What is the schedule of fees for chemical affairs in Vietnam? What are regulations on the management and use of fees in chemical affairs in Vietnam?

What is the schedule of fees for chemical affairs in Vietnam?

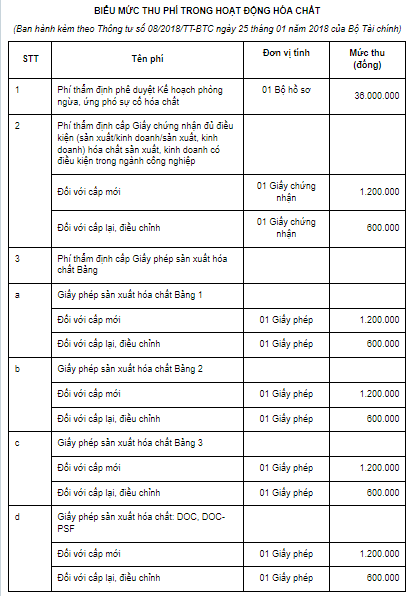

Pursuant to the Schedule of Fees for chemical affairs issued in conjunction with Circular 08/2018/TT-BTC as follows:

See detailed fee schedule for chemical affairs in accordance with Circular 08/2018/TT-BTC.

What is the schedule of fees for chemical affairs in Vietnam? What are regulations on the management and use of fees in chemical affairs in Vietnam? (Image from Internet)

Vietnam: To whom do the fee schedules for chemical affairs apply?

Based on Article 1 of Circular 08/2018/TT-BTC, the application is as follows:

Scope of Adjustment and Subjects of Application

1. Scope of Adjustment

This Circular stipulates the levels of fees, collection policies, payment, management, and use of fees in chemical affairs.

2. Subjects of Application

This Circular applies to:

a) Organizations and individuals requesting the issuance of Licenses, Certificates in chemical affairs; approving Plans for chemical incident prevention and response;

b) State agencies with authority to issue Licenses, Certificates in chemical affairs; approving Plans for chemical incident prevention and response;

c) Other organizations and individuals related to the collection and payment of fees in chemical affairs as stipulated in this Circular.

Thus, the fee schedule in chemical affairs issued in conjunction with Circular 08/2018/TT-BTC applies to the following three subjects:

[1] Organizations and individuals requesting the issuance of Licenses, Certificates in chemical affairs; approving Plans for chemical incident prevention and response;

[2] State agencies with authority to issue Licenses, Certificates in chemical affairs; approving Plans for chemical incident prevention and response;

[3] Other organizations and individuals related to the collection and payment of fees in chemical affairs as stipulated in this Circular.

What are regulations on the management and usage of fees in chemical affairs in Vietnam?

Based on Article 6 of Circular 08/2018/TT-BTC regarding management and usage of fees as follows:

- The fee-collecting organization must remit all the collected fee amounts into the state budget according to the current state budget catalog. The source for covering the cost of fee collection is allocated by the state budget in the organization's budget estimates according to the policies and expenditure norms of the state budget as prescribed by law.

- In cases where the fee-collecting organization is allowed operational expenditure according to the Government of Vietnam or the Prime Minister's regulation on autonomous mechanisms, self-responsibility in staffing and administrative expense management for state agencies, it is entitled to retain 90% (ninety percent) of the total collected fees to cover the cost of fee collection as specified in Clause 2, Article 5 Decree 120/2016/ND-CP dated August 23, 2016, of the Government of Vietnam detailing and guiding the implementation of some articles of the Law on Fees and Charges. The remaining 10% (ten percent) must be remitted to the state budget according to the current state budget catalog.

What are the principles for fee management and usage according to legal provisions?

Based on Article 4 of Decree 120/2016/ND-CP, amended by Clause 3, Article 1 of Decree 82/2023/ND-CP, the principles for fee management and usage are regulated as follows:

- Fees collected from service activities performed by state agencies must be remitted to the state budget. In cases where the state agency is allowed operational expenditure from the fee revenues, it is deductible at a specified rate as stipulated in Article 5 Decree 120/2016/ND-CP; the remaining part (if any) is remitted to the state budget.

State agencies allowed operational expenditure from fee revenues include:

+ State agencies implementing the financial mechanism as stipulated in Decree 130/2005/ND-CP dated October 17, 2005, by the Government of Vietnam which stipulates the policies of autonomy and responsibility in staffing and administrative expense management for state agencies, Decree 117/2013/ND-CP dated October 7, 2013, by the Government of Vietnam amending and supplementing several articles of Decree 130/2005/ND-CP dated October 17, 2005, by the Government of Vietnam and state agencies implementing the financial mechanism and specific income as defined by the Government of Vietnam or the Prime Minister.

+ Vietnamese representative agencies abroad.

+ Public security and national defense agencies assigned to provide services or perform jobs for state management, collecting fees according to the Law on Fees and Charges.

- Fees collected from service activities performed by public service providers are to be retained partially or fully to cover the costs of providing services and collecting fees according to a specified rate as stipulated in Article 5 Decree 120/2016/ND-CP; the remaining part (if any) is remitted to the state budget.

- Fees collected from service activities performed by organizations authorized by state agencies are to be retained partially or fully to cover the costs of providing services and collecting fees as identified by Article 5 Decree 120/2016/ND-CP; the remaining part (if any) is remitted to the state budget. The retained fee amount is revenue for the fee-collecting organization.