Warning on regulations for updating citizen ID card's information in Vietnam

Recently, the General Department of Taxation has received reports that a center/group claiming to support the General Department of Taxation has been sending notifications stating:"By no later than March 31, 2023, enterprises must complete the procedure of updating the chip-based citizen ID Card for the legal representative on the Business Registration and there is a fee ranging from a few hundred to several million VND";

In recent times, the General Department of Taxation of Vietnam has received reports of a center/group allegedly affiliated with the General Department of Taxation of Vietnam sending notifications stating: “By March 31, 2023, enterprises must complete the procedures for updating the chip-based citizen ID card for the legal representative on the Business Registration” and charging fees ranging from hundreds to millions of VND.

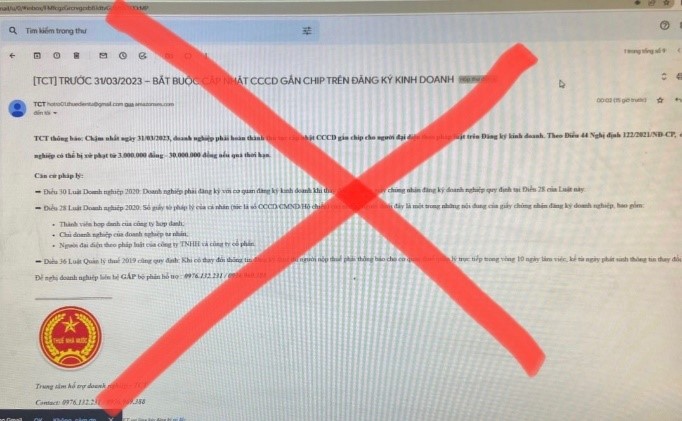

Content of the fraudulent email sent to taxpayers

The General Department of Taxation of Vietnam confirms that there is no policy, nor have they sent any emails or notifications to taxpayers regarding the aforementioned matter. The notification “By March 31, 2023, enterprises must complete the procedures for updating the chip-based citizen ID card for the legal representative on the Business Registration” is a fraudulent and counterfeit notification purportedly from the General Department of Taxation of Vietnam; this is an illegal act that exploits the name of the tax authority for personal gain, deceives businesses, and damages the reputation and image of the Tax sector.

The mandatory regulation for changing information on the Enterprise Registration Certificate is stipulated in the Law on Enterprises No. 68/2014/QH13, which took effect on July 1, 2015. When there is a change in the legal document number of the individual representative, the enterprise must register with the Business Registration Authority within 10 days from the date of change.

Taxpayers are advised to remain vigilant and promptly provide information and report fraudulent activities to the Police or the managing Tax Authority in their locality.

Additionally, taxpayers can access officially published information and support on the Tax Sector Information Portal https://gdt.gov.vn.

The General Department of Taxation of Vietnam notifies this to taxpayers for awareness, prevention, and cooperation in handling.

We sincerely thank taxpayers for their cooperation.

According to The General Department of Taxation of Vietnam Information Portal

- Key word:

- citizen ID card

- Number of deputy directors of departments in Vietnam in accordance with Decree 45/2025/ND-CP

- Cases ineligible for pardon in Vietnam in 2025

- Decree 50/2025 amending Decree 151/2017 on the management of public assets in Vietnam

- Circular 07/2025 amending Circular 02/2022 on the Law on Environmental Protection in Vietnam

- Adjustment to the organizational structure of the Ministry of Health of Vietnam: Certain agencies are no longer listed in the organizational structure

- Vietnam aims to welcome 22-23 million international tourists in Vietnam in 2025

-

- Guidelines of the police force on management of ...

- 21:37, 10/07/2024

-

- Hanoi-Vietnam: Forms used in the issuance, management ...

- 20:20, 10/07/2024

-

- Vietnam: What is a Personal Identification Number ...

- 13:43, 10/07/2024

-

- Is it compulsory for all citizens in Vietnam to ...

- 16:30, 09/07/2024

-

- Latest information people need to know about chip ...

- 16:30, 09/07/2024

-

- Notable new policies of Vietnam effective as of ...

- 16:26, 11/04/2025

-

.Medium.png)

- Notable documents of Vietnam in the previous week ...

- 16:21, 11/04/2025

-

.Medium.png)

- Notable documents of Vietnam in the previous week ...

- 16:11, 02/04/2025

-

.Medium.png)

- Notable new policies of Vietnam to be effective ...

- 16:04, 02/04/2025

-

.Medium.png)

- Notable new policies of Vietnam effective from ...

- 14:51, 21/03/2025

Article table of contents

Article table of contents