Tax deduction is the action performed by organizations or individuals paying income to subtract the tax payable from the taxpayer's income before paying the income. Here are the latest guidelines for filling out Certificate of personal income tax withholding in Vietnam.

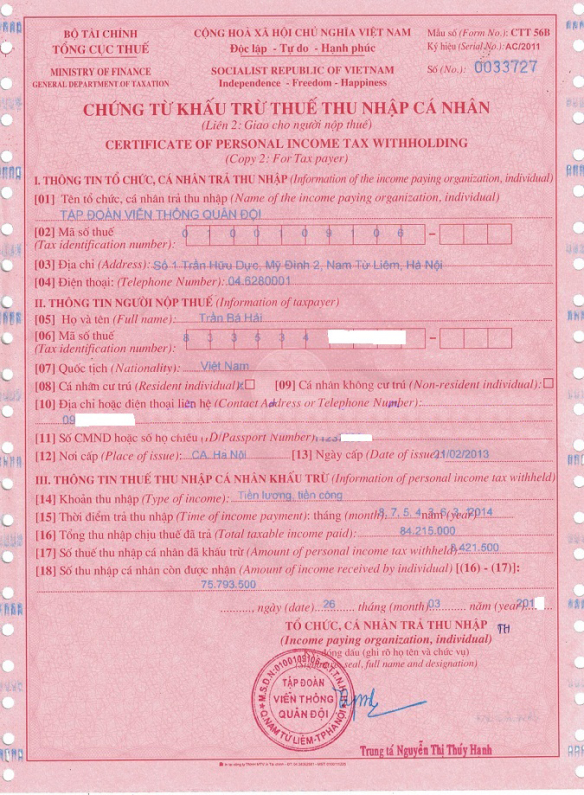

Template for Certificate of personal income tax withholding in Vietnam

I. INFORMATION OF THE ORGANIZATION OR INDIVIDUAL PAYING INCOME

[01] Name of the organization or individual paying income: Fully record the name of the income-paying organization in CAPITAL LETTERS as per the Establishment Decision or Business Registration Certificate. If it is an individual, fully record the name of the individual in CAPITAL LETTERS as per their ID Card or Passport.

[02] Tax code: Record the tax code of the income-paying organization as per the Business Registration Certificate or TIN of the organization.

[03] Address: Record the address of the income-paying organization as per the Business Registration Certificate.

[04] Telephone: Record the telephone number of the income-paying organization.

II. INFORMATION OF THE TAXPAYER

[05] Full name: Record the full name of the taxpayer in CAPITAL LETTERS as per their ID Card or Passport.

[06] Tax code: Fully record the tax code of the taxpayer as per the issued TIN.

[07] Nationality: Record the nationality of the taxpayer.

[08], [09] Check the corresponding box for either resident individual or non-resident individual.

[10] Contact address or telephone: Record the contact address or telephone number for convenient communication between the tax authority and the taxpayer.

[11] ID Card number or Passport number: Fully enter the ID Card number or Passport number.

[12] Place of issue, [13] Date of issue: Record as per the ID Card or Passport.

III. INFORMATION ON PERSONAL INCOME TAX DEDUCTED

[14] Income source: Clearly state the type of income received by the individual, including: Income from salary, wages, business income, capital investment income, etc.

[15] Time of income payment: This is the time when the organization or individual pays the income within the calendar year. In the case of income payment over a period, specify from which month to which month.

Example: If the agency pays income to an individual for the months of April, May, and June, then record: "April to June".

[16] Total taxable income paid: This is the total income paid by the organization or individual to the person, minus exemptions.

Note: Total taxable income = Total income – Exemptions

According to the regulations in Article 4 of the Personal Income Tax Law, Point i, Article 3 of Circular 111/2013/TT-BTC, the income from salary and wages exempted from tax includes the part of salary and wages for night work and overtime paid higher than the salary and wages for daytime and regular hours according to the Labor Code. This includes: The part of the salary and wage paid higher due to night work and overtime is exempted based on the actual salary and wages paid for night work and overtime minus (-) the salary and wages calculated according to regular working days; lunch allowances, midshift meals, telephone allowances, etc.

Total taxable income before deductions, including: Family circumstance deduction, deductions for insurance contributions, voluntary retirement fund, and deductions for charitable, humanitarian, study promotion contributions.

[17] Amount of personal income tax deducted: This is the amount of personal income tax that the organization or individual has deducted from the taxpayer (Taxable income * Tax rate)

[18] Amount of personal income tax remaining to be received: This is the amount the individual still receives.

Le Vy

Article table of contents

Article table of contents