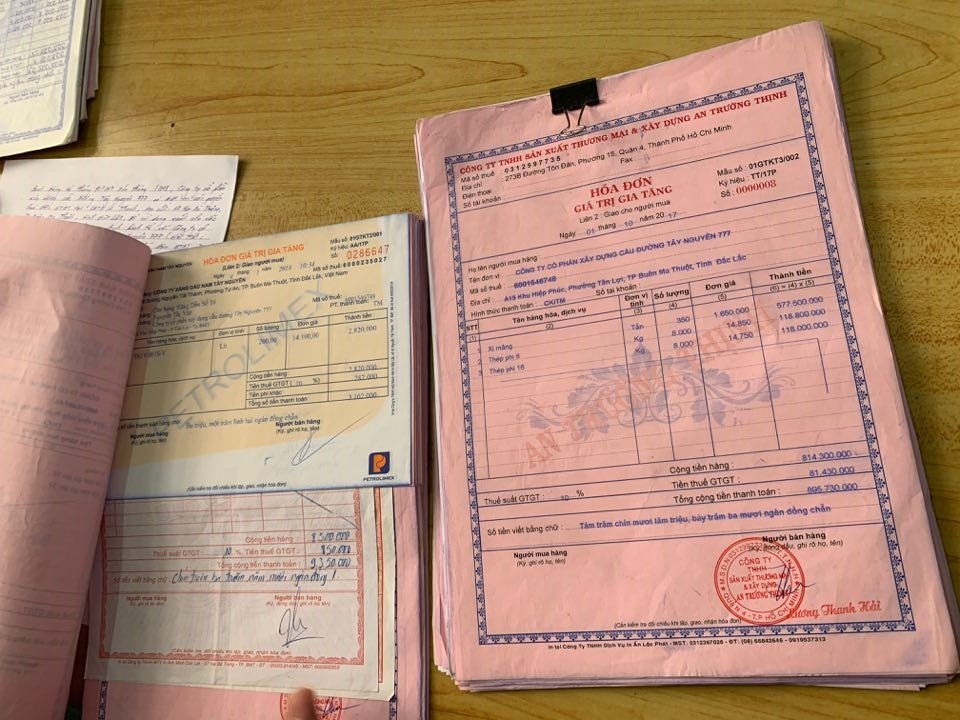

invoice

-

- Shortening the Tax Authority's Response Time Regarding the Use of Invoices Conditions in Vietnam

- 09:54, 11/07/2024

- Below is the newly adjusted content in Circular 37/2017/TT-BTC on amendments and supplements to certain regulations on invoices in Vietnam.

-

- Update: All Electronic Invoice Templates in Vietnam according to Circular 68/2019/TT-BTC

- 20:59, 09/07/2024

- Circular 68/2019/TT-BTC provides guidance on the implementation of certain articles of Decree 119/2018/ND-CP regarding electronic invoices for the sale of goods and provision of services in Vietnam, which was issued on September 30, 2019, and officially came into effect on November 14, 2019.

-

- All fine amounts for invoice violations when selling goods and services from December 05, 2020 in Vietnam

- 19:45, 09/07/2024

- Invoice is an accounting document created by the organizations and individuals selling goods or providing services, recording information about sales of goods and provision of services in accordance with the Accounting Law in Vietnam. The issuance of invoices by organizations and individuals must be in conformity with the law. Below are all fine amounts for invoice violations when selling goods and services from December 05, 2020 in Vietnam.

-

- Compilation of Forms Used in Administrative Sanctions on Taxes, Invoices from December 05, 2020 in Vietnam

- 19:43, 09/07/2024

- On October 19, 2020, the Government of Vietnam issued Decree 125/2020/ND-CP providing regulations on administrative penalties for tax and invoice violations.

-

- Must businesses perform non-cash payment for each invoice for goods and services of at least VND 20 million in Vietnam?

- 15:37, 22/02/2024

- Must businesses perform non-cash payment for each invoice for goods and services of at least VND 20 million in Vietnam? - Quoc Huy (Binh Duong)

-

- Is an invoice issued for returned goods in Vietnam?

- 17:08, 08/12/2023

- Is an invoice issued for returned goods in Vietnam? Who must issue a return invoice in Vietnam? -Gia Han (Nghe An)

-

- To complete the information technology system with electronic invoices no later than the first quarter of 2024 in Vietnam

- 11:07, 06/12/2023

- Is there an information technology system with electronic invoices in Vietnam? - Thuy Linh (Binh Phuoc)

-

- What are the penalties for violations against regulations on printing of externally ordered invoices in Vietnam?

- 09:07, 02/12/2023

- What are the penalties for violations against regulations on printing of externally ordered invoices in Vietnam? - Kim Thoa (Hau Giang)

-

- Instruction on handling of the results of the assessment and classification of taxpayers with signs of invoice risk in Vietnam

- 11:05, 26/05/2023

- General Department of Taxation of Vietnam issued Decision 575/QD-TCT dated May 10, 2023 on the process of applying risk management to assess and identify taxpayers with signs of risk in the management and use of invoices.

Most view

SEARCH ARTICLE