Current regulations on termination of the use of forms of provision and use of e-invoice information in Vietnam

Below are the current regulations on termination of the use of forms of provision and use of e-invoice information in Vietnam.

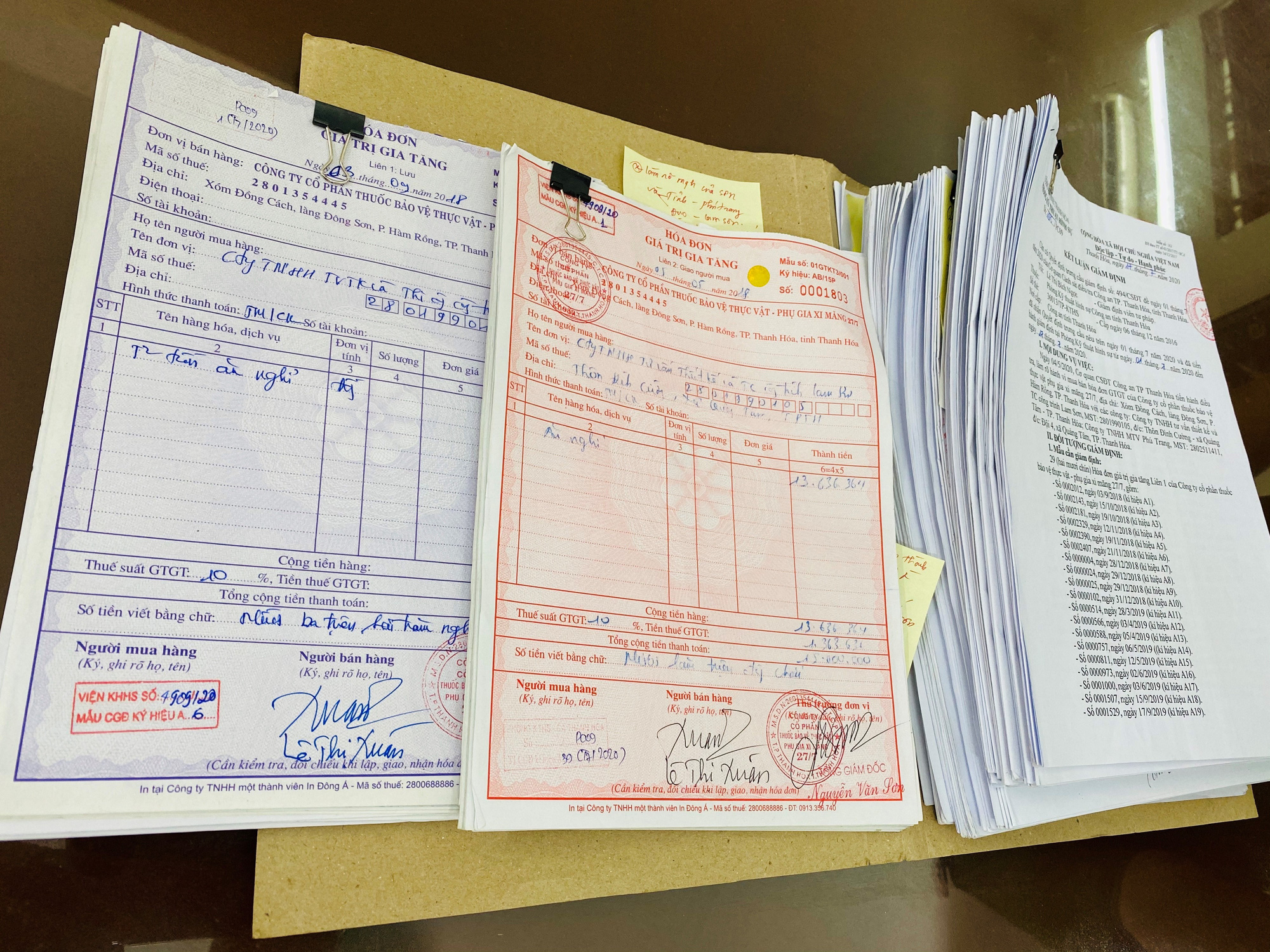

Current regulations on termination of the use of forms of provision and use of e-invoice information in Vietnam (Image from the internet)

Current regulations on termination of the use of forms of provision and use of e-invoice information in Vietnam

In Article 50 of Decree 123/2020/ND-CP, it is stipulated about the termination of using forms of provision and usage of e-invoice information in Vietnam as follows:

- The General Department of Taxation shall revoke access accounts to the electronic information portal or revoke the usability of the SMS form of the mobile phone number in the following cases:

+ Upon request from the registration focal point of the information user;+ The usage period has expired;+ The access account to the electronic information portal or the mobile phone number has not performed information inquiry for six consecutive months;+ Detection of cases of using e-invoice information for improper purposes, serving for operational activities according to the functions and tasks of the information user, non-conformable to the law on protection of state secrets.

- The General Department of Taxation shall terminate the connection of the user's system with the electronic information portal in the following cases:

+ Upon request from the registration focal point of the information user;+ Detection of cases of using e-invoice information for improper purposes, serving for operational activities according to the functions and tasks of the information user, non-conformable to the law on protection of state secrets.

- No later than five working days before the official termination of using forms of provision and usage of e-invoice information by the information user (except for cases where the registration focal point of the information user requests it in writing), the General Department of Taxation shall notify in writing the registration focal point of the information user about the termination of using forms of provision and usage of e-invoice information and electronic documents, clearly stating the reason for the termination.

Guidelines for registering, terminating the Connection of the User's System with the Electronic Information Portal for Using e-invoice Information in Vietnam

- The registration focal point of the information user sends one original official letter to the General Department of Taxation to request connection or termination of connection with the electronic information portal according to Form No. 01/CCTT-KN Appendix II issued with Decree 123/2020/ND-CP;

- Within no more than three working days from the receipt of the request letter, the General Department of Taxation shall notify the registration focal point of the information user in writing about the acceptance or refusal of the information user's request, and in case of refusal, must clearly state the reason;

- For cases of connecting systems: Within no more than 10 working days from the date of sending the notification, the General Department of Taxation shall dispatch a survey team to the location and facilities implementing the information system of the information user to check the satisfaction of requirements.

- If the survey team's conclusion confirms that the information system of the information user meets the requirements, within no more than 10 working days, the General Department of Taxation shall notify the information user in writing about the eligibility for connection and coordinate to connect the systems to provide e-invoice information, electronic documents;

- If the survey team's conclusion confirms that the information system of the information user does not meet the requirements, within no more than 10 working days, the General Department of Taxation shall notify the information user in writing about the ineligibility for connection with the electronic information portal.

- For cases of terminating the connection: from the notification date, the General Department of Taxation shall cooperate with the information user to terminate the connection of the systems.

(Clause 4 of Article 49 of Decree 123/2020/ND-CP)

- Cases of land rent exemption and reduction under the latest regulations in Vietnam

- Economic infrastructure and social infrastructure system in Thu Duc City, Ho Chi Minh City

- Regulations on ordination with foreign elements in religious organizations in Vietnam

- Increase land compensation prices in Vietnam from January 1, 2026

- Determination of land compensation levels for damage during land requisition process in Vietnam

- Who is permitted to purchase social housing according to latest regulations in Vietnam?

-

- Number of deputy directors of departments in Vietnam ...

- 15:04, 05/03/2025

-

- Cases ineligible for pardon in Vietnam in 2025

- 14:43, 05/03/2025

-

- Decree 50/2025 amending Decree 151/2017 on the ...

- 12:00, 05/03/2025

-

- Circular 07/2025 amending Circular 02/2022 on ...

- 11:30, 05/03/2025

-

- Adjustment to the organizational structure of ...

- 10:34, 05/03/2025

-

- Notable new policies of Vietnam effective as of ...

- 16:26, 11/04/2025

-

.Medium.png)

- Notable documents of Vietnam in the previous week ...

- 16:21, 11/04/2025

-

.Medium.png)

- Notable documents of Vietnam in the previous week ...

- 16:11, 02/04/2025

-

.Medium.png)

- Notable new policies of Vietnam to be effective ...

- 16:04, 02/04/2025

-

.Medium.png)

- Notable new policies of Vietnam effective from ...

- 14:51, 21/03/2025

Article table of contents

Article table of contents