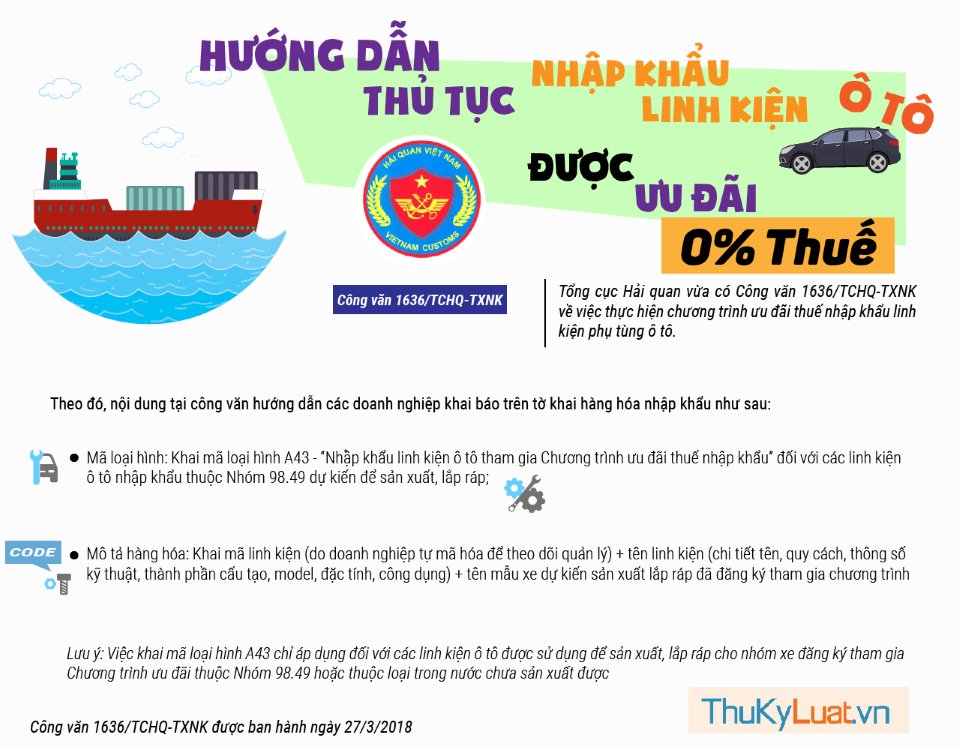

Guidance on Procedures for Importing Auto Parts with 0% Tax Incentives

The General Department of Customs has recently issued Official Dispatch 1636/TCHQ-TXNK regarding the implementation of the preferential import tax program for automobile parts and components.

The content in the official dispatch guides enterprises to declare on the import goods declaration as follows:

- Type Code: Declare type code A43 - “Import of automobile components participating in the Import Tax Incentive Program” for imported automobile components under Group 98.49 intended for production and assembly;- Product Description: Declare the component code (coded by the enterprise for management purposes) + component name (detailed name, specifications, technical parameters, composition, model, characteristics, utility) + name of the proposed car model for production and assembly that has registered to participate in the program.

Note: The declaration of type code A43 only applies to automobile components used for production and assembly for the vehicle group registered to participate in the Incentive Program under Group 98.49 or of a type not yet produced domestically.

More details can be found in Official Dispatch 1636/TCHQ-TXNK issued on March 27, 2018.

- [InfoGraphic] 6 forms of discipline for officials and public employees under Decree 71/2016/ND-CP

- The Health Sector Recruits No More Than 50% of Positions Vacated

- Guidelines for Inspection of Export and Import Goods at Border Gates

- Import of Eggs and Salt from ASEAN Without Quantity Restriction from May 17, 2018

- Infographic: Important Points to Note When Signing a Labor Contract

- Upcoming inspection on safety and security at all schools in Vietnam

-

- Notable new policies of Vietnam effective as of ...

- 16:26, 11/04/2025

-

.Medium.png)

- Notable documents of Vietnam in the previous week ...

- 16:21, 11/04/2025

-

.Medium.png)

- Notable documents of Vietnam in the previous week ...

- 16:11, 02/04/2025

-

.Medium.png)

- Notable new policies of Vietnam to be effective ...

- 16:04, 02/04/2025

-

.Medium.png)

- Notable new policies of Vietnam effective from ...

- 14:51, 21/03/2025

Article table of contents

Article table of contents