Recently, the Government of Vietnam has officially issued Decree No. 41/2020/NĐ-CP on tax and land rent deferral.

According to Decree No. 41/2020/NĐ-CP of Vietnam’s Government, deferral of added value tax (VAT), corporate income tax (CIT), personal income tax (PIT) and land rent shall apply to the followings:

1. Enterprises, organizations, households and individuals (hereinafter referred to as “taxpayers”) that are manufacturers in the following economic sectors:

- Agriculture, forestry, aquaculture;

- Production and processing of food; textiles; garments; manufacture of leather and leather products; wood treatment and manufacture of products from wood, bamboo, rattan (except furniture); manufacture of products from straw and plaiting materials; manufacture of paper products; manufacture of rubber and plastic products; manufacture of products from other non-metallic minerals; metal production; mechanical working; metal treating and coating; manufacture of electronics, computers and optical products; manufacture of automobiles and other motor vehicles; furniture production;

- Construction.

2. Taxpayers that operate in the following economic sectors:

- Transport and warehousing; accommodation, food and drink; education and training; healthcare and social assistance; real estate trading;

- Employment services; travel agencies, tourism services and auxiliary tourism services;

- Composing, art and entertainment; library, archive, museum operation and other artistic activities; sports and entertainment; cinemas.

3. Taxpayers that are manufacturers of prioritized ancillary industry products or key mechanical products.

4. Small enterprises and microenterprises shall be determined in accordance with the Law on Assistance for Medium and Small Enterprises 2017 of Vietnam.

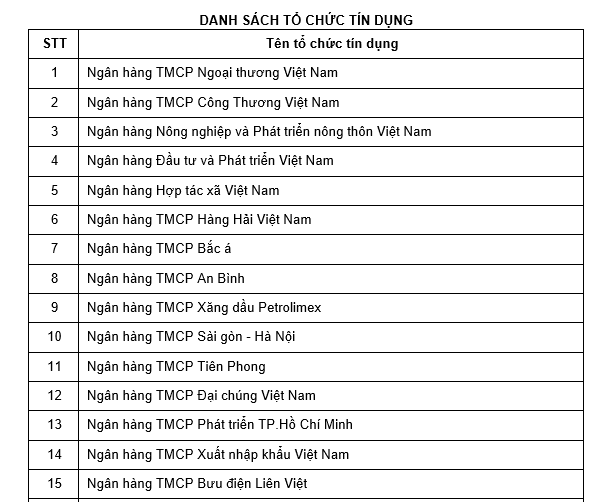

5. Credit institutions and foreign bank branches (FBB) shall provide assistance for enterprises, organizations and individuals affected by Covid-19 as prescribed by the State bank of Vietnam (SBV).

Note: The economic sectors and business lines of taxpayers mentioned in Clause 1, Clause 2 and Clause 3 are those the taxpayers operate in and earn revenue from in 2019 or 2020.

View more details at Decree No. 41/2020/NĐ-CP of Vietnam’s Government, effective from April 08, 2020.

Le Hai

Article table of contents

Article table of contents

.Medium.png)

.Medium.png)

.Medium.png)

.Medium.png)