Conditions for pension enjoyment in Vietnam

What are the conditions for pension enjoyment in Vietnam? - Hien Vinh (Khanh Hoa)

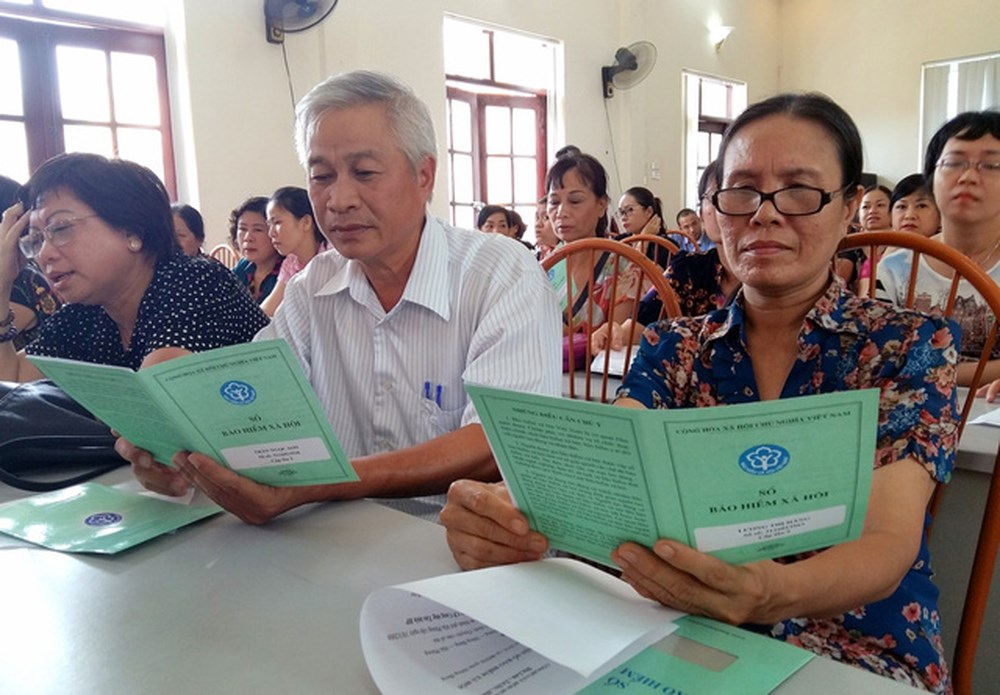

Conditions for pension enjoyment in Vietnam (Internet image)

Regarding this issue, LawNet would like to answer as follows:

1. Conditions for pension enjoyment in Vietnam

1.1 Conditions for pension enjoyment for compulsory insurance

(i) Employees defined at Points a, b, c, d, g, h and i, Clause 1, Article 2 of this Law, except those defined in Clause 3 of this Article, who have paid social insurance premiums for at least full 20 years are entitled to pension when falling in one of the following cases:

(i.1) Being full 60 years old, for men, or full 55 years old, for women;

(i.2) Being between full 55 years and full 60 years old, for men, or between full 50 years and full 55 years old, for women, and having full 15 years doing heavy, hazardous or dangerous occupations or jobs or extremely heavy, hazardous or dangerous occupations or jobs on the list jointly issued by the Ministry of Labor, War Invalids and Social Affairs and the Ministry of Health, or having full 15 years working in areas with a region-based allowance coefficient of 0.7 or higher;

(i.3) Employees who are between full 50 years and full 55 years old and have paid social insurance premiums for at least full 20 years, including full 15 years spent in coal mines;

(i.4) Employees who are infected with HIV/AIDS due to occupational risks.

(ii) Employees defined at Points dd and e, Clause 1, Article 2 of this Law, who cease working after having paid social insurance premiums for at least full 20 years, are entitled to pension when falling in one of the following cases:

(ii.1) Being full 55 years old, for men, or full 50 years old, for women, unless otherwise provided by the Law on Officers of the Vietnam People’s Army, the Law on People’s Public Security or the Law on Cipher;

(ii.2) Being between full 50 years and full 55 years old, for men, or between full 45 years and full 50 years old, for women, and having full 15 years doing heavy, hazardous or dangerous occupations or jobs or extremely heavy, hazardous or dangerous occupations or jobs on the list jointly issued by the Ministry of Labor, War Invalids and Social Affairs and the Ministry of Health, or having full 15 years working in areas with a region-based allowance coefficient of 0.7 or higher;

(ii.3) Employees who are infected with HIV/AIDS due to occupational risks.

(iii) Female employees who are full-time or part-time staffs in communes, wards or townships, and cease working after having paid social insurance premiums for between full 15 years and under 20 years, and are full 55 years old, are entitled to pension.

(iv) The Government shall stipulate the conditions on retirement ages for pension enjoyment in special cases; and the conditions for pension enjoyment for the subjects defined at Point (i.3) and Point (i.4) Clause (i), Point (ii.3) Clause (ii).

(Article 54 of the Law on Social Insurance 2014)

1.2 Conditions for pension enjoyment for voluntary insurance

- Employees are entitled to pension when fully satisfying the following conditions:

(i) Full retirement age as prescribed in Clause 2, Article 169 of the Labor Code 2019;

(ii) Having paid social insurance premiums for at least full 20 years.

- Employees who satisfy the age requirement specified at Point (i) but have paid social insurance premiums for under 20 years may continue paying social insurance premiums until the payment period reaches full 20 years in order to enjoy pension.

(Article 73 of the Law on Social Insurance 2014)

2. Regulations on retirement age in Vietnam

According to Article 169 of the Labor Code 2019, the retirement ages are specified as follows:

- An employee who has paid social insurance for an adequate period of time as prescribed by social insurance laws shall receive retirement pension when he/she reaches the retirement age.

- Retirement ages of employees in normal working conditions shall be gradually increased to 62 for males by 2028 and 60 for females in 2035.

From 2021, the retirement ages of employees in normal working conditions shall be 60 yeas 03 months for males and 55 years 04 months for females, and shall increase by 03 months for males and 04 months for females after every year.

- The retirement ages of employees who suffer from work capacity reduction; doing laborious, toxic or dangerous works; working in highly disadvantaged areas may be younger by up to 05 years than the retirement ages specified in Clause 2 of Article 169 of the Labor Code 2019, unless otherwise prescribed by law.

- Retirement ages of skilled employees and employees in certain special cases may be older by up to 05 years than the retirement ages specified in Clause 2 of Article 169 of the Labor Code 2019, unless otherwise prescribed by law.

Nguyen Ngoc Que Anh

- Key word:

- pension enjoyment

- in Vietnam

- Cases of land rent exemption and reduction under the latest regulations in Vietnam

- Economic infrastructure and social infrastructure system in Thu Duc City, Ho Chi Minh City

- Regulations on ordination with foreign elements in religious organizations in Vietnam

- Increase land compensation prices in Vietnam from January 1, 2026

- Determination of land compensation levels for damage during land requisition process in Vietnam

- Who is permitted to purchase social housing according to latest regulations in Vietnam?

-

- Emergency response and search and rescue organizations ...

- 10:29, 11/09/2024

-

- Handling of the acceptance results of ministerial ...

- 09:30, 11/09/2024

-

- Guidance on unexploded ordnance investigation ...

- 18:30, 09/09/2024

-

- Sources of the National database on construction ...

- 16:37, 09/09/2024

-

- General regulations on the implementation of administrative ...

- 11:30, 09/09/2024

-

- Notable new policies of Vietnam effective as of ...

- 16:26, 11/04/2025

-

.Medium.png)

- Notable documents of Vietnam in the previous week ...

- 16:21, 11/04/2025

-

.Medium.png)

- Notable documents of Vietnam in the previous week ...

- 16:11, 02/04/2025

-

.Medium.png)

- Notable new policies of Vietnam to be effective ...

- 16:04, 02/04/2025

-

.Medium.png)

- Notable new policies of Vietnam effective from ...

- 14:51, 21/03/2025

Article table of contents

Article table of contents