What is the initial licensing fee declaration form in Vietnam in 2025? How to complete the 2025 licensing fee declaration?

What is the initial licensing fee declaration form in Vietnam in 2025?

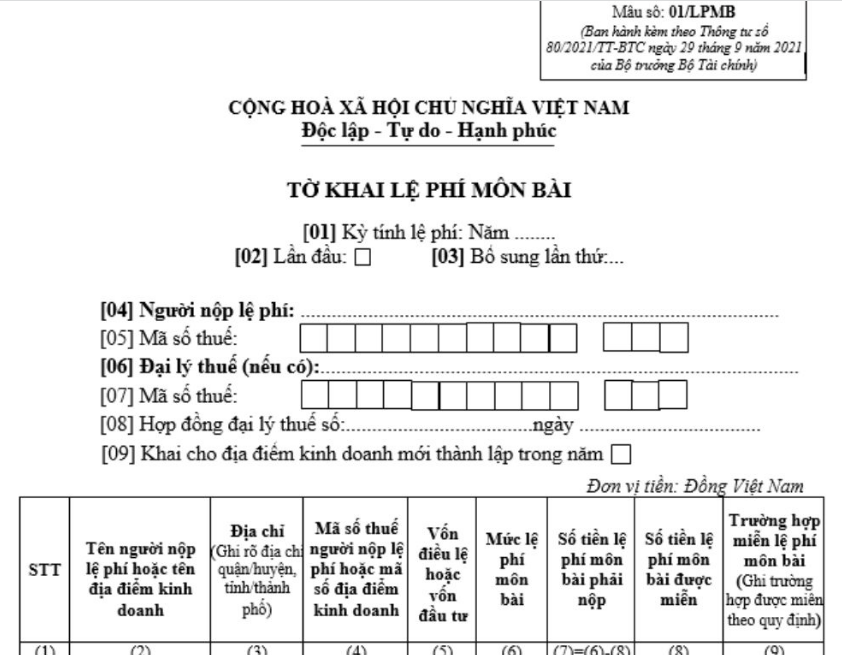

The initial licensing fee declaration form for 2025 is Form 01/LPMB as stipulated in Appendix 2 issued with Circular 80/2021/TT-BTC as follows

licensing fee declaration 2025 Downloadhttps://cdn.lawnet.vn/uploads/giao-duc/THH/to-khai-phi-mon-bai.doc

Guidance on Completing the 2025 licensing fee declaration form

- Indicator [01]: Declare the year for calculating business license fees.

- Indicator [02]: Select this for the initial declaration only.

- Indicator [03]: Select this if the taxpayer (hereafter referred to as taxpayer and abbreviated as NNT) has submitted the declaration but later found changes in the declared obligations and needs to re-declare for the fee calculation period already declared. Note, NNT should choose only one of the two indicators [02] and [03], not both simultaneously.

- Indicators [04] to [05]: Declare information according to the taxpayer registration of NNT.

- Indicators [06] to [08]: Declare information about the tax agent (if any).

- Indicator [09]: Select this if NNT has declared the initial licensing fee but subsequently establishes a new business location.

What is the initial licensing fee declaration form in Vietnam in 2025? How to complete the 2025 licensing fee declaration? (Image from the Internet)

What cases are exempted from licensing fee in Vietnam?

Based on Article 3 of Decree 139/2016/ND-CP (amended by point a, clause 1, Article 1 of Decree 22/2020/ND-CP, supplemented by point c, clause 1, Article 1 of Decree 22/2020/ND-CP), the cases exempted from licensing fee for 2025 are as follows:

- Individuals, groups of individuals, and households engaged in production and business with annual revenue of 100 million VND or less.

- Individuals, groups of individuals, and households engaged in non-regular production and business; no fixed location as guided by the Ministry of Finance.

- Individuals, groups of individuals, and households engaged in salt production.

- Organizations, individuals, groups of individuals, households engaged in aquaculture, fishing, and fishery logistic services.

- Cultural postal points; press agencies (print, audio, visual, electronic).

- Cooperatives, cooperative alliances (including branches, representative offices, business locations) operating in the field of agriculture in accordance with the law on agricultural cooperatives.

- People's credit funds; branches, representative offices, business locations of cooperatives, cooperative alliances, and private enterprises located in mountainous areas. Mountainous areas are defined according to the regulations of the Committee for Ethnic Minority Affairs.

- Exemption from business license fees in the first year of establishment or commencement of production, business activities (from January 1 to December 31) for:

+ Newly established organizations (granted a new tax code, new enterprise code).

+ Households, individuals, and groups of individuals engaged in production and business activities for the first time.

+ During the exemption period, if the organization, household, individual, or group of individuals establishes a branch, representative office, or business location, such branch, representative office, or business location is exempted from business license fees during the period the organization, household, individual, or group of individuals is exempted.

- Small and medium-sized enterprises transitioning from a household business (pursuant to Article 16 of the Law on Supporting Small and Medium Enterprises 2017) are exempt from business license fees for a period of 03 years from the date of receiving the initial business registration certificate.

+ During the exemption period, if a small and medium enterprise establishes a branch, representative office, or business location, they are exempted from business license fees during the exemption period provided to the small and medium enterprise.

+ Branches, representative offices, business locations of small and medium enterprises (eligible for exemption under Article 16 of the Law on Supporting Small and Medium Enterprises 2017) established before this Decree takes effect will have their exemption period calculated from the date this Decree takes effect until the end of the period the small and medium enterprise is exempted.

+ Small and medium enterprises transitioning from a household business before this Decree takes effect shall implement business license fee exemption according to the provisions of Articles 16 and 35 of the Law on Supporting Small and Medium Enterprises 2017.

- Public general education establishments and public preschool education establishments.

Where is the paid licensing fee listed in Vietnam?

Based on the provisions in Article 14 of the Law on Fees and Charges 2015, the responsibilities of the organization collecting fees and charges are as follows:

(1) Publicly list at the collection point and disclose on the organization's electronic information page the names of fees, charges, their rates, collection methods, payers, exemptions, reductions, and the legal documents governing the fees and charges.

(2) Prepare and issue receipts to the fee and charge payers as per legal provisions.

(3) Implement accounting policies, periodically report on revenue, payment, and use of fees and charges, and comply with financial disclosure policies according to legal regulations.

(4) Account for each type of fee and charge separately.

(5) Report on the collection, remittance, management, and use of fees and charges.

Thus, the paid licensing fee is listed at the collection point and publicly disclosed on the electronic information page of the organization collecting the fees and charges, detailing the names of fees, charges, their rates, collection methods, payers, exemptions, reductions, and the legal documents governing them.