/2018/ND-CP dated May 15, 2018, by the Government of Vietnam, detailing certain provisions of the Law on Foreign Trade Management and Article 15 of Circular No. 12/2018/TT-BCT dated June 15, 2018, by the Minister of Industry and Trade, detailing certain provisions of the Law on Foreign Trade Management and Decree No. 69/2018/ND-CP dated May 15, 2018, by the Government of Vietnam.

Thus, the import tariff-rate quotas for salt and poultry eggs in 2025 are allocated according to the method specified in Article 9 of Decree 69/2018/ND-CP and Article 15 of Circular 12/2018/TT-BCT as follows:

- Import Quotas for Salt and Poultry Eggs in 2025 shall be issued in the form of direct import licenses.

- The Ministry of Industry and Trade is responsible for allocating quotas to enterprises with legitimate needs.

- Enterprises need to submit applications and prove their usage needs for approval.

- The auction form of quota is not applied to these two items.

The allocation of import tariff-rate quotas for salt and poultry eggs is done in the form of import licenses based on specific criteria set by the Ministry of Industry and Trade, ensuring transparency and compliance with international commitments.

What is the Vietnam import tariff-rate quotas for salt and poultry eggs from March 2, 2025?

What is the import tariff applied to goods managed by import tariff quotas of Vietnam?

According to Article 13 of Circular 12/2018/TT-BCT, the import tariff applied to goods managed by import tariff quotas is regulated as follows:

(1) Businesses that are granted Import Licenses by the Ministry of Industry and Trade under import tariff quotas or notified in writing by the Ministry of Industry and Trade of the right to use import tariff quotas are eligible for the import tariff under the tariff quota for the quantity of goods imported as stated in the Import License under the tariff quota or the notice of the right to use import tariff quotas.

(2) For the quantity of goods imported beyond the tariff quotas, the out-of-quota import tariff shall be applied.

(3) In cases where the method of administering import tariff quotas differs from the management method in (1) of this section, the Ministry of Industry and Trade shall provide guidance.

(4) The import tariffs within import tariff quotas and out-of-quota import tariffs shall be implemented following the regulations of the Government of Vietnam.

What are regulations on issuing license for importing commodities under the tariff-rate quotas in Vietnam

Based on Article 15 of Circular 12/2018/TT-BCT, the issuance of license for importing commodities under the tariff-rate quotas is as follows:

(1) Based on the annual announced tariff quotas and business registrations, the Ministry of Industry and Trade considers issuing license for importing commodities under the tariff-rate quotas to businesses.

(2) The dossier for issuing license for importing commodities under the tariff-rate quotas is implemented according to the regulations at point a, point b, clause 1 of Article 9 Decree 69/2018/ND-CP. To be specific:

- Application form for import tariff quotas registration according to the form specified in Appendix XIII attached to Circular 12/2018/TT-BCT: 1 original copy.

- Investment Certificate or Business Registration Certificate or Enterprise Registration Certificate: 1 certified copy with the trader’s seal.

(3) The process of issuing license for importing commodities under the tariff-rate quotas is implemented according to the regulations in clause 2, Article 9 of Decree 69/2018/ND-CP. To be specific:

- Businesses submit 1 dossier as regulated in (2) directly, by postal mail, or online (if applicable) to the Ministry of Industry and Trade (Import-Export Department), address: 54 Hai Ba Trung, Hoan Kiem District, Hanoi.

- If the dossier is incomplete, non-conformable, or requires additional documentation, within 3 working days from the date of receipt, the Ministry of Industry and Trade will notify the business to complete the dossier.

- The time frame for resolving the issuance of license for importing commodities under the tariff-rate quotas for businesses is within 10 working days from the allocation time specified in clause 5, Article 14 of Circular 12/2018/TT-BCT and when the Ministry of Industry and Trade receives a complete, conformable dossier.

In case the license is not granted, the Ministry of Industry and Trade will respond to the business in writing, specifying the reasons.

(4) Businesses are responsible for reporting quarterly or irregularly on the import situation as requested by the Ministry of Industry and Trade (Import-Export Department) according to the form specified in Appendix 13 issued with Circular 12/2018/TT-BCT.

Before September 30 of each year, businesses must submit a report (replacing the Q3 report) to the Ministry of Industry and Trade to evaluate the annual import capacity, propose increases or decreases in allocated import quotas, or report the quantity of goods that cannot be imported, for reallocation to other businesses.