Vietnam: What is the deadline to change the VAT and PIT period from monthly to quarterly in 2025?

Vietnam: What is the deadline to change the VAT and PIT period from monthly to quarterly in 2025?

According to Clause 2, Article 9 of Decree 126/2020/ND-CP, it is stipulated as follows:

Criteria for quarterly tax declaration for value-added tax and personal income tax

...

2. Taxpayers are responsible for self-determining whether they meet the criteria for quarterly tax declaration to carry out tax declaration according to regulations.

a) Taxpayers eligible for quarterly tax declaration can choose to declare tax monthly or quarterly continuously for the whole calendar year.

b) In cases where taxpayers declaring monthly taxes meet the conditions for quarterly declaration and choose to switch to quarterly tax declaration, they must submit a request as prescribed in Appendix I issued with this Decree to change the tax period to the directly managing tax authority by January 31 of the first year they start to declare quarterly*. If after this deadline, the taxpayer does not submit the request to the tax authority, they must continue to declare tax monthly throughout the calendar year.*

c) In cases where taxpayers self-identify as ineligible for quarterly tax declaration, they must declare tax from the first month of the subsequent quarter monthly. Taxpayers are not required to resubmit monthly tax declarations for previous quarters but must submit a statement determining the additional monthly tax to be paid compared to the amount declared quarterly as prescribed in Appendix I issued with this Decree and must pay late penalties in accordance with regulations.

d) In cases where the tax authority discovers that a taxpayer is ineligible for quarterly tax declaration, the tax authority will determine the additional monthly tax to be paid compared to the amount declared by the taxpayer and must calculate late penalties according to regulations. The taxpayer must declare tax monthly from the point of receiving the notification from the tax authority.

For taxpayers who are declaring tax monthly and meet the conditions and opt to switch to quarterly tax declaration, they need to submit a request to the directly managing tax authority by January 31 of the starting tax year.

If after this deadline the taxpayer does not submit the document to the tax authority, they must continue monthly tax declaration for the entire calendar year.

Thus, in 2025, if the taxpayer is declaring tax monthly and wishes to switch to quarterly, the deadline to change the tax period is January 31, 2025.

Vietnam: What is the deadline to change the VAT and PIT period from monthly to quarterly in 2025? (Image from the Internet)

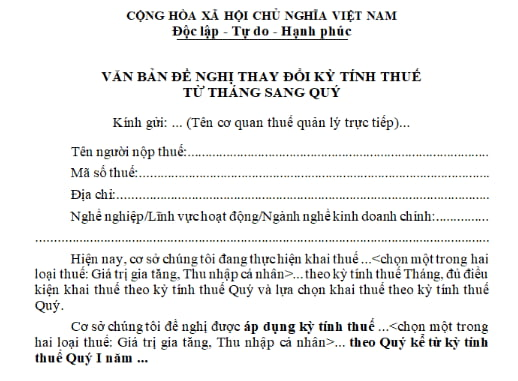

Which form is used for conversion from monthly declaration to quarterly declaration of taxes in Vietnam?

Currently, the application for conversion from monthly declaration to quarterly declaration of taxes is Form 01/DK-TDKTT issued with Appendix I of Circular 80/2021/TT-BTC.

Download Form 01/DK-TDKTT requesting a change in the tax period from monthly to quarterly: Here

What are the conditions and criteria for quarterly VAT and PIT declarations in Vietnam?

According to Clause 1, Article 9 of Decree 126/2020/ND-CP, the criteria for quarterly tax declaration regarding value-added tax and personal income tax are as follows:

(1) Quarterly Value-Added Tax Declaration

- Taxpayers within the scope for monthly VAT declaration, who have a total revenue from the sale of goods and provision of services of the previous calendar year not exceeding 50 billion VND, may declare VAT quarterly. The revenue from sales and services is determined as the total revenue on VAT declarations of tax periods within the calendar year.

In cases where taxpayers declare tax centrally at the head office for a dependent unit, business location, the sales and service revenue includes revenue from the dependent unit, business location.

- New taxpayers from the beginning of operations have the option of declaring VAT quarterly. After 12 months of business operations, from the calendar year immediately following the year completing 12 months, they will base it on the revenue of the preceding calendar year to conduct VAT declarations by either monthly or quarterly tax periods.

(2) Quarterly Personal Income Tax Declaration:

- Taxpayers required to declare PIT monthly who meet the conditions for quarterly VAT declaration may choose to declare PIT quarterly.

- Quarterly tax declaration is determined once from the first quarter in which the tax declaration obligation arises and is applied consistently throughout the calendar year.

- What are Answers to Round 3 of the Contest on Learn about the 95th Anniversary of the Founding of the Communist Party of Vietnam and the History of the CPV Committee of Quang Ninh Province?

- How to calculate benefits for those retiring early upon downsizing in Vietnam? Is the retirement allowance subject to PIT?

- What is the initial licensing fee declaration form in Vietnam in 2025? How to complete the 2025 licensing fee declaration?

- What is the schedule of fees for chemical affairs in Vietnam? What are regulations on the management and use of fees in chemical affairs in Vietnam?

- What are the slaughtering control fees in veterinary in Vietnam? Are livestock farms subject to environmental protection fees in Vietnam?

- What are instructions for completing the tax declaration for fixed tax payers changing tax calculation methods in Vietnam (Form 01/CNKD)?

- How to determine the 2025 Tet bonus fund for Vietnamese officials and public employees according to Decree 73? Are 2025 Tet bonuses for Vietnamese officials and public employees taxable?

- What is the 2025 Tet holiday schedule for Shopee couriers in Vietnam? Shall goods under 1 million VND sent via express delivery to Vietnam not be exempted from import duty?

- What is the fixed asset liquidation minutes form in Vietnam according to Circular 200/2014?

- How to calculate benefits for Vietnamese tax officials retiring early in 2025?