Vietnam: Guidance on VAT tax deferral from April 08, 2020

Recently, the Government of Vietnam has officially issued Decree No. 41/2020/NĐ-CP on tax and land rent deferral.

Entities specified in Article 2 of Decree No. 41/2020/NĐ-CP of Vietnam’s Government shall be entitled to VAT tax deferral (except VAT paid upon importation of goods), specifically as follows:

1. VAT incurred by the enterprises and organizations mentioned in Article 2 of this Decree during March, April, May, June of 2020 (for taxpayers declaring tax monthly), first and second quarter of 2020 (for taxpayers declaring tax quarterly) may be deferred for 05 months from the deadlines for VAT payment prescribed by tax administration laws.

In case a taxpayer makes a revision to the tax declaration that results in an increase in the VAT payable and submit the revised tax declaration to the tax authority by the deadline, the VAT amount eligible for deferral will include the increase in VAT payable.

Enterprises and organizations eligible for tax deferral shall submit their monthly or quarterly VAT declarations in accordance with applicable laws and may postpone payment of the VAT declared. Deferred deadlines:

- Deadline for payment of VAT incurred in March 2020 is deferred to September 20, 2020.

- Deadline for payment of VAT incurred in April 2020 is deferred to October 20, 2020.

- Deadline for payment of VAT incurred in May 2020 is deferred to November 20, 2020.

- Deadline for payment of VAT incurred in June 2020 is deferred to December 20, 2020.

- Deadline for payment of VAT incurred in the first quarter of 2020 is deferred to September 30, 2020.

- Deadline for payment of VAT incurred in the second quarter of 2020 is deferred to December 30, 2020.

2. In case an enterprise or organization mentioned in Article 2 of this Decree has a branch or affiliated unit that declares VAT separately to its supervisory tax authority, the branch or unit is also eligible for VAT deferral. The branches and units of the enterprises and organizations mentioned in Clause 1, Clause 2 and Clause 3 Article 2 of this Decree shall not be eligible for VAT deferral if none of their economic sectors or business lines is eligible for deferral.

Deferral procedures are specified in Article 3 of Decree No. 41/2020/NĐ-CP of Vietnam’s Government, effective from April 08, 2020.

Le Hai

- Key word:

- Decree No. 41/2020/NĐ-CP

- Guidelines for maintenance and renovation of villas in Ho Chi Minh City

- Guidelines for maintenance and renovation of villas in Ho Chi Minh City

- Resolution 190: Principles for addressing certain issues related to the organization and arrangement of state apparatus in Vietnam

- Guidance on identifying cases of inaccurate or non-operational electricity meters in Vietnam

- Official Telegram 16: Urgent requirement to allocate the entire state budget investment plan in 2025 in Vietnam

- Prime Minister of Vietnam directs to accelerate allocation and disbursement of public investment capital in 2025 in Vietnam

-

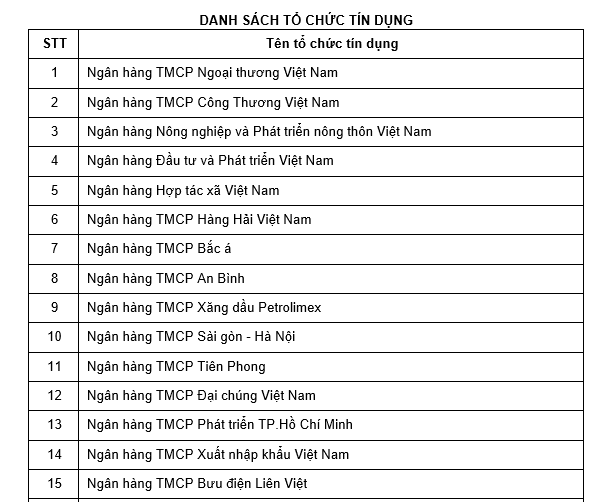

- Vietnam: Publishing the List of credit institutions ...

- 09:42, 04/05/2020

-

- Vietnam: VAT, CIT, PIT and land rent deferred ...

- 08:29, 25/04/2020

-

- What types of taxes are small enterprises and ...

- 16:56, 12/04/2020

-

- Guidance on tax and land rent deferral applied ...

- 11:30, 09/04/2020

-

.jpg)

- Official: 05 entities eligible for tax and land ...

- 09:44, 09/04/2020

-

- Guidelines for maintenance and renovation of villas ...

- 14:30, 21/02/2025

-

- Guidelines for maintenance and renovation of villas ...

- 14:30, 21/02/2025

-

- Procedures for high school admission in Vietnam

- 14:25, 21/02/2025

-

- Resolution 190: Principles for addressing certain ...

- 11:30, 21/02/2025

-

- Guidance on identifying cases of inaccurate or ...

- 11:00, 21/02/2025

Article table of contents

Article table of contents