The Ministry of Finance has just issued Circular 95/2016/TT-BTC providing detailed guidelines on taxpayer registration for organizations and individuals. Notably, it includes specific regulations regarding the taxpayer registration certificate for various subjects.

Paying taxes is both a right and an obligation of all citizens, particularly for individuals, organizations, and businesses with arising income, as they must fulfill this obligation for the following reasons:

- Paying taxes contributes to the stability of the State and national budget. And the budget can only be stabilized when citizens effectively fulfill their tax obligations.- The tax amounts paid into the budget are partly used for state administrative management and the rest serves the interests of the taxpayers themselves.- Additionally, tax revenue is an important tool for the state to regulate the market economy, manage society, and ensure a balance among different social interest groups through tax increases, reductions, or exemptions.

Firstly, to fulfill their tax obligations, taxpayers must register with the state agency and evidence this taxpayer registration with a taxpayer registration certificate.

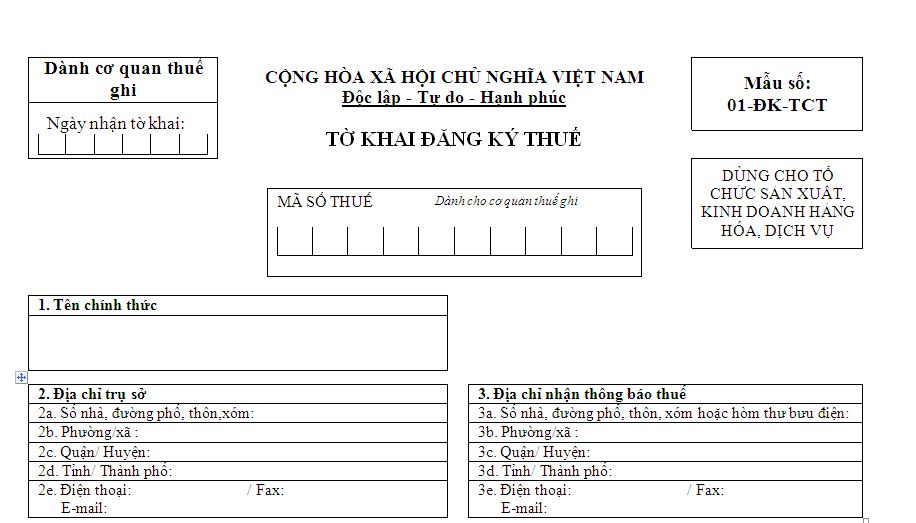

Sample taxpayer registration form

According to the provisions of Circular 80/2012/TT-BTC guiding the Law on Tax Management, the taxpayer registration certificate is issued to organizations and individuals with income arising from business activities or other activities. However, depending on the specific subject, there are different types of certificates, including:

- Taxpayer registration certificate for taxpayers engaged in production and business activities;- Personal tax code card for individuals subject to personal income tax;- Tax code notification for the following subjects:- Taxpayers with new business activities or expanding business activities to other localities without establishing branches or dependent units;- Individuals or groups of individuals doing business without an identity card or lacking a business registration certificate;- Individuals paying non-agricultural land use tax;- Vietnamese parties paying contractor tax on behalf of foreign contractors or subcontractors;- Non-business units, armed units; economic organizations of political organizations, socio-political organizations, social organizations, social-professional organizations...

Sample taxpayer registration certificate

Soon, Circular 95/2016/TT-BTC will replace the above Circular 80 and provide regulations on amendments and supplements for the types of certificates for taxpayers as follows:

- Taxpayer registration certificate: Applied to enterprises, organizations, households, and individuals engaged in production, business activities:- In fields such as securities, insurance, accounting, auditing, law, notarization, or other specialized fields not registering enterprises through the business registration agency (hereinafter referred to as Economic Organizations);- Non-business units; armed units; economic organizations of political organizations,... conducting business activities as prescribed but not required to register enterprises; organizations of countries sharing land borders with Vietnam conducting purchasing, selling, and exchanging goods at border markets, border gate economic zones, cooperative groups established and operating under the Cooperative Law;- Households, groups of individuals, and individuals engaged in production, business activities, and providing goods and services- Personal tax code certificate applied to individuals with income subject to personal income tax (excluding business individuals), other individuals obligated to pay the state budget- Tax code notification applied to other organizations and individuals (not falling under the above two cases).- Additionally, there is a Dependent’s tax code notification applied to individuals with income subject to personal income tax from wages and salaries registering tax codes for their dependents.

For further guidance on taxpayer registration, refer to Circular 95/2016/TT-BTC effective from August 12, 2016.

Article table of contents

Article table of contents