The Ministry of Finance is drafting a Circular providing guidance on the preparation of accounting documents, accounting account methods, accounting book recording methods, preparation and presentation methods for financial reports, and State budget settlement reports applicable to State agencies, organizations, and public service providers that use or do not use the State budget (hereinafter referred to as administrative and non-business units).

Regulations on Accounting Documents

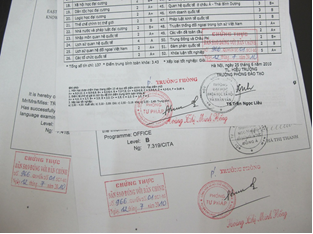

According to the Draft, the system of accounting document templates applicable to administrative units includes the following criteria:

- Labor and wages;- Materials;- Currency;- Fixed assets;- Others.

The current regulation under Decision 19/2006/QD-BTC states that the system of accounting document templates applicable to administrative units only includes four criteria: labor - wages, materials, currency, and fixed assets.

The use, management, and printing of accounting document templates are as follows:

- Mandatory accounting document templates specified in this Circular must be uniformly used. During implementation, units are not allowed to modify mandatory document templates.- For guided accounting document templates, in addition to the prescribed contents on the template, accounting units can add more criteria or change the format to fit their recording and management requirements.- For documents not specified in this Circular and other documents, units can design their own templates to reflect the arising economic transactions. Self-designed document templates must meet a minimum of seven contents specified in Article 16 of the Accounting Law.- Pre-printed document templates must be carefully preserved, and not allowed to be damaged or deteriorated. Checks, receipts, and other valuable papers must be managed like cash.

Regulations on Accounting Accounts

Compared to the current regulations, the Account System has many changes. The Account System includes ten categories, specifically:

- Accounts from Type 1 to Type 9 are used for financial accounting reflecting the situation: assets, liabilities, capital sources, revenue, expenses, other income, other expenses, determining results, and off-balance sheet accounts of the unit in the accounting period;- Type 10 accounts are used for budgeting accounting (abbreviated as budget accounting) for units funded by the state budget. If an economic or financial transaction arises related to state budget receipts and expenditures, accounting must be done in both financial accounting and budget accounting.

Under Decision 19/2006/QD-BTC, the accounting account system applicable to administrative units regulated by the Ministry of Finance consists of seven types, specifically:

- Type 0: Off-balance sheet accounts;- Type 1: Material assets;- Type 2: Fixed assets;- Type 3: Payments;- Type 4: Funding sources;- Type 5: Revenue accounts;- Type 6: Expense accounts.

Accounting Books System and Accounting Forms

Each accounting unit has only one accounting book system for an annual accounting period. The accounting books include: General Ledger and Detailed Ledger. Financial accounting books and budget accounting books. Depending on the accounting form applied by the unit, it must fully open the general ledger, detailed ledger, and fully implement the regulations of the accounting form regarding content, sequence, and recording methods for each accounting book template. The types of general ledgers (General Ledger, Journal) are mandatory book templates, and the types of detailed accounting books and detailed accounting cards are guided templates. Budget accounting books must be reflected according to the state budget categories for receiving and using state budget funds.

The accounting forms applicable to administrative units include:

- General Journal accounting form;- Journal - General Ledger accounting form;- Document recording accounting form;- Computer-based accounting form.

The accounting unit is allowed to choose one of the four accounting book forms and must strictly adhere to all the basic principles prescribed for the chosen accounting book form regarding: types of books, quantity, structure of book types, the relationship between book types, sequence, and recording techniques of the accounting books.

Financial Report and Settlement Report

Deadline for preparing financial reports:

- Units must prepare financial reports at the end of the annual accounting period (as of December 31) as prescribed by the Accounting Law.- If the law requires the preparation of financial reports for other accounting periods, in addition to the annual financial report, the unit must also prepare financial reports for those periods.

The deadline for preparing financial reports according to the draft differs from the current regulation. Specifically, under Decision 19/2006/QD-BTC, the financial report preparation is as follows:

- Financial reports of administrative units and organizations using state budget funds must be prepared at the end of the quarterly and annual accounting periods.- Financial reports of units and organizations not using state budget funds must be prepared at the end of the annual accounting period.- Accounting units that are split, merged, or cease operations must prepare financial reports at the time of the decision to split, merge, or cease operations.

According to the Draft, annual financial reports of administrative units must be submitted to the competent state authorities or superior units within 90 days from the end of the annual accounting period as prescribed by law. Subordinate accounting units without legal status must submit financial reports to the superior unit within the time limit prescribed by the superior unit to support the consolidation of financial reports of the superior unit.

For state budget settlement reports: Units prepare the report annually. The data for the annual state budget settlement report includes the revenue and expenditure of the budget year, calculated up to the end of the state budget settlement adjustment period (January 31 of the following year) as prescribed by the Law on State Budget. Other funding settlement reports: Units prepare the annual settlement report. Units must prepare settlement reports at the end of the annual accounting period (after December 31). If the law requires the preparation of reports for other accounting periods, in addition to the annual settlement report, the unit must also prepare reports for those periods.

Article table of contents

Article table of contents