What is the level-2 licensing fee 2863? Where is the place to submit the licensing fee declaration in Vietnam?

What is the level-2 licensing fee 2863 in Vietnam?

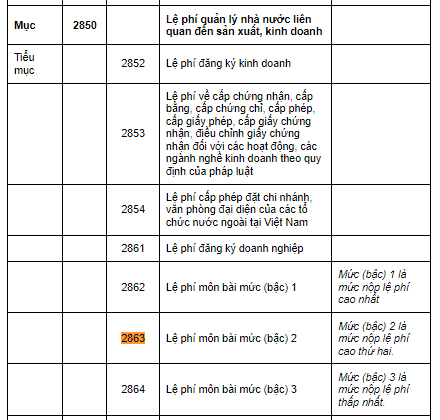

Based on Section 2850 Appendix III Classification, item code issued together with Circular 324/2016/TT-BTC as supplemented by point p, clause 4, Article 1 Circular 93/2019/TT-BTC stipulating article licensing fee 2025, including the level-2 licensing fee for 2025 as follows:

Thus, according to the above provisions, the level-2 licensing fee 2863 is the Item Code in the Classification, item code issued together with Circular 324/2016/TT-BTC.

What is the level-2 licensing fee 2863? Where is the place to submit the licensing fee declaration in Vietnam? (Image from the Internet)

What is the place to submit the licensing fee declaration in Vietnam?

According to point k, clause 1, Article 11 Decree 126/2020/ND-CP, the place for submitting the licensing fee declaration is specified as follows:

- Enterprises, business households submit their licensing fee declarations to the directly managing tax authority.

- Particularly, in the case of submitting a licensing fee declaration for a dependent unit, business place with a provincial-level area different from where the head office is located: the file is submitted to the tax authority where the dependent unit, business place is located.

Additionally, as per clause 5, Article 3 Circular 80/2021/TT-BTC, the regulation is as follows:

Explanation of terms

In addition to the terms already defined in the Tax Management Law and Decree 126/2020/ND-CP, some terms in this Circular are understood as follows:

…

5. “Directly managing tax authority” includes:

a) Tax authority managing the area of the taxpayer's main headquarters, except as provided in point c of this clause;

b) Tax authority managing the area where the taxpayer has a dependent unit in a different province from where the taxpayer is headquartered, but the dependent unit directly declares tax with the tax authority in the area;

c) The Large Enterprise Tax Department under the General Department of Taxation established under Decision No. 15/2021/QD-TTg dated March 30, 2021, by the Prime Minister;

d) For individuals with income from wages or salaries, the directly managing tax authority is the tax authority granting the tax code and may change according to the tax authority settling accounts for individuals as per regulation;

đ) For individuals receiving inheritances or gifts that are securities or capital contributions in economic organizations, businesses in Vietnam, subject to direct tax declaration with the tax authority, the directly managing tax authority is the tax authority managing the issuing unit; in case there are multiple tax authorities managing different issuing units, the directly managing tax authority is the tax authority where the individual receiving the inheritance, gift resides.

The directly managing tax authority may be indicated on taxpayer registration certificates or tax code notifications or notices of tax authority management or notices assigning tax authority management when granting enterprise codes, cooperative codes, tax codes, or when changing registration information or reallocating tax authority management as per legal provisions.

Thus, it can be seen that the place for submitting the licensing fee (licensing fee) declaration is the directly managing tax authority.

This means that when an enterprise registers to operate in a particular place, it will submit the licensing fee declaration to the directly managing tax authority in that place.

When is the deadline for submitting the licensing fee in Vietnam for 2025?

Based on the provisions of clause 9, Article 18 Decree 126/2020/ND-CP, it is regulated as follows:

The licensing fee is paid annually. To be specific:

- The deadline for submitting the licensing fee is no later than January 30 each year.

- For small and medium-sized enterprises transitioning from business households (including dependent units and business places of the enterprise) at the end of the licensing fee exemption period (the fourth year since the establishment of the enterprise), the deadline for submitting the licensing fee is as follows:

+ If the exemption period ends within the first 6 months of the year, the deadline is no later than July 30 of the year the exemption ends.

+ If the exemption period ends in the last 6 months of the year, the deadline is no later than January 30 of the year immediately following the end of the exemption.

- For business households, individual businesses that have ceased production and business activities then resume operations, the deadline for submitting the licensing fee is as follows:

+ If resuming activities within the first 6 months of the year: No later than July 30 of the year resuming activities.

+ If resuming activities in the last 6 months of the year: No later than January 30 of the year immediately following the year resuming activities.

Thus, the deadline for submitting the licensing fee for 2025 is no later than January 30, 2025.

- What are Answers to Round 3 of the Contest on Learn about the 95th Anniversary of the Founding of the Communist Party of Vietnam and the History of the CPV Committee of Quang Ninh Province?

- How to calculate benefits for those retiring early upon downsizing in Vietnam? Is the retirement allowance subject to PIT?

- What is the initial licensing fee declaration form in Vietnam in 2025? How to complete the 2025 licensing fee declaration?

- What is the schedule of fees for chemical affairs in Vietnam? What are regulations on the management and use of fees in chemical affairs in Vietnam?

- What are the slaughtering control fees in veterinary in Vietnam? Are livestock farms subject to environmental protection fees in Vietnam?

- What are instructions for completing the tax declaration for fixed tax payers changing tax calculation methods in Vietnam (Form 01/CNKD)?

- How to determine the 2025 Tet bonus fund for Vietnamese officials and public employees according to Decree 73? Are 2025 Tet bonuses for Vietnamese officials and public employees taxable?

- What is the 2025 Tet holiday schedule for Shopee couriers in Vietnam? Shall goods under 1 million VND sent via express delivery to Vietnam not be exempted from import duty?

- What is the fixed asset liquidation minutes form in Vietnam according to Circular 200/2014?

- How to calculate benefits for Vietnamese tax officials retiring early in 2025?