What are guidelines for handover, accounting, and bookkeeping in the case of dissolution, merger, or consolidation of units of Vietnamese Trade Union?

What are guidelines for handover, accounting, and bookkeeping in the case of dissolution, merger, or consolidation of units of Vietnamese Trade Union?

Recently, the Vietnam General Confederation of Labor issued Official Dispatch 3199/TD-TC year 2025 providing guidelines on handover, accounting, and bookkeeping in cases of dissolution, merger, or consolidation of units of Vietnamese Trade Union.

To be specific, the Vietnam General Confederation of Labor guidelines cover the financial and asset handover, receipt, and accounting methods for units of Vietnamese Trade Union in cases of dissolution, mergers, or consolidation as follows:

(1) For Intermediate-level Unions

At the dissolving, merging, or consolidating unit

The dissolving, merging, or consolidating unit must transfer the financial status and assets to the receiving unit at the time of dissolution, merger, or consolidation. The dissolving, merging, or consolidating unit must perform the following tasks:

- Closing accounting books, checking assets, reconciling outstanding debts, and preparing financial statements up to the termination of activities date;

- Handing over all assets, outstanding debts, preparing a handover record, and recording in the accounting books according to the handover record. For dissolving units, handover to the directly managing higher-level agency; for merging units, handover to the unit receiving the merger; for consolidating units, handover to the newly established unit.

- Details of some handover contents are as follows:

+ For cash: The unit creates a disbursement slip for transferring the total cash balance at the handover time to the new unit.

+ For savings deposits: The unit liquidates all deposit contracts before the handover time into a payment deposit account.

+ For payment deposits: Before closing the account, the unit creates a bank transfer order to transfer the total amount to the new unit.

+ For fixed assets (TSCĐ): The unit accounts for the reduction of fixed assets to transfer to the new unit.

+ For accounts payable and receivable: The unit accounts for transferring accounts payable and receivable to the new unit for continued monitoring and fulfillment of receivable and payable obligations.

+ For union funds: The unit accounts for the transfer of funds to the new unit for tracking.

- Handing over all accounting documents to the accounting unit receiving the merger or the post-conversion accounting unit. (Only hand over accounting documents still within the storage period; for documents that have expired, proceed with disposal according to current legal regulations).

At the receiving unit of the dissolving, merging, or consolidating unit

The receiving unit of the dissolving, merging, or consolidating unit conducts receipt of financial and asset transfers from the dissolving, merging, or consolidating unit.

- Receiving all accounting documents of the dissolving, merging, or consolidating unit.

- Receiving all accounting data of the dissolving, merging, or consolidating unit.

- Details of some receipt contents are as follows:

+ For cash: The receiving unit creates a receipt slip for accepting the total cash balance from the dissolving or merging unit.

+ For payment deposits: The unit records an increase in deposits corresponding to the amount received from the dissolving or merging entity.

+ For fixed assets (TSCĐ): The unit records an increase in fixed assets transferred.

+ For accounts payable and receivable: The unit records the accounts payable and receivable received for continued monitoring and fulfillment of obligations.

+ For union funds: The unit accounts for receiving funds for tracking.

(For specific examples of accounting according to the annex attached to Official Dispatch 3199/TD-TC year 2025).

(2) For Basic-level Unions

For basic-level unions conducting accounting, they follow Guide 22/HD-TLD dated April 29, 2021, and Guide 86/HD-TLD dated May 29, 2023, from the General Confederation for receiving and handing over as intermediate unions.

For basic-level unions that follow Guide 47/HD-TLD from December 30, 2021, specific measures include:

At the dissolved, merged, or consolidated basic-level union

- The basic-level union finalizes financial revenue and expenditure upon cessation of operations.

- Submit finalized financial statements, financial accumulations (remaining funds in cash registers, bank deposits, money at the Treasury, pending payments to higher levels, amounts still receivable from higher levels) until the end of activities, including the stamp, to the higher union levels that manage financial allocation (create a signed receipt from representatives of both parties).

At the receiving basic-level union of the merged or consolidated unit

The receiving unit proceeds with the financial and asset receipt from the merged or consolidated entity.

- Receiving all accounting documents from the merged or consolidated entity.

- Receiving all accounting data from the merged or consolidated entity.

- Detailed receipt process includes:

+ For cash: The receiving unit creates a receipt slip for the entire outstanding cash balance from the merged or consolidated entity.

+ For payment deposits: The unit records an increase in deposits corresponding to the amount from the merging or consolidating entity.

+ For receivables and payables: The unit tracks receivables and payables to continue monitoring and fulfilling obligations.

+ For union funds: The unit receives funds for continued monitoring.

What are guidelines for handover, accounting, and bookkeeping in the case of dissolution, merger, or consolidation of units of Vietnamese Trade Union? (Image from the Internet)

What are detailed guidelines for accounting and bookkeeping at the new unit in Vietnam?

According to the annex attached to Official Dispatch 3199/TLĐ-TC year 2025, detailed accounting and bookkeeping at the new or receiving unit are guided as follows:

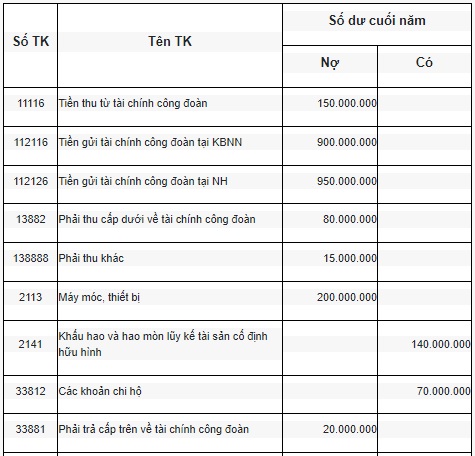

The direct superior union at facility A has the account as of the financial handover time (revenue and cost already transferred) as follows:

Unit: VND

Accounting and bookkeeping at the direct superior union of facility A

1. Accounting depreciation of fixed assets to transfer to a new unit

Debit Account 2141: 140,000,000

Debit Account 431612: 60,000,000

Credit Account 2113: 200,000,000

2. Determining the TCCĐ Accumulation Balance for Transfer

Debit Account 431611: 300,000,000 for item 42

Debit Account 43163: 820,000,000 for item 42

Debit Account 43164: 400,000,000 for item 42

Credit Account 338888: 1,520,000,000

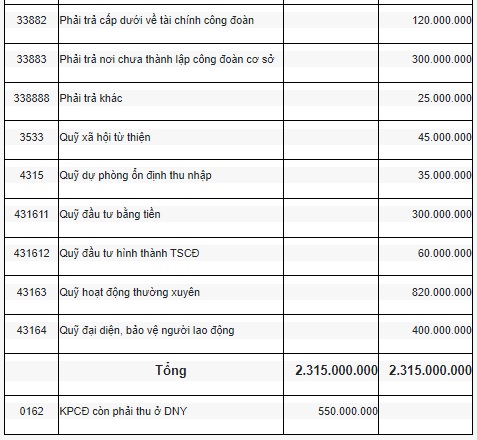

3. Accounting for the Transfer of Other Payables

Debit Account 4315: 35,000,000

Debit Account 3533: 45,000,000

Debit Account 33883: 300,000,000

Debit Account 33882: 120,000,000

Debit Account 33812: 70,000,000

Credit Account 338888: 570,000,000

Upon completion, Account 338888 has a credit balance of 2,115,000,000

4. Handover of cash

Debit Account 338888/Credit Account 11116: 150,000,000

5. Transfer of Treasury Deposits

Debit Account 338888/Credit Account 112116: 900,000,000

6. Transfer of Bank Deposits

Debit Account 338888/Credit Account 112126: 950,000,000

7. Transfer of Receivables to the New Unit

Debit Account 338888: 115,000,000

Credit Account 13882: 80,000,000

Credit Account 138888: 15,000,000

Credit Account 33881: 20,000,000

8. Transfer of Uncollected KPCĐ from enterprise Y

Credit Account 0162 (enterprise Y): 550,000,000

Detailed Accounting and Bookkeeping Guidance at the New or Receiving Unit:

(1) Receipt of Fixed Assets Transferred from a Dissolved Unit

Debit Account 2113: 200,000,000

Credit Account 2141: 140,000,000

Credit Account 431612: 60,000,000

(2) Reflection of TCCĐ Accumulation Received

Debit Account 138888: 1,520,000,000

Credit Account 431611: 300,000,000 for item 40

Credit Account 43163: 820,000,000 for item 40

Credit Account 43164: 400,000,000 for item 40

(3) Accounting for Transfer of Other Payables

Debit Account 138888: 595,000,000

Credit Account 4315: 35,000,000

Credit Account 3533: 45,000,000

Credit Account 33883: 300,000,000

Credit Account 33882: 120,000,000 for item 00

Credit Account 33812: 70,000,000

Credit Account 338888: 25,000,000

Upon completion, Account 138888 has a debit balance of 2,115,000,000

(4) Receipt of Cash Transfer

Debit Account 11116/Credit Account 138888: 150,000,000

(5) Receipt of Transfer of Deposits

Debit Account 112116, 112126/Credit Account 138888: 1,850,000,000

(6) Transfer of Receivables to the New Unit

Debit Account 13882: 80,000,000

Debit Account 33881: 20,000,000 for item 00

Debit Account 138888: 100,000,000

The remaining debit balance on Account 138888 is 2,115,000,000 - 150,000,000 - 1,850,000,000 - 100,000,000 = 15,000,000 (equals other receivables from Union A).

(7) Receipt of KPCĐ to be Collected from enterprise Y

Debit Account 0162 (enterprise Y): 550,000,000

Shall an enterprise retain its TIN after a merger in Vietnam?

According to the provisions in Clause 1, Article 201 of the Enterprise Law 2020, one or several companies (referred to as merging companies) can merge into another enterprise (referred to as the receiving enterprise) by transferring all assets, rights, obligations, and legitimate interests to the receiving enterprise, concurrently terminating the existence of the merging enterprise.

According to Clause 3, Article 20 of Circular 86/2024/TT-BTC, the receiving enterprise retains its TIN.

Concerning merging companies, their TINs become invalid.