What are the contents of accounting records in Vietnam?

What are the contents of accounting records in Vietnam? - Ngoc Lam (Thanh Hoa)

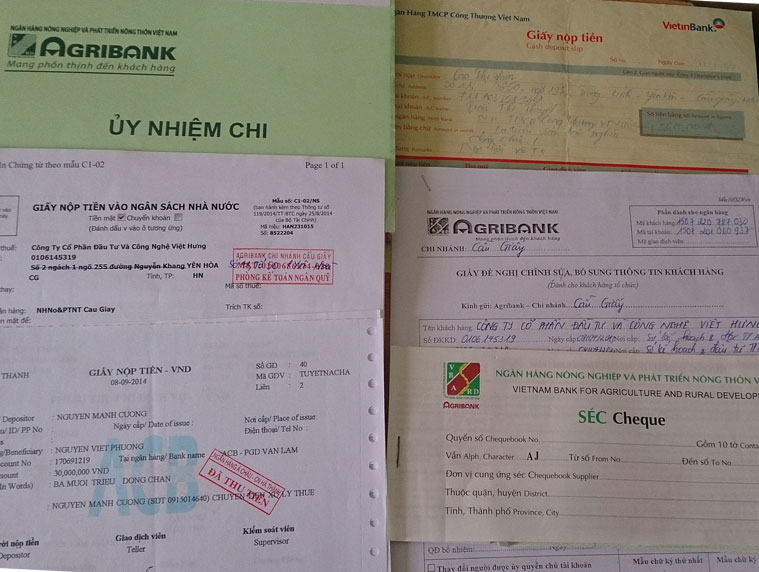

What are the contents of accounting records in Vietnam? (Internet image)

Regarding this issue, LawNe would like to answer as follows:

1. What are the contents of accounting records in Vietnam?

An accounting record must have:

- Name and number of the accounting record;

- Date of the accounting record;

- Name, address of the entity that makes the accounting record;

- Name, address of the entity that receives the accounting record;

- Contents of the economic/financial transaction that occurs;

- Quantity, unit price, amount of the economic/financial transaction in number; total amount of accounting records serving collection or payment of money in both number and words;

- Signatures, full names of the persons who make, approve the accounting record, and relevant persons

Apart from the primary contents specified above, an accounting record may have other contents depending on its type.

(Article 16 of Law on Accounting 2015)

2. Regulations on making and retention of accounting records in Vietnam

Specifically, Article 18 of the Law on Accounting 2015 stipulates the making and retention of accounting records as follows:

- An accounting record shall be made for each economic/financial transaction that occurs during the operation of an accounting unit. Only one accounting record shall be made for each economic/financial transaction.

- Accounting records must be made in a clear, complete, timely, and accurate manner in accordance with the set form. If an accounting record form is not available, the accounting unit may design its own accounting records as long as they have sufficient contents specified in Article 16 of the Law on Accounting 2015.

- Economic/financial transactions on accounting records must not be abbreviated, erased, changed; Text must be written by pen; digits and letters must be written continuously without interruption; blank spaces must be crossed out. Accounting records that are changed are not valid for payment and recording in accounting books. Every incorrect accounting record must be crossed out.

- An accounting record must have a sufficient number of copies as prescribed. Contents of the copies of an accounting record for an economic/financial transaction must be identical.

- The persons who make, approve, and other persons that sign the accounting record are responsible for its content.

- Electronic accounting records must comply with provisions of Article 17, Clause 1 and Clause 2 of Article 18 of the Law on Accounting 2015. Electronic accounting records shall be printed and retained in accordance with Article 41 of Law on Accounting 2015.

If electronic records are stored in electronic devices instead of being printed, it is required to ensure safety and security of information and accessibility during the retention period.

3. Regulations on signing accounting records

Pursuant to Article 19 of the Law on Accounting 2015, regulations on signing accounting records are as follows:

- An accounting record must sufficient signatures. Accounting records must be signed with indelible ink. It is prohibited to use red ink or rubber signature stamps on accounting records. Signatures on accounting records appended by the same person must be consistent. The Government shall provide for signatures on accounting records appended by visually impaired people.

- Accounting records must be signed by competent persons or authorized persons. It is prohibited to sign an accounting record that does not have sufficient content.

- Accounting records on payment must be signed by the person competent to approve payments and the chief accountant or an authorized person before making such payment. Every copies of an accounting record on payment must be signed.

- Electronic records must bear electronic signatures. Signatures on electronic records are as valid as signatures on physical records.

4. Regulations on management and use of accounting records in Vietnam

According to Article 21 of the Law on Accounting 2015, regulations on management and use of accounting records are as follows:

- Information and data on accounting records are the basis for making accounting books.

- Accounting records must be sorted by transaction content and by time, and preserved as prescribed by law.

- Only competent authorities are entitled to impound, confiscate, or seal accounting records.

Where accounting records are impounded or confiscated, the competent authority shall photocopy the records impounded or confiscated, append signature on the copies, and give the copies to the accounting unit; make a record which specifies the reasons for impoundment of confiscation, quantity of each type of accounting records impounded or confiscated, and append the signature and seal on the record.

- The competent authority that seals accounting records shall issue a record which specifies the reasons for sealing, quantity of each type of accounting records sealed, and append the signature and seal on the record.

Ho Quoc Tuan

- Key word:

- accounting records

- in Vietnam

- Cases of land rent exemption and reduction under the latest regulations in Vietnam

- Economic infrastructure and social infrastructure system in Thu Duc City, Ho Chi Minh City

- Regulations on ordination with foreign elements in religious organizations in Vietnam

- Increase land compensation prices in Vietnam from January 1, 2026

- Determination of land compensation levels for damage during land requisition process in Vietnam

- Who is permitted to purchase social housing according to latest regulations in Vietnam?

-

- Emergency response and search and rescue organizations ...

- 10:29, 11/09/2024

-

- Handling of the acceptance results of ministerial ...

- 09:30, 11/09/2024

-

- Guidance on unexploded ordnance investigation ...

- 18:30, 09/09/2024

-

- Sources of the National database on construction ...

- 16:37, 09/09/2024

-

- General regulations on the implementation of administrative ...

- 11:30, 09/09/2024

-

- Notable new policies of Vietnam effective as of ...

- 16:26, 11/04/2025

-

.Medium.png)

- Notable documents of Vietnam in the previous week ...

- 16:21, 11/04/2025

-

.Medium.png)

- Notable documents of Vietnam in the previous week ...

- 16:11, 02/04/2025

-

.Medium.png)

- Notable new policies of Vietnam to be effective ...

- 16:04, 02/04/2025

-

.Medium.png)

- Notable new policies of Vietnam effective from ...

- 14:51, 21/03/2025

Article table of contents

Article table of contents