The Ministry of Finance has recently indicated a "direction" to continue implementing the tax rate on the second and subsequent houses for individuals owning multiple properties. This is a direct tax, which will be levied directly on individuals and organizations with assets, specifically those owning more than one property.

Renewing outdated regulations

This is not the first time the Ministry of Finance has proposed the implementation of a tax on housing; this type of tax was constructed in a Draft Law in 2009: the Law on Housing and Land Tax (Draft). However, for many reasons, perhaps due to an inappropriate timing or facing much opposition, the Draft Law remained on paper and “faded into oblivion.”

Therefore, the Ministry of Finance’s re-addressing of this type of tax has caused quite a bit of “surprise.” According to the provisions of the Draft Law, the subjects of this tax rate include residential houses, homestead land, and non-agricultural production and business land.

Tax calculation per square meter for the second house onwards

According to Clause 1, Article 5 of the Draft Law on Housing and Land Tax, the tax calculation for taxable residential houses is computed as follows:

Taxable residential floor area * absolute tax rate per square meter

The absolute tax rate/tax rate is stipulated in Article 8.

According to the Draft, the Ministry of Finance proposed three options to determine the taxable housing area as follows:

Option 1: The basis for tax calculation for residential houses is determined by the taxable housing area. The starting point for tax calculation is for areas over 200 square meters. According to this option, the tax rate is only applied to houses with a total area of 200 square meters or more (total area includes auxiliary constructions, balconies, or as stated in the Certificate).

For houses used for both residential and business purposes, the business area will still be included in the taxable area if the business area cannot be separately determined.

For cases of owning multiple houses, the taxable area is the total area of all taxable houses.

Option 2: The basis for tax calculation for residential houses is determined by the taxable housing value. The starting point for tax calculation for residential houses is 01 billion VND. The tax calculation method is based on the construction value of the residential buildings to apply the tax rate, whereby houses with a construction value of over 02 billion VND are subject to the tax (Point b, Clause 1, Option 2, Article 6). The taxable value used in this option is calculated at ½ of the construction value at the current time. This provision is quite vague as constructions built 10 years ago or 20 years ago may have a taxable value equivalent to a construction newly built a year ago. When the new Law is constructed, the Ministry of Finance will probably reconsider this regulation.

Moreover, for cases of owning multiple houses, the taxable area is the total area of all taxable houses.

Both initial options share a common point in the number of taxable houses, whereby the area of all houses is included in the total taxable area.

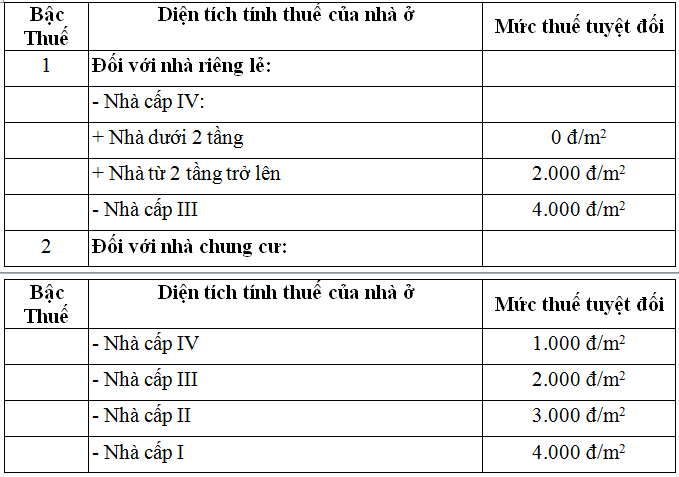

Option 3: According to this option, tax is only applied to the second house onwards in cases where individuals own multiple houses. The tax rate proposed by the Ministry of Finance is as follows:

Applying the absolute yearly tax rate for residential houses under Option 3

In the near future, when the Ministry of Finance proceeds to construct the new Housing Tax Law, the tax rate per square meter will be adjusted to suit practical conditions and specific localities.

Article table of contents

Article table of contents

.Medium.png)

.Medium.png)

.Medium.png)

.Medium.png)