customs

-

- Customs formalities for repurposing goods in Vietnam

- 18:00, 23/08/2024

- The following article will provide information on customs formalities for repurposing goods in Vietnam.

-

- Compilation of Official Dispatches resolving issues in Circular 39 on customs procedures in Vietnam

- 19:11, 11/07/2024

- Lawnet would like to share with everyone the all of the Official Dispatches addressing issues regarding customs procedures in Vietnam in Circular 39/2018/TT-BTC and Decree 59/2018/ND-CP.

-

- TPP - Chapter 05 - Customs Administration and Trade Facilitation

- 12:10, 11/07/2024

- Chapter 05-TPP Agreement on Customs Administration and Trade Facilitation within the TPP Agreement

-

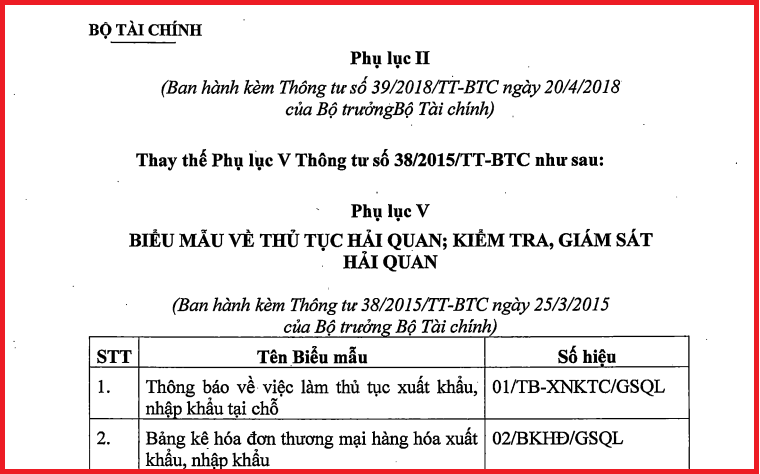

- Customs Procedure Forms; Customs Inspection and Supervision according to the Circular 39/2018/TT-BTC in Vietnam

- 10:06, 11/07/2024

- The entire set of customs procedure forms; customs inspection and supervision in Vietnam promulgated in Appendix II of Circular 39/2018/TT-BTC replacing Appendix V of Circular 38/2015/TT-BTC are stipulated as follows.

-

- Regulations Amending and Supplementing the Forms of Sanctions for Customs Violations in Vietnam

- 12:43, 10/07/2024

- Draft Decree stipulating sanctions for administrative violations in the field of customs in Vietnam is being put forward for public comment. Notably, this Draft includes revised and supplemented provisions on sanctions and remedial measures for customs violations.

-

- Compilation of Effective Legal Documents in the Field of Customs in Vietnam

- 21:08, 09/07/2024

- In order to assist our clients and members who are working in or interested in the customs sector to grasp the current effective legal documents in the customs field in Vietnam, LAWNET is pleased to send to our clients and members the following summarized table.

-

- Information Not to Be Supplemented on the Customs Declaration Form in Vietnam

- 20:14, 09/07/2024

- In order to assist our Customers and Members in understanding the current regulations on customs declaration in Vietnam, Lawnet would like to send to our Customers and Members a summary of the information criteria on the customs declaration form to be supplemented in the table below.

-

- Guidance on applying administrative sanction forms in customs in Vietnam from December 26, 2022

- 15:31, 09/07/2024

- What are details about administrative sanction forms in customs in Vietnam? - Xuan Tai (Quang Ninh)

-

- Latest customs formalities in Vietnam

- 17:07, 06/06/2024

- Regulations on customs brokers and regulations on customs brokers in Vietnam are specified in Law on Customs 2014.

Most view

.Medium.png) Notable new policies of Vietnam to be effective as of the start of April 2025

Notable new policies of Vietnam to be effective as of the start of April 2025 Cases of promulgating legislative documents under simplified procedures; requirements for digital signing software and digital signature verification software; etc., are notable policies that will be covered in this bulletin.

- Notable documents of Vietnam in the previous week (from March 24 to March 30, 2025)

- Notable documents of Vietnam in the previous week (from March 31 to April 6, 2025)

- Notable new policies of Vietnam effective as of the middle of April 2025

SEARCH ARTICLE