What is the latest form used yo make authorization letter for personal income tax finalization in Vietnam in 2024?

What is the latest form used yo make authorization letter for personal income tax finalization in Vietnam in 2024?

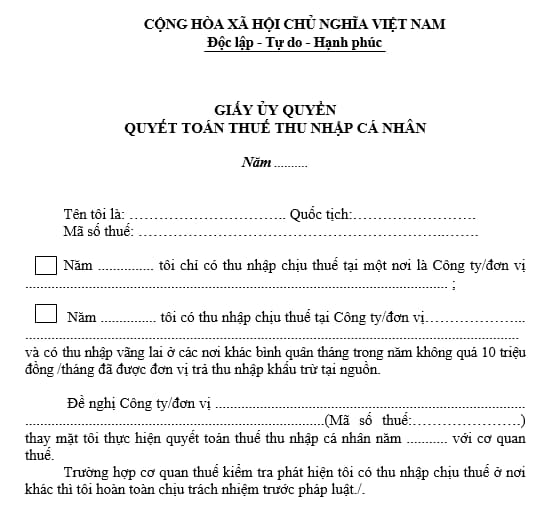

Pursuant to Template 08/UQ-QTT-TNCN Appendix 2 issued together with Circular 80/2021/TT-BTC stipulating the form used yo make authorization letter for personal income tax finalization in Vietnam as follows:

Download the form used yo make authorization letter for personal income tax finalization in Vietnam for 2024

What is the latest form used yo make authorization letter for personal income tax finalization in Vietnam in 2024? (Internet image)

Who are eligible to authorize personal income tax finalization in Vietnam for 2024?

Pursuant to point d clause 6 Article 8 of Decree 126/2020/ND-CP stipulating authorization for personal income tax finalization in Vietnam as follows:

[1] For organizations and individuals paying income

- Organizations and individuals paying income from salaries and wages are responsible for tax finalization declaration and finalization on behalf of individuals who have authorized them by the organizations and individuals paying income, regardless of whether tax withholding is incurred or not.

+ In cases where organizations and individuals do not incur income payments, they are not required to declare personal income tax finalization.

+ In cases where an individual is an employee transferred from an old organization to a new organization due to merger, consolidation, division, separation, conversion of business type, or

When the old organization and the new organization are within the same system, the new organization is responsible for tax finalization as authorized by the individual for both income paid by the old organization and for reclaiming the personal income tax withholding documents issued by the old organization to the employee (if any).

[2] For residents with income from salaries and wages

- Residents with income from salaries and wages can authorize tax finalization to the organizations or individuals paying their income. Specifically:

+ Individuals with income from salaries and wages with labor contracts of 03 months or more at one place and who are actually working there at the time organizations or individuals paying income conduct tax finalization, including cases of not working for the full 12 months of the year.

+ In cases where an individual is transferred from an old organization to a new organization, the individual can authorize tax finalization to the new organization.

+ Individuals with income from salaries and wages with labor contracts of 03 months or more at one place and who are actually working there at the time organizations or individuals paying income conduct tax finalization, including cases of not working for the full 12 months of the year;

Meanwhile, having sporadic income at other places averaging no more than 10 million VND per month in the year and has had personal income tax withheld at a rate of 10% if there is no demand for tax finalization for this income portion.

What do taxable incomes from salaries or wages in Vietnam?

Pursuant to clause 1 Article 11 of the Personal Income Tax Law 2007 stipulating Taxable incomes from salaries or wages in Vietnam:

Article 11. Taxable incomes from salaries or wages

- Taxable income from salaries and wages is determined by the total income specified in clause 2 Article 3 of this Law received by the taxpayer during the tax calculation period.

- The time of determining Taxable incomes from salaries or wages is the time the organization or individual pays income to the taxpayer or the time the taxpayer receives the income.

Taxable income from salaries and wages includes income items specified in clause 2 Article 3 of the Personal Income Tax Law 2007 amended by clause 1 Article 1 of the Law amending Personal Income Tax Law 2012 as follows:

- Salaries, wages, and other income items of a similar nature.

- Allowances and subsidies, excluding:

+ Allowances and subsidies prescribed by law for people with meritorious service.

+ National defense and security allowances.

+ Hazardous and dangerous allowances for industries, professions, or jobs at workplaces with hazardous or dangerous factors.

+ Attraction allowances, regional allowances as prescribed by law.

+ Unexpected hardship subsidies, occupational disease and accident compensations, one-off childbirth or adoption allowances, allowances due to decreased working capacity, one-time pension allowances, monthly death benefits, and other allowances as prescribed by social insurance law.

+ Severance pay, dismissal allowances as prescribed by the Labor Code 2019.

+ Social protection allowances and other allowances and subsidies not of a salary or wage nature as prescribed by the Government of Vietnam.