Can the Chairman of the People's Committee of Vietnam issue a decision to apply coercive measures for deduction of money from accounts?

Can the Chairman of the People's Committee of Vietnam issue a decision to apply coercive measures for deduction of money from accounts?

According to Article 87 of the Law on Handling Administrative Violations 2012 (amended by Clause 44, Article 1 of the Amended Law on Handling Administrative Violations 2020), the authority to issue enforcement decisions is stipulated as follows:

Article 87. Authority to issue enforcement decisions

- The following individuals have the authority to issue enforcement decisions:

a) Chairmen of People's Committees of all levels;

b) Heads of Police Stations, Heads of District-level Police, Directors of Provincial-level Police, Directors of the Department of Economic Security, Directors of the Department of Administrative Management of Social Order Police, Directors of the Department of Criminal Investigation of Social Order, Directors of the Department of Criminal Investigation on Corruption, Economy, Smuggling, Directors of the Department of Criminal Investigation of Drug-related Crimes, Directors of the Department of Traffic Police, Directors of the Department of Fire Prevention, Fighting and Rescue Police, Directors of the Department of Environmental Crime Prevention, Directors of the Department of Cyber Security and High-tech Crime Prevention, Directors of the Department of Homeland Security, Directors of the Department of Detention Management and Punishment Execution in the Community, Commanders of Mobile Police;

[...]

According to Article 13 of Decree 166/2013/ND-CP, the subjects to which enforcement by account deduction applies are regulated as follows:

Article 13. Subjects subject to enforcement by account deduction

Subjects subject to enforcement by account deduction are organizations and individuals that do not voluntarily comply with penalty decisions, remedial decisions, do not pay or pay insufficient enforcement costs and have deposits at credit institutions in Vietnam.

According to Article 14 of Decree 166/2013/ND-CP, it is regulated to verify information about the account of individuals and organizations subject to enforcement:

Article 14. Verification of information about the account of individuals and organizations subject to enforcement

- The person with the authority to issue a decision on enforcement by account deduction has the right to request credit institutions to provide information about the accounts of individuals and organizations subject to enforcement in accordance with the law; in case the person with the authority to issue enforcement decisions does not have the authority to request account information, they shall propose that the competent person requests the credit institution to provide information. The person provided with information is responsible for keeping the provided information confidential.

- Individuals and organizations subject to enforcement have the responsibility to notify the person with the authority to issue a decision on enforcement by account deduction about the name of the credit institution, the place where the account is opened, and their account number at the credit institution when requested.

According to the above regulations, the Chairman of the People's Committee is fully authorized to issue a decision to enforce the deduction of money from accounts when organizations or individuals do not voluntarily comply with penalty decisions, remedial decisions, do not pay or pay insufficient enforcement costs.

The person with the authority to issue a decision on enforcement by account deduction has the right to request credit institutions to provide information about the accounts of individuals and organizations subject to enforcement according to the law; if the person with the authority to issue a decision on enforcement does not have the authority to request account information, they shall propose that the competent person request the credit institution to provide information. The person provided with the information has the responsibility to keep the provided information confidential.

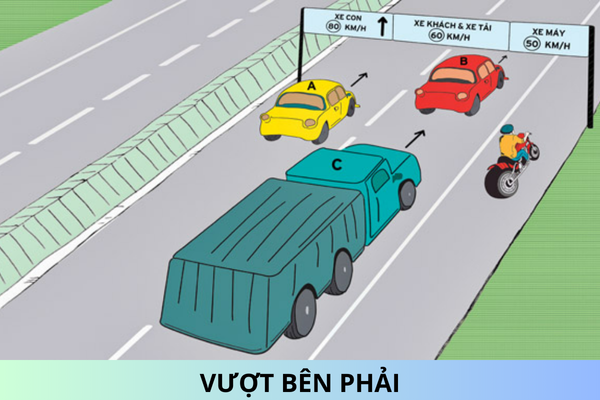

Can the Chairman of the People's Committee of Vietnam issue a decision to apply coercive measures for deduction of money from accounts? (Image from the Internet)

What are the contents of a decision on enforcing deduction of money from an account in Vietnam?

According to Article 15 of Decree 166/2013/ND-CP, the decision to enforce a deduction from an account includes:

Article 15. Decision to enforce account deduction

1. A decision to enforce account deduction includes the following contents: Decision number; date, month, year of decision; basis for decision; full name, title, working unit of the person issuing the decision; amount of money to be deducted, reason for deduction; full name, account number of the individual or organization subject to deduction; name, address of the credit institution where the subject of deduction opens the account; name, address, account number of the State Treasury, method of transferring the deducted amount from the credit institution to the State Treasury; signature of the person issuing the decision and the seal of the issuing agency.

- Upon receiving the decision to enforce account deduction, individuals and organizations subject to enforcement are responsible for requesting the credit institution where they open their accounts to transfer money from their accounts to the State Treasury account specified in the enforcement decision.

Thus, a decision to enforce account deduction includes the following contents:

- Decision number

- Date, month, year of decision

- Basis for decision

- Full name, title, working unit of the person issuing the decision

- Amount of money to be deducted, reason for deduction

- Full name, account number of the individual or organization subject to deduction

- Name, address of the credit institution where the subject of deduction opens its account

- Name, address, account number of the State Treasury, method of transferring the deducted amount from the credit institution to the State Treasury

- Signature of the person issuing the decision and the seal of the issuing agency

What measures are available to enforce compliance with administrative penalty decisions in Vietnam?

According to Article 86 of the Law on Handling Administrative Violations 2012 (amended by Clause 43, Article 1 of the Amended Law on Handling Administrative Violations 2020), the enforcement of administrative penalty decisions is provided as follows:

Article 86. Enforcement of administrative penalty decisions

- Enforcement of administrative penalty decisions is applied in the following cases:

a) Individuals or organizations sanctioned for administrative violations do not voluntarily comply with the penalty decisions as provided in Article 73 of this Law;

b) Individuals or organizations committing administrative violations do not voluntarily reimburse costs to the agency implementing remedial measures as provided in Clause 5, Article 85 of this Law.

- The enforcement measures include:

a) Deduction of a part of the salary or income, deduction of money from the accounts of violating individuals or organizations;

b) Confiscation of assets equivalent to the penalty amount for auction;

c) Collection of money or other assets from individuals and organizations subject to enforcement of administrative penalty decisions, which are held by other individuals or organizations when such individuals and organizations have intentionally dispersed assets after committing violations.

d) Compulsion to implement remedial measures as provided in Clause 1, Article 28 of this Law.

- The Government of Vietnam shall specify the enforcement of administrative penalty decisions.

Thus, the measures available to enforce compliance with administrative penalty decisions include:

- Deduction of a part of salary or income, deduction of money from the accounts of violating individuals or organizations

- Confiscation of assets equivalent to the penalty amount for auction

- Collection of money or other assets from subjects of enforcement of administrative penalty decisions that are held by other individuals or organizations in cases where individuals or organizations intentionally disperse assets after committing violations

- Compulsion to implement the following remedial measures:

+ Compulsion to restore the original state

+ Compulsion to dismantle works, parts of construction works without a permit or constructed not in accordance with the permit

+ Compulsion to implement measures to remedy environmental pollution, epidemic spread

+ Compulsion to have goods, items, or means removed from the territory of the Socialist Republic of Vietnam or re-exported

+ Compulsion to destroy goods, items harmful to human health, animals, plants, and the environment, cultural products with harmful content

+ Compulsion to correct false or misleading information

+ Compulsion to remove violations on goods, packaging, business means, items

+ Compulsion to recall products, goods of poor quality

+ Compulsion to remit illegal profits gained from administrative violations or remit an amount equivalent to the value of the illegally disposed, dispersed, or destroyed items, means contrary to legal regulations

+ Other remedial measures as prescribed by the Government of Vietnam