What are regulations on the personal income tax period applicable to incomes from salaries and wages in Vietnam?

What are regulations on the personal income tax period applicable to incomes from salaries and wages in Vietnam?

Based on Article 7 of the Personal Income Tax Law 2007 as amended by Clause 3, Article 1 of the Law amending Personal Income Tax Law 2012, the tax period is stipulated as follows:

Article 7. Tax Period

1. The tax period for resident individuals is specified as follows:

a) The annual tax period applies to income from business activities; income from wages and salaries;

b) The tax period by each time income arises applies to income from capital investment; income from capital transfers, except income from security transfers; income from real estate transfers; income from winnings; income from royalties; income from franchising; income from inheritance; income from gifts;

c) The tax period can be by each transfer time or annually for income from securities transfers

2. For non-resident individuals, the tax period is calculated based on the time income arises for all taxable income.

According to the above regulation, the tax period for individual residents in terms of income from wages and salaries is calculated annually.

For non-resident individuals, the tax period for personal income tax on income from wages and salaries is determined based on each instance the income arises.

What are regulations on the personal income tax period applicable to incomes from salaries and wages in Vietnam? (Internet image)

What are incomes from salaries and wages that are subject to personal income tax in Vietnam in 2024?

Based on Article 3 of the Personal Income Tax Law 2007 as amended by Clauses 1, 2, Article 2 of the 2014 Law Amending Various Tax Laws and Clause 1, Article 1 of the Law amending Personal Income Tax Law 2012 stipulating taxable incomes in Vietnam:

Article 3. Taxable Income

Taxable personal income includes the following types of income, except for income exempted under Article 4 of this Law:

1. Income from business, including:

a) Income from the production and business activities of goods and services;

b) Income from independent professional activities of individuals having licenses or practicing certificates as prescribed by law.

Business income specified in this clause does not include income of individuals doing business generating revenue of VND 100 million/year or less.

2. Income from wages and salaries, including:

a) Salaries, wages, and payments of a salary and wage nature;

b) Allowances and support, except for allowances, support as prescribed by laws on incentives for meritorious people; defense and security allowances; hazardous and dangerous allowances for professions or jobs at workplaces with hazardous and dangerous elements; attraction allowances and area allowances as prescribed by law; exceptional hardship allowances, accident support, occupational disease support, one-time subsidy for childbirth or adoption of a child, support due to reduced labor ability, one-time pension support, monthly survivor's pension, and other support as regulated by social insurance law; severance allowances, unemployment allowances as stipulated by the Labor Code; social protection nature allowances, and other allowances, support not of a salary and wage nature as stipulated by the Government of Vietnam.

[...]

Thus, income from wages and salaries subject to personal income tax includes payments of wages, salaries, and those of a wage and salary nature, as well as allowances and support.

Except for the following allowances and support not subject to personal income tax:

- Allowances and support as prescribed by laws on incentives for meritorious people

- Defense and security allowances

- Hazardous, dangerous allowances for professions or jobs at workplaces with hazardous and dangerous elements

- Attraction allowances, area allowances as prescribed by law

- Exceptional hardship allowances, accident support, occupational disease support, one-time subsidy for childbirth or adoption of a child, support due to reduced labor ability, one-time pension support, monthly survivor's pension and other support as regulated by social insurance law

- Severance allowances, unemployment allowances as stipulated by the Labor Code

- Social protection nature allowances, and other allowances, support of a non-wage nature as stipulated by the Government of Vietnam.

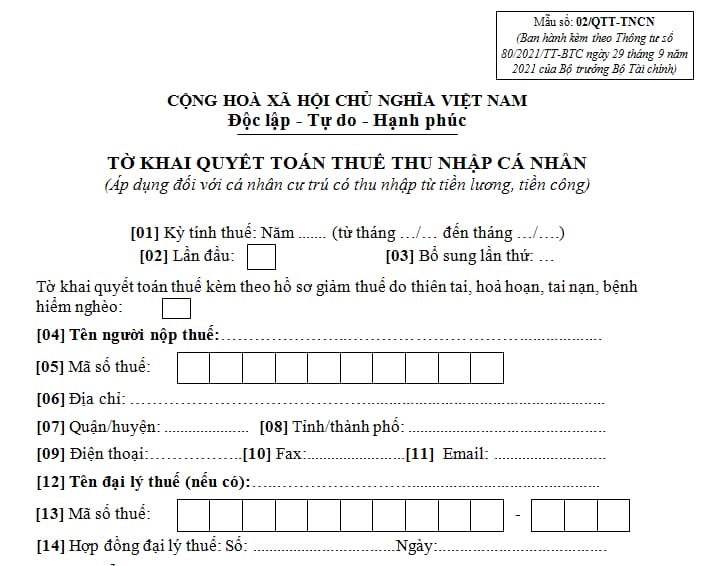

What are details of Form 02/QTT-TNCN for personal income tax finalization in Vietnam as per Circular 80?

Based on Form 02/QTT-TNCN in Appendix 2 issued together with Circular 80/2021/TT-BTC stipulating the personal income tax finalization form in Vietnam:

Download Form 02/QTT-TNCN - personal income tax finalization form as per Circular 80

Note: Form 02/QTT-TNCN - personal income tax finalization form applies to individuals earning income from wages and salaries.