Funding Source for Adjusting New Statutory Pay Rate in Vietnam

21:22, 11/07/2024

According to the guidelines in Circular 68/2018/TT-BTC, the funding source for adjusting the statutory pay rate in Vietnam as stipulated in Decree 72/2018/ND-CP and the monthly allowances for retired commune officials in Vietnam as stipulated in Decree 88/2018/ND-CP are determined as follows:

| For State administrative agencies, Vietnam Communist Party, and Organizations | - The funding for wage reform up to the end of 2017 that has not been used will be carried forward to 2018 (if any); - At least 40% of retained revenues according to 2018 policies (after being used to adjust the statutory pay rate from 1.21 million VND to 1.3 million VND/month); - Cost savings associated with implementing reform solutions and reorganizing the political system as regulated (from operating expenditure norms, salary expenses for streamlined personnel, administrative reorganization, and any other solutions if available). In case the funding sources are smaller than the needs for adjusting the statutory pay rate as regulated, the agency or unit must self-arrange within the assigned 2018 State Budget expenditure estimate to ensure sufficient funding. If the agency or unit ensures sufficient funds for adjusting the statutory pay rate as regulated in Article 2 of this Circular and has significant remaining wage reform funds and requires operational development, they should propose utilization plans and report to their central management agency for aggregation, then send to the Ministry of Finance for agreement before usage; at the same time, they must commit to self-ensuring their funds for additional salary adjustments according to the roadmap decided by the authorized agency. |

| Public Service Providers | - The funding for wage reform up to the end of 2017 that has not been used will be carried forward to 2018 (if any); - At least 40% of retained revenues according to 2018 policies (after being used to implement a statutory pay rate of 1.3 million VND/month). For revenue from disease examination, treatment services, preventive healthcare, and other health services provided by public health facilities, at least 35% must be used. - Cost savings associated with implementing reform solutions, reorganizing management systems, and improving the quality and efficiency of public service providers as regulated (from operational expenditure norms, salary expenses for streamlined personnel, from the State Budget allocated for increasing the number of financially autonomous public service providers, reorganizing public service providers, and any other solutions if available). In case the funding sources are smaller than the needs for adjusting the statutory pay rate, the unit must self-arrange from its revenue sources as regulated and from the assigned 2018 State Budget expenditure estimate (if available) to ensure sufficient funding. If there are significant remaining wage reform funds after ensuring sufficient funds for the statutory pay rate adjustment and there is a commitment to self-ensuring the unit's funds for additional salary adjustments as per the authorized agency's roadmap decision, the remaining funds can be used for investment, procurement, professional activities, and implementing current autonomy mechanisms; at the end of the budget year, report to the competent authority for aggregation and report to the Ministry of Finance on the results of utilizing these funds. |

| Provinces and Centrally Affiliated Cities | - Saving 10% of regular expenditure (excluding salary, allowance, salary-related expenses, and human-related expenses according to policies) from the increased 2018 budget estimate compared to the 2017 budget estimate as per the budget allocation decision by the Ministry of Finance. - Using 50% of the local budget revenue increase (excluding land levy and state lottery revenues) achieved compared to the 2017 budget estimate assigned by the Prime Minister. - Using unspent wage reform funds from 2017 carried forward to the following year (if any). - Using any remaining funds (if any) after ensuring the wage adjustment needs to the statutory pay rate of 1.3 million VND/month, derived from sources such as: + Saving 10% of regular expenditure (excluding salary, allowance, salary-related expenses, and human-related expenses according to policies) from the increased 2017 budget estimate as per the budget allocation decision by the Ministry of Finance; + Cost savings associated with implementing reform solutions and reorganizing the political system; renewal of management systems, improving the quality and efficiency of public service providers as regulated (from operational expenditure norms, salary expenses for streamlined personnel, from the State Budget allocated due to consolidating administrative units at district, commune, village, or street level; from the State Budget allocated for increasing the number of financially autonomous public service providers, reorganizing public service providers, and any other solutions if available according to regulations). + Using at least 40% of retained revenues according to 2018 policies; for revenue from disease examination, treatment services, preventive healthcare, and other health services provided by public health facilities, at least 35% must be used. + 50% of the local budget revenue increase (excluding land levy and state lottery revenues) achieved in the 2018 budget estimate compared to the 2017 budget estimate assigned by the Prime Minister. |

Circular 68/2018/TT-BTC, replacing Circular 67/2017/TT-BTC, took effect from November 19, 2018.

Related Content

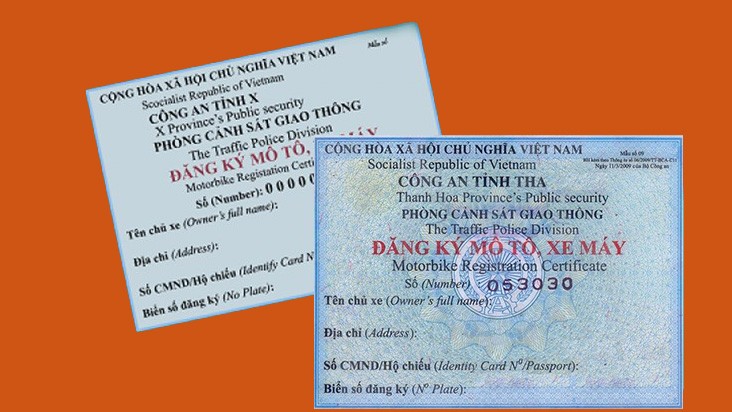

- Cases of revocation of certificate of vehicle and license plate registration for motorized vehicles and heavy-duty vehicles in road traffic in Vietnam from January 1, 2025

- 08 Rights of Social insurance beneficiaries in Vietnam from July 1, 2025

- Ministry of Health's response to the petition regarding overload condition at central-level hospitals in Vietnam

- Regulations on Study Time for Primary School Students in Ho Chi Minh City for the 2024-2025 School Year

- State Policy on Road Traffic Order and Safety from 2025

- Regulations on the System of National Defense Industrial Bases

SEARCH ARTICLE

Related Article

-

- Newest regulation on procedures for the issuance ...

- 15:00, 01/09/2024

-

- Cases of revocation of certificate of vehicle ...

- 14:00, 01/09/2024

-

- Cases of registration of security interests in ...

- 13:00, 01/09/2024

-

- 08 Rights of Social insurance beneficiaries in ...

- 12:00, 01/09/2024

-

- Procedures for provision of land-related information ...

- 11:01, 01/09/2024

JUST UPDATED

-

- Newest regulation on procedures for the issuance ...

- 15:00, 01/09/2024

-

- Cases of revocation of certificate of vehicle ...

- 14:00, 01/09/2024

-

- Cases of registration of security interests in ...

- 13:00, 01/09/2024

-

- 08 Rights of Social insurance beneficiaries in ...

- 12:00, 01/09/2024

-

- Procedures for provision of land-related information ...

- 11:01, 01/09/2024

New text summary report

-

Real estate

-

Policy analysis

-

Legal Counselling

-

Case law

-

Forms and Templates

-

New text catalog

-

New Text Notification

-

Highlights of the week

-

Finance

-

New policy in effect

-

Labor - Salary

-

Officials and civil servants

-

Land - Housing

-

Tax-free-fee

-

Custom

-

Enterprise - Investment

-

Administration

-

Insurance

-

Civil

-

Set of Laws

-

News about Case Law

-

Economy

-

Life

-

Health

-

Cultural

-

Commerce

-

Military

-

History

-

Strange story

-

Criminal

-

Traffic

-

Education

-

Other

Article table of contents

Article table of contents