Cases of e-invoices not required to have all the contents in Vietnam

What are the cases of e-invoices not required to have all the contents in Vietnam? - My Kim (Long An)

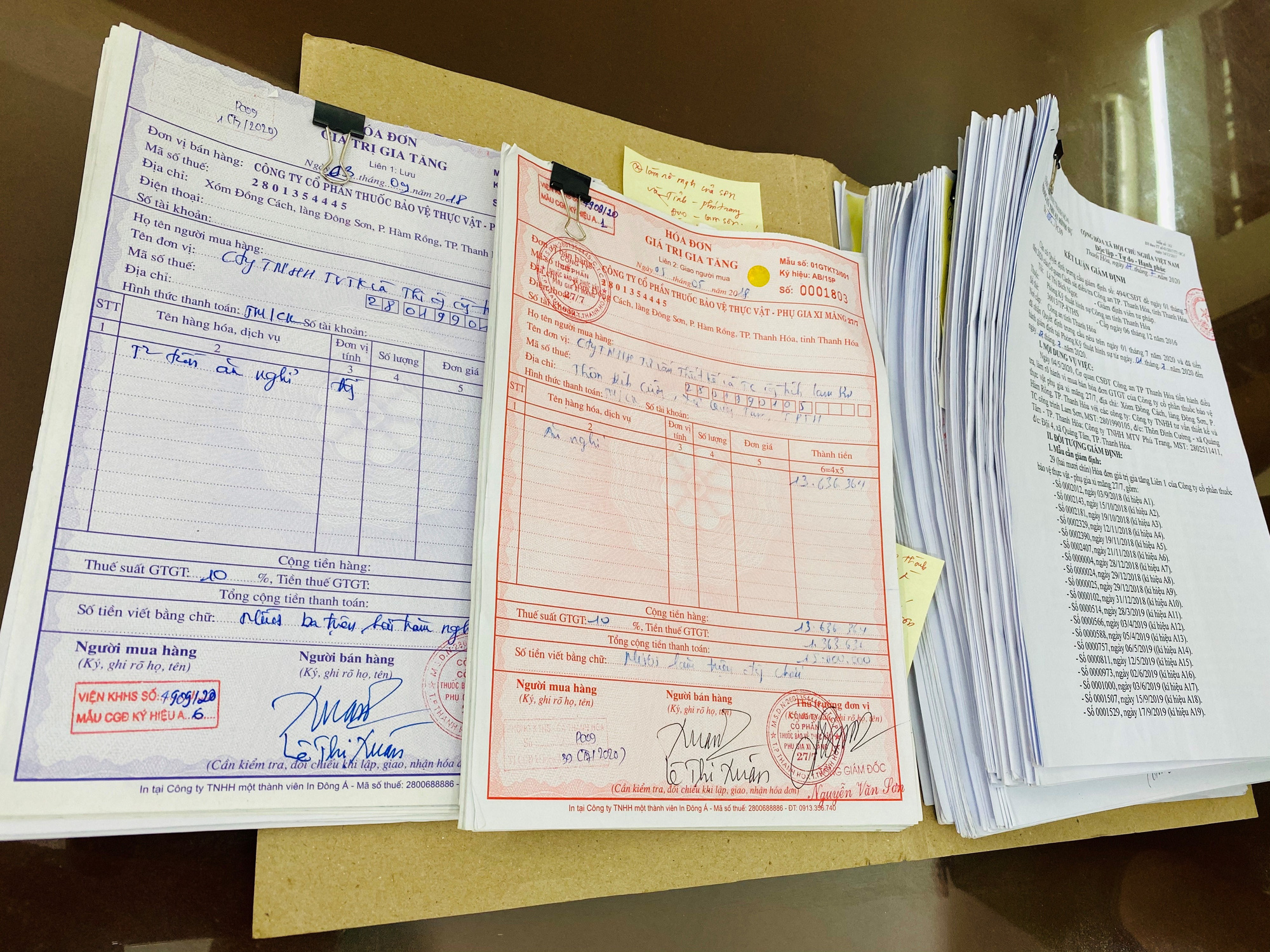

Cases of e-invoices not required to have all the contents in Vietnam (Internet image)

Regarding this issue, LawNet would like to answer as follows:

1. Cases of e-invoices not required to have all the contents in Vietnam

Cases of e-invoices not required to have all the contents in Vietnam specified in Clause 14, Article 10 of Decree 123/2020/ND-CP are as follows:

- An electronic invoice does not necessarily have the buyer’s electronic signature, even if goods/services are sold overseas.

In case the buyer is a business establishment and both the buyer and the seller agrees to use digital or electronic signatures on the e-invoice issued by the seller, the invoice shall bear the buyer’s and the seller’s digital or electronic signatures as agreed.

- E-invoices separately issued by tax authorities do not necessarily bear the buyer’s and the seller’s digital signatures.

- The e-invoice issued by a supermarket or shopping mall to a non-business buyer does not necessarily bear the buyer’s name, address and TIN.

E-invoices for sale of oil and gas to non-business individuals do not necessarily bear the name, form number, reference number, and number of the invoice; the buyer’s name, address, TIN, electronic signature; the seller’s digital or electronic signature; VAT rate.

- E-invoices in the form of stamps, tickets or cards do not necessarily contain the seller’s digital signature (except for those authenticated by tax authorities), the buyer’s information (name, address and TIN), VAT rate and VAT amount.

Pre-priced electronic stamps, tickets and cards do not necessarily contain the unit, quantity and unit price.

- Electronic air tickets issued via websites and e-commerce systems to buyers that are non-business individuals following international practices do not necessarily bear the reference number, form number and number of the invoice, VAT rate, the buyer’s TIN and address, and the seller’s digital signature.

In case a business or non-business organization buys air tickets, the electronic air tickets issued via websites or e-commerce systems to individuals of that organization following international practices are not considered e-invoices.

Airliners shall issue e-invoices with sufficient information and provide them for their buyers.

- Invoices for construction and installation, or construction of houses for sale under installment plans do not necessarily bear the unit, quantity and unit price.

- Delivery and internal transfer note shall bear information on the internal transfer order, recipient’s name, deliverer’s name, sending address, receiving address, and vehicle.

To be specific:

+ The buyer’s name is the recipient’s name and the buyer’s address is receiving address;

+ The seller’s name is the deliverer’s name and the seller’s address is sending address and vehicle;

+ Tax rate, tax amount and total amount payable are not required.

Delivery notes for goods sent to sales agents shall specify information on the economic contract, deliverer, vehicle, sending address, receiving address, name of goods/products, unit, quantity, unit price and amounts.

To be specific:

+ Number and date of the signed economic contract;

+ Deliverer’s full name, delivery contract (if any),

+ The seller’s address which is the sending address.

- Invoices for interline payment between airliners issued in accordance with regulations of the International Air Transport Association (IATA) do not necessarily have the reference number and form number of the invoice, the buyer’s name, address, TIN and electronic signature, unit, quantity, unit price.

- Invoices issued by an airline to its agents according to reports verified by two parties and general statements do not necessarily contain the unit price.

- Invoices for construction, installation, production or provision of products/services of enterprises servicing national defense and security in accordance with the Government's regulations do not necessarily bear the unit, quantity and unit price, and shall have the goods/services provided under the signed contracts written at the columns of name of goods/services.

2. What is e-invoice?

According to Clause 2, Article 3 of Decree 123/2020/ND-CP, e-invoice means an invoice, with or without the tax authority’s authentication code, in the form of electronic data, issued by the goods seller or service provider by using electronic instruments to record:

Information on the sale of goods or service provision in accordance with regulations of the Law on accounting and the Law on taxation, including the invoices generated by POS cash registers that are digitally connected to tax authorities. To be specific:

- Authenticated e-invoice means an e-invoice that is granted an authentication code by the tax authority before it is sent to the buyer by the goods seller or service provider.

The authentication code on an e-invoice is a unique serial number generated by the tax authority’s system and a series of characters encoded by the tax authority based on the information specified by the seller on the invoice.

- Unauthenticated e-invoice means an e-invoice that is sent to the buyer by the goods seller or service provider without the tax authority’s authentication code.

- Key word:

- e-invoice

- in Vietnam

- Cases of land rent exemption and reduction under the latest regulations in Vietnam

- Economic infrastructure and social infrastructure system in Thu Duc City, Ho Chi Minh City

- Regulations on ordination with foreign elements in religious organizations in Vietnam

- Increase land compensation prices in Vietnam from January 1, 2026

- Determination of land compensation levels for damage during land requisition process in Vietnam

- Who is permitted to purchase social housing according to latest regulations in Vietnam?

-

- Prime Minister of Vietnam requests to intensify ...

- 12:00, 11/12/2024

-

- Current regulations on termination of the use ...

- 17:30, 27/09/2024

-

- What are current regulations on form number of ...

- 17:00, 27/09/2024

-

- Emergency response and search and rescue organizations ...

- 10:29, 11/09/2024

-

- Handling of the acceptance results of ministerial ...

- 09:30, 11/09/2024

-

- Notable new policies of Vietnam effective as of ...

- 16:26, 11/04/2025

-

.Medium.png)

- Notable documents of Vietnam in the previous week ...

- 16:21, 11/04/2025

-

.Medium.png)

- Notable documents of Vietnam in the previous week ...

- 16:11, 02/04/2025

-

.Medium.png)

- Notable new policies of Vietnam to be effective ...

- 16:04, 02/04/2025

-

.Medium.png)

- Notable new policies of Vietnam effective from ...

- 14:51, 21/03/2025

Article table of contents

Article table of contents