Time limit for provision of e-invoice information in Vietnam

What are the regulations on the time limit for provision of e-invoice information in Vietnam? - Thanh Thao (Lam Dong)

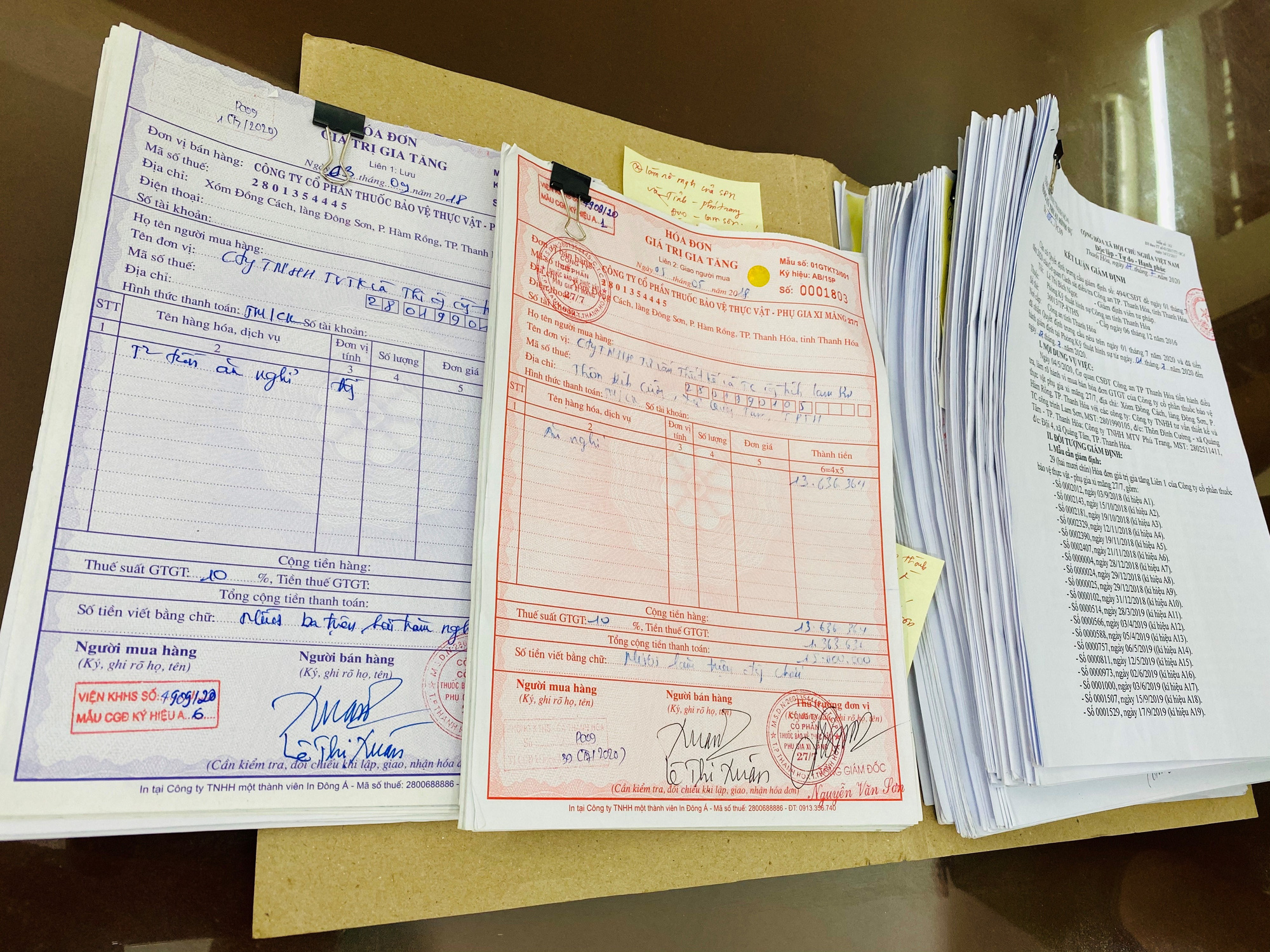

Time limit for provision of e-invoice information in Vietnam (Internet image)

Regarding this issue, LawNet would like to answer as follows:

1. Time limit for provision of e-invoice information in Vietnam

According to Article 51 of Decree 123/2020/ND-CP, within 05 minutes from receipt of the request, a response shall be sent from the web portal to the information user to provide:

- E-invoice information

Reasons must be provided in case the system fails or no e-invoice information is found.

- If a large amount of information is requested, the time limit for information provision shall be notified by the General Department of Taxation.

2. Responsibilities of information users in Vietnam

Responsibilities of information users according to Article 53 of Decree 123/2020/ND-CP are as follows:

- Use e-invoice information for intended purposes and serving professional operations within functions and tasks of the information user, and in a manner that complies with regulations of the Law on protection of state secrets.

- Prepare appropriate technical facilities and equipment to ensure searching, connection and use of e-invoice information.

- Apply for the right to access, search and use e-invoice information.

- Manage and keep confidentiality of information about the user account which is used for accessing the web portal, or the telephone number which is used for receiving e-invoice/electronic record information messaged by the General Department of Taxation.

- Ensure the development and operation of the system receiving e-invoice information.

3. Regulations on termination of provision or use of e-invoice information in Vietnam

Regulations on termination of provision or use of e-invoice information according to Article 50 of Decree 123/2020/ND-CP are as follows:

- The General Department of Taxation shall revoke the user account for accessing its web portal or cancel the provision of e-invoice information in the messaging form in the following cases:

+ The revocation or cancellation is made at the request of the responsible applicant of the information user;

+ The validity period of the user account or provision of e-invoice information in the messaging form expires;

+ The user account or telephone number has been not used for searching e-invoice information for a consecutive period of 06 months;

+ The information user is found to have not used e-invoice information for its intended purposes and serving professional operations within its functions and tasks, or have used it inconsistently with regulations of the Law on protection of state secrets.

- The General Department of Taxation shall make disconnection between the information user’s system and its web portal in the following cases:

+ The disconnection is made at the request of the responsible applicant of the information user;

+ The information user is found to have not used e-invoice information for its intended purposes and serving professional operations within its functions and tasks, or have used it inconsistently with regulations of the Law on protection of state secrets.

- At least 05 working days before the official date of termination of provision or use of e-invoice information (except cases where the termination is made at the request of the responsible applicant of the information user), the General Department of Taxation shall give a written notification of termination of provision or use of e-invoice/electronic record information to the responsible applicant of the information user, in which reasons for such termination must be specified.

4. Rules for searching, provision and use of e-invoice information in Vietnam

Rules for searching, provision and use of e-invoice information according to Article 44 of Decree 123/2020/ND-CP are as follows:

- E-invoice information shall be searched for, provided and used for completing tax procedures, making payments via banks and other administrative procedures; verifying the legitimacy of goods sold on the market.

- E-invoice information must be only searched for and provided by authorized persons in an adequate and timely manner.

- The provided e-invoice information must be used for its intended purposes, serving professional operations within the functions and tasks of the information user, and in a manner that complies with regulations of the Law on protection of state secrets.

- Key word:

- e-invoice

- in Vietnam

- Penalties for fraudulent activities on e-commerce platforms in Vietnam

- Guidance on issuing driver licenses for individuals with expired driver licenses in Vietnam

- Cases of verification of driver licenses in Vietnam according to Circular 35

- Proposal on night shift allowance policies and meal support for healthcare employees in Vietnam

- What is Pi Network? Is Pi Network legal in Vietnam?

- Proposal to lower health insurance contribution rates to alleviate economic burden on citizens in Vietnam

-

- Prime Minister of Vietnam requests to intensify ...

- 12:00, 11/12/2024

-

- Current regulations on termination of the use ...

- 17:30, 27/09/2024

-

- What are current regulations on form number of ...

- 17:00, 27/09/2024

-

- Emergency response and search and rescue organizations ...

- 10:29, 11/09/2024

-

- Handling of the acceptance results of ministerial ...

- 09:30, 11/09/2024

-

- Guidelines for maintenance and renovation of villas ...

- 14:30, 21/02/2025

-

- Guidelines for maintenance and renovation of villas ...

- 14:30, 21/02/2025

-

- Procedures for high school admission in Vietnam

- 14:25, 21/02/2025

-

- Resolution 190: Principles for addressing certain ...

- 11:30, 21/02/2025

-

- Guidance on identifying cases of inaccurate or ...

- 11:00, 21/02/2025

Article table of contents

Article table of contents