tax authorities

-

- Propagating and disseminating to employees information about registering and using e-transaction accounts with tax authorities in Vietnam

- 08:08, 31/10/2024

- October 18, 2024, the Large Taxpayer Department (General Department of Taxation) issued Official Dispatch 1345-CT-QLT2-2024 regarding coordination in communication and dissemination in personal income tax refund activities in Vietnam. In this document, the tax authority advises not to provide taxpayer information to unidentified parties.

-

- Guidance on receiving application for tax-related administrative procedure submitted via Postal Services under the Single-window system at Tax Authorities in Vietnam

- 13:00, 05/10/2024

- Below is the guidance on receiving application for tax-related administrative procedure submitted via Postal Services under the Single-window system at Tax Authorities in Vietnam

-

- Deadline for receiving and processing tax applications under the single-window system at tax authorities in Vietnam

- 16:52, 03/10/2024

- On September 16, 2024, the General Department of Taxation issued Decision 1335/QD-TCT regarding the procedures for receiving, processing, and returning Results of tax applications under the single-window and interlinked single-window systems at tax authorities in Vietnam.

-

- Regulations on procedures for registering transactions with tax authorities by electronic means in Vietnam

- 08:30, 30/09/2024

- The Ministry of Finance has announced the detailed content of the procedures for registering transactions with tax authorities by electronic means in Vietnam.

-

- Vietnam: 07 cases of suspension of use of e-invoices

- 20:49, 10/07/2024

- Draft Decree regulating invoices and records has been released for public consultation. It includes provisions on cases of suspension of use of e-invoices in Vietnam.

-

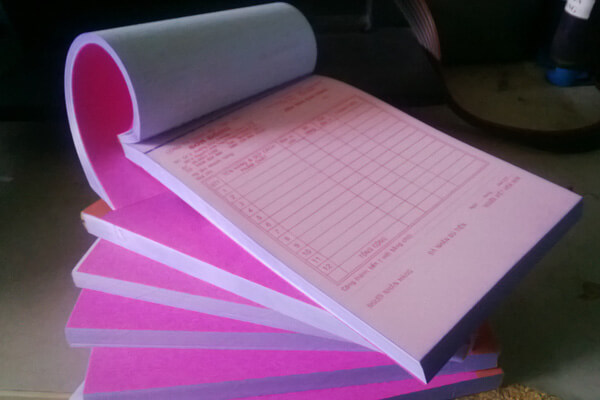

- Vietnam: What is the deadline for sending reports on use of invoices purchased from tax authorities?

- 20:48, 10/07/2024

- Recently, the Government of Vietnam has announced the draft Decree on invoices and records, including the deadline for sending reports on the use of invoices purchased from tax authorities.

-

- Domestic revenue reporting system applies to tax authorities at all levels in Vietnam

- 10:06, 21/03/2024

- What are the regulations on domestic revenue reporting system applies to tax authorities at all levels in Vietnam? – Thu Cuc (Khanh Hoa)

-

- In what cases are tax authorities in Vietnam allowed to publish taxpayer information?

- 15:35, 09/10/2023

- In what cases are tax authorities in Vietnam allowed to publish taxpayer information? - Minh Quan (Khanh Hoa)

-

- What are the tax authorities in Vietnam?

- 08:35, 12/08/2023

- What are the tax authorities in Vietnam? - Hoang Minh (Dong Thap)

Most view

Composition and uses of cadastral records in Vietnam under the new Land Law

Composition and uses of cadastral records in Vietnam under the new Land LawBelow are the regulations regarding the composition and uses of cadastral records in Vietnam under the new Land Law

- Requirements on the implementation of surrogate care in Vietnam

- Plan for Conducting Tourism Resource Investigation in Vietnam

- Validity period of temporary vehicle registration certificates for motor vehicles and specialized motor vehicles in Vietnam from January 1, 2025

- Amendments to regulations on revocation and renewal of Insurance Agent Certificates in Vietnam from January 15, 2025

SEARCH ARTICLE