What types of taxes are small enterprises and microenterprises in Vietnam entitled to its deferral?

Small enterprises and microenterprises in Vietnam shall be entitled to deferral of the following taxes: added value tax (VAT), corporate income tax (CIT), personal income tax (PIT).

Specifically, according to Decree No. 41/2020/NĐ-CP of Vietnam’s Government, small enterprises and microenterprises determined in accordance with the Law No. 04/2017/QH14 on Assistance for Medium and Small Enterprises and the Government’s Decree No. 39/2018/ND-CP dated March 11, 2018 elaborating the Law on Assistance for Medium and Small Enterprises shall be entitled to deferral of added value tax (VAT), corporate income tax (CIT), personal income tax (PIT) as follows:

1. VAT (except VAT paid upon importation of goods)

VAT incurred by the enterprises and organizations mentioned in Article 2 of Decree No. 41/2020/NĐ-CP during March, April, May, June of 2020 (for taxpayers declaring tax monthly), first and second quarter of 2020 (for taxpayers declaring tax quarterly) may be deferred for 05 months from the deadlines for VAT payment prescribed by tax administration laws.

In case an enterprise or organization mentioned in Article 2 of this Decree has a branch or affiliated unit that declares VAT separately to its supervisory tax authority, the branch or unit is also eligible for VAT deferral. The branches and units of the enterprises and organizations mentioned in Clause 1, Clause 2 and Clause 3 Article 2 of this Decree shall not be eligible for VAT deferral if none of their economic sectors or business lines is eligible for deferral.

2. Corporate income tax (CIT)

CIT declared in the 2019’s annual statement and CIT declared in the first and second quarters of 2020 by organizations and enterprises specified in Article 2 of this Decree will be deferred for 05 months from the deadline for CIT payment prescribed by tax administration laws.

In case an enterprise or organization mentioned in Article 2 of this Decree has a branch or affiliated unit that declares CIT separately to its supervisory tax authority, the branch or unit is also eligible for CIT deferral. The branches and units of the enterprises and organizations mentioned in Clause 1, Clause 2 and Clause 3 Article 2 of this Decree shall not be eligible for CIT deferral if none of their economic sectors or business lines is eligible for deferral.

3. VAT and personal income tax (PIT) of household and individual businesses

The deadline for paying VAT and CIT incurred in 2020 of household and individual businesses operating in the economic sectors, business lines specified in Clause 1, Clause 2 and Clause 3 Article 2 of this Decree is deferred to December 31, 2020.

In addition to the above tax deferral, enterprises are also entitled to deferral of land rent: Deadline for annual payment of rents that are due in beginning of 2020 for direct lease of land by the State to the taxpayers mentioned in Article 2 of this Decree under decisions or contracts of competent authorities will be deferred for 05 months starting from May 31, 2020.

View more details at Decree No. 41/2020/NĐ-CP of Vietnam’s Government, effective from April 08, 2020.

Le Hai

- Number of deputy directors of departments in Vietnam in accordance with Decree 45/2025/ND-CP

- Cases ineligible for pardon in Vietnam in 2025

- Decree 50/2025 amending Decree 151/2017 on the management of public assets in Vietnam

- Circular 07/2025 amending Circular 02/2022 on the Law on Environmental Protection in Vietnam

- Adjustment to the organizational structure of the Ministry of Health of Vietnam: Certain agencies are no longer listed in the organizational structure

- Vietnam aims to welcome 22-23 million international tourists in Vietnam in 2025

-

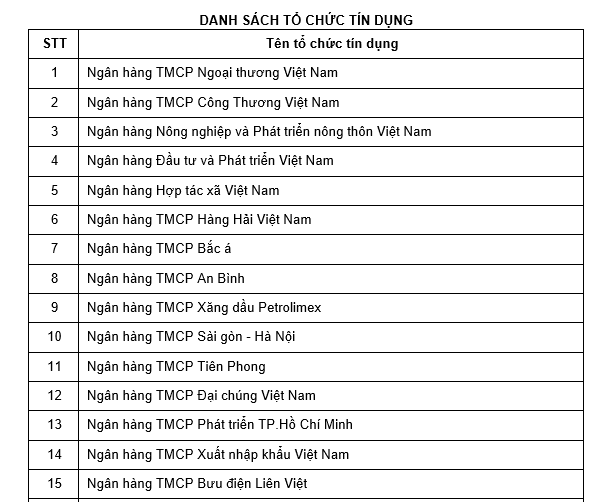

- Vietnam: Publishing the List of credit institutions ...

- 09:42, 04/05/2020

-

- Vietnam: VAT, CIT, PIT and land rent deferred ...

- 08:29, 25/04/2020

-

- Vietnam: Guidance on VAT tax deferral from April ...

- 17:15, 12/04/2020

-

- Guidance on tax and land rent deferral applied ...

- 11:30, 09/04/2020

-

.jpg)

- Official: 05 entities eligible for tax and land ...

- 09:44, 09/04/2020

-

- Notable new policies of Vietnam effective as of ...

- 16:26, 11/04/2025

-

.Medium.png)

- Notable documents of Vietnam in the previous week ...

- 16:21, 11/04/2025

-

.Medium.png)

- Notable documents of Vietnam in the previous week ...

- 16:11, 02/04/2025

-

.Medium.png)

- Notable new policies of Vietnam to be effective ...

- 16:04, 02/04/2025

-

.Medium.png)

- Notable new policies of Vietnam effective from ...

- 14:51, 21/03/2025

Article table of contents

Article table of contents