What are the penalties for violations against regulations on printing of externally ordered invoices in Vietnam?

What are the penalties for violations against regulations on printing of externally ordered invoices in Vietnam? - Kim Thoa (Hau Giang)

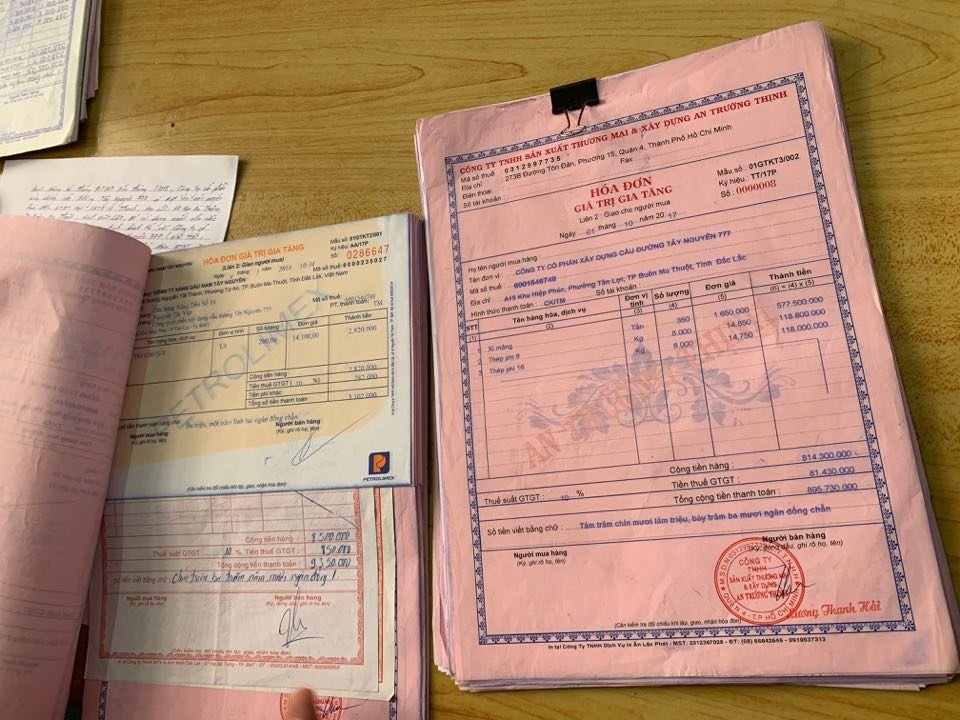

What are the penalties for violations against regulations on printing of externally ordered invoices in Vietnam? (Internet image)

Regarding this issue, LawNet would like to answer as follows:

1. What are the penalties for violations against regulations on printing of externally ordered invoices in Vietnam?

According to Article 21 of Decree 125/2020/ND-CP, violations of regulations on printing ordered invoices can be punished with the following fines:

- Cautions shall be given as a form of penalty imposed for the following violations:

+ Reporting on the acceptance of the supply of invoice printing service from 1 to 5 days after expiry of the regulated time limit;

+ Reporting on the acceptance of the supply of invoice printing service from 6 to 10 days after expiry of the regulated time limit under any mitigating circumstances.

- Fines ranging from VND 500,000 to VND 1,500,000 shall be imposed for the act of printing externally ordered invoices without signing any written printing service contract.

- Fines ranging from VND 2,000,000 to VND 4,000,000 shall be imposed for the act of reporting on the printing of invoices for at least 6 days after the regulated reporting deadline, except the case prescribed in point b of clause 1 of Article 21 of Decree 125/2020/ND-CP.

- Fines ranging from VND 4,000,000 to VND 8,000,000 shall be imposed for the act of failing to cancel damaged or redundant printouts upon termination of printing contracts.

- Fines ranging from VND 6,000,000 to VND 18,000,000 shall be imposed for one of the following violations:

+ Rendering the service of the printing of externally ordered invoices despite failing to meet the prescribed eligibility requirements for printing of invoices;

+ Failing to report on the loss of invoices occurring before delivery to clients.

- Fines ranging from VND 10,000,000 to VND 20,000,000 shall be imposed for the act of transferring the entire printing process or any stage in the printing process to other printing establishments.

- Fines ranging from VND 20,000,000 to VND 50,000,000 shall be imposed for the act of printing invoices by using sample invoices already released by other entities or persons, or the act of ordering of the service of printing invoices if printed invoices share the same numbers as those having the same invoice symbol.

- Other supplementary penalties: Suspending the printing service for the period from 01 month to 03 months from the effective date of penalty decisions with respect to the acts prescribed in clause 7 of Article 21 of Decree 125/2020/ND-CP.

Note: Remedies: Compelling the cancellation of printouts or invoices with respect to the acts specified in clause 4 and 7 of Article 21 of Decree 125/2020/ND-CP.

2. Destruction of tax authority-ordered printed invoices in Vietnam

Destruction of tax authority-ordered printed invoices in Vietnam according to Article 27 of Decree 123/2020/ND-CP as follows:

- Enterprises, business entities, household or individual businesses shall destroy their unused invoices. Invoices must be destroyed within 30 days from the date on which the destruction is notified to the tax authority. If an invoice is expired according to the tax authority’s notice (in case of enforcement of payment of tax debts), the relevant enterprise, business entity, household or individual business shall carry out the destruction of invoice within 10 days from the date of the tax authority’s notice or the date on which the lost invoice is found.

Invoices issued by accounting units shall be destroyed in accordance with regulations of the Law on accounting.

Invoices which are not yet issued but are exhibits of lawsuit cases shall not be destroyed and must be handled in accordance with regulations of laws.

- Invoices of enterprises, business entities, household or individual businesses shall be destroyed as follows:

+ The enterprise, business entity, household or individual business shall make the list of invoices to be destroyed.

+ The enterprise or business entity shall establish an invoice destruction council. The invoice destruction council is comprised of senior representatives and representatives of accounting department. The household or individual business is not required to establish an invoice destruction council.

+ The invoice destruction record shall bear signatures of members of the invoice destruction council who shall assume legal liability for any mistakes thereof.

+ Invoice destruction dossier includes:

++ The decision on establishment of the invoice destruction council, except household or individual businesses;

++ The list of invoices to be destroyed, including: Name, form number and reference number of the invoice, number of destroyed invoices (from number….to number…., or number of each invoice if the invoice numbers are not continuous);

++ The invoice destruction record;

++ The notice of invoice destruction result includes: type, reference number and quantity of destroyed invoice, from number…..to number….., reasons, date and time, and method of destruction, using Form No. 02/HUY-HDG in Appendix IA enclosed with Decree 123/2020/ND-CP.

The invoice destruction dossier shall be kept by the enterprise, business entity, household or individual business using invoices. The notice of invoice destruction result is made into 02 copies of which one copy is kept on file, and the other is sent to the supervisory tax authority within 05 working days from the date of invoice destruction.

- Destruction of invoices by tax authorities

+ Tax authorities shall take charge of destroying invoices which are printed according to orders of a Provincial Department of Taxation, are not sold or issued but are no longer used.

+ The General Department of Taxation shall promulgate procedures for destruction of invoices printed according to orders of Provincial Departments of Taxation.

- Key word:

- invoice

- in Vietnam

- Cases of land rent exemption and reduction under the latest regulations in Vietnam

- Economic infrastructure and social infrastructure system in Thu Duc City, Ho Chi Minh City

- Regulations on ordination with foreign elements in religious organizations in Vietnam

- Increase land compensation prices in Vietnam from January 1, 2026

- Determination of land compensation levels for damage during land requisition process in Vietnam

- Who is permitted to purchase social housing according to latest regulations in Vietnam?

-

- Emergency response and search and rescue organizations ...

- 10:29, 11/09/2024

-

- Handling of the acceptance results of ministerial ...

- 09:30, 11/09/2024

-

- Guidance on unexploded ordnance investigation ...

- 18:30, 09/09/2024

-

- Sources of the National database on construction ...

- 16:37, 09/09/2024

-

- General regulations on the implementation of administrative ...

- 11:30, 09/09/2024

-

- Notable new policies of Vietnam effective as of ...

- 16:26, 11/04/2025

-

.Medium.png)

- Notable documents of Vietnam in the previous week ...

- 16:21, 11/04/2025

-

.Medium.png)

- Notable documents of Vietnam in the previous week ...

- 16:11, 02/04/2025

-

.Medium.png)

- Notable new policies of Vietnam to be effective ...

- 16:04, 02/04/2025

-

.Medium.png)

- Notable new policies of Vietnam effective from ...

- 14:51, 21/03/2025

Article table of contents

Article table of contents